5 Tips for Selling Your Silver Investments

If you have been contemplating selling your silver investments, you’ve come to the right source. Grasping the market dynamics and recognizing the ideal moment to sell can profoundly influence your returns.

This guide delves into essential strategies, helping you identify the optimal time for selling, explore diverse selling avenues, and prepare your silver for market presentation.

This guide also covers potential buyers, the advantages of appraisals, tax considerations, and tips for safe storage. Dive into this guide and transform your selling journey today!

Contents

- Key Takeaways:

- 1. Understand the Market for Silver

- 2. Determine the Right Time to Sell

- 3. Consider Different Selling Options

- 4. Research Potential Buyers

- 5. Prepare Your Silver for Sale

- What Factors Affect the Value of Silver?

- Frequently Asked Questions

- What are the top 5 tips for selling my silver investments?

- How can I determine the current market price of silver?

- Is it better to sell my silver to a dealer or through an online platform?

- How can cleaning and polishing my silver help with selling?

- When is the best time to sell my silver investments?

- Do I need to keep records and documentation for my silver investments?

Key Takeaways:

- Understand the current market trends and demand for silver before selling.

- Timing is crucial when selling silver, so be aware of market fluctuations and sell when prices are high.

- Explore different selling options, such as online platforms or local dealers, to find the best price for your silver investments.

1. Understand the Market for Silver

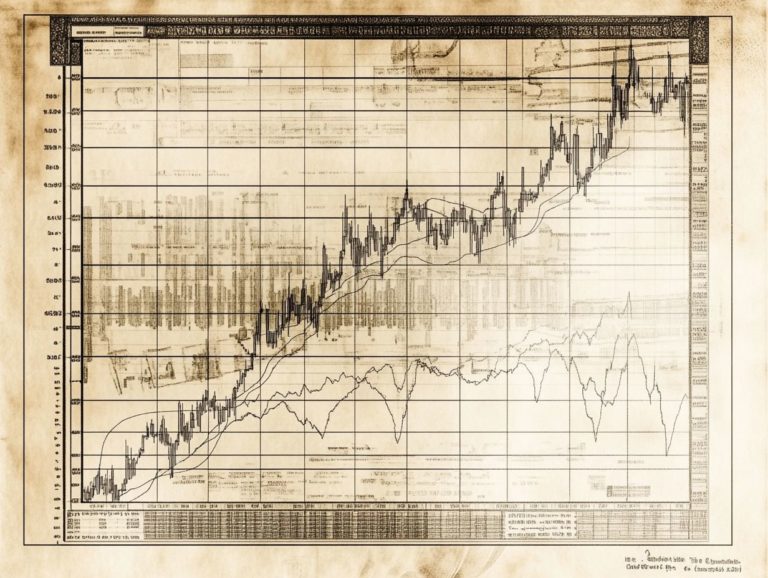

Understanding the silver market is essential for making well-informed financial decisions, especially when it comes to investment strategies involving valuable metals. Economic conditions, market trends, and current silver prices significantly influence silver’s value, which can fluctuate based on various economic influences.

Historically, silver has shown noteworthy price trends shaped by factors such as industrial demand and geopolitical events. For example, during times of economic uncertainty, silver is often seen as a safe-haven asset, meaning it retains value when other investments decline, drawing in investors looking to hedge against inflation or currency devaluation.

The rising demand for silver in technology and renewable energy sectors, particularly in solar panel manufacturing, adds yet another layer to its market dynamics.

By exploring these historical price movements and understanding the intricate relationship between silver and broader economic indicators, you can develop strategies that minimize risks while maximizing potential returns, ultimately creating a balanced and resilient investment portfolio.

2. Determine the Right Time to Sell

Determining the right moment to sell silver requires a keen understanding of market conditions and an assessment of profitability, both of which play a significant role in your overall financial health and investment returns.

Market trends often signal when to take action, with indicators like price surges presenting prime opportunities for divestment. Economic news, whether favorable or unfavorable, significantly influences demand and market dynamics.

By keeping a close watch on global economic indicators, geopolitical developments, and shifts in inflation, you can gain valuable insights that inform your decisions. It’s essential to develop strategies that incorporate regular market monitoring and the establishment of target prices, ensuring you maximize returns while being mindful of timing an element that can greatly affect profitability in the ever-changing realm of valuable metals.

3. Consider Different Selling Options

Regarding selling silver, it s vital to explore various selling options to ensure a secure transaction while maximizing your returns, whether you choose reputable dealers or the convenience of mail-in services.

Diving into the different methods available can significantly impact both your selling experience and your final profit. Local dealers may offer immediate cash and personalized service, but be prepared for their offers to vary more widely.

On the other hand, online platforms provide a hassle-free alternative, reaching a broader audience with competitive pricing, though you should stay wary of potential shipping risks and scams. Auction houses can help you fetch higher prices for rare items, but keep in mind that they typically take a commission on sales.

No matter which method you select, emphasizing authenticity verification and secure transactions is crucial to protect both your interests and those of the buyer.

4. Research Potential Buyers

Researching potential buyers is a vital step in your selling process. This crucial phase helps you gauge potential offers and ensures you re entering trustworthy partnerships.

Dive into the details of these buyers by checking their online presence for customer reviews and testimonials. Past customer experiences can unveil insights into how a buyer conducts business and their overall reliability.

Value assessments also play a significant role in this process. They enable you to determine accurate market rates and ensure that the offers you receive reflect value.

5. Prepare Your Silver for Sale

Preparing your silver for sale is all about ensuring its condition is top-notch, obtaining necessary value assessments, and verifying genuineness to attract potential buyers effectively.

Start by cleaning the silver thoroughly. Remove tarnish and dirt with safe cleaning solutions. Once they re sparkling, take a moment to evaluate the items for any signs of wear, scratches, or dents. These factors will influence their overall value.

After your careful assessment, seek a professional appraisal. This establishes a fair pricing strategy and verifies genuineness, significantly boosting buyer confidence.

What Factors Affect the Value of Silver?

The value of silver is shaped by many factors, including economic conditions, inflation, and market trends. These elements are crucial in determining its market worth.

Global demand for silver in industries like electronics and jewelry significantly impacts its price. Production costs, driven by mining operations and labor expenses, also play a vital role.

Geopolitical events, such as trade disputes or conflicts in key mining regions, can introduce uncertainties that sway prices. When coupled with inflation rates, fluctuations in currency values can lead to increased volatility in silver prices.

What Are the Different Forms of Silver Investments?

Silver investments come in various forms, including bullion coins, silver mining stocks, and exchange-traded funds (ETFs) like the iShares Silver Trust. Each presents unique advantages and risks.

If you invest in bullion coins, you acquire a tangible asset that many find appealing due to its physical presence and historical value. However, you’ll want to consider potential liquidity and storage challenges as drawbacks.

Silver mining stocks may attract you if you’re seeking high returns tied to market fluctuations. Just keep in mind that they also carry risks related to company performance and broader economic factors.

ETFs provide greater liquidity and diversification, but consider management fees. By understanding how these various silver investments fit into your overall portfolio strategy, you can enhance both stability and growth potential. Additionally, for those interested in precious metals, knowing the best ways to store platinum safely is crucial for protecting your investment.

What Are the Pros and Cons of Selling Silver?

Selling silver has both advantages and disadvantages. Factors like liquidity and market trends can significantly influence your investment returns.

Are you eyeing those current high prices? Parting with silver can be a fantastic strategy to realize gains and reinvest in other lucrative opportunities. The allure of quickly turning your silver into cash becomes compelling during times of economic uncertainty, allowing you to adjust to shifting financial landscapes. Additionally, consider exploring essential tips for selling your platinum assets to maximize your investments.

However, it’s also important to consider the potential downsides. Market volatility can lead to fluctuating prices that may not work in your favor. It’s crucial to consider the tax implications; selling silver might trigger tax on profits from selling, impacting your overall profitability. Additionally, if you’re interested in investing in other precious metals, exploring the best methods for buying platinum can be beneficial.

How Can a Professional Appraisal Help with Selling Silver?

A professional appraisal can enhance your ability to sell silver. It provides accurate market rates and ensures authenticity, which boosts buyer confidence.

This assessment delivers an unbiased valuation and plays a key role in the negotiation process. When potential buyers see a credible appraisal, it reinforces the silver’s worth, enabling you to negotiate better prices.

The appraisal process builds trust, showing buyers they are making a wise investment. Knowing that the item has undergone professional evaluation reduces skepticism about its value, fostering a more favorable environment for successful sales.

Ultimately, the insights from an appraisal become a powerful asset, smoothing the path to sales and nurturing long-term relationships with clients.

What Are the Tax Implications of Selling Silver?

Understanding the tax implications of selling silver is vital for making informed financial decisions and optimizing your investment returns.

When you decide to sell your silver, you’ll need to navigate specific tax laws, as they can impact your financial outcome. Tax on profits from selling typically applies to the profit you realize above the initial purchase price, and this rate can vary depending on how long you’ve held the silver. Additionally, if you are considering investing in platinum, it’s important to know how to store your platinum investments safely.

Short-term gains might be taxed at a higher rate than long-term gains, so timing your sale can work in your favor. Strategies like selling losing investments to lower your tax bill or utilizing retirement accounts for purchases can help you minimize tax liabilities.

Given the complexities, seeking tailored advice from a financial advisor is essential to ensure each sale maximizes your potential returns while remaining compliant with legal requirements.

How Can One Safely Store and Transport Silver for Sale?

Safely storing and transporting silver is vital for preserving its value and integrity. This ensures smooth authenticity verification during secure transactions.

Utilizing the right storage methods is key. To protect your silver items from tarnishing, consider investing in anti-tarnish cloths designed to absorb moisture and prevent oxidation. Placing your silver in a cool, dry environment helps maintain its luster.

When transporting your pieces to potential buyers or appraisers, wrapping them in soft cloth or bubble wrap is an excellent way to prevent scratches and damage.

Choose a sturdy container to secure your items and remember to insure high-value pieces during transit. By following these best practices, you ensure that both storage and transport are handled with care.

Frequently Asked Questions

What are the top 5 tips for selling my silver investments?

Here are the top 5 tips for selling your silver investments:

1. Research current market prices.

2. Sell to a reputable dealer or through a trusted online platform.

3. Clean and polish your silver to attract buyers.

4. Wait for the right time to sell.

5. Keep all records and documentation of your investments.

How can I determine the current market price of silver?

Check online sources like major precious metal exchanges or financial news outlets.

You can also visit local coin shops to see current prices in your area.

Is it better to sell my silver to a dealer or through an online platform?

Selling to a dealer might be quicker, but the price could be lower.

Online platforms may take longer but can connect you to more buyers, potentially yielding a better price. Research carefully to find the best option for you.

How can cleaning and polishing my silver help with selling?

Cleaning and polishing makes silver look better and might increase its worth.

Buyers prefer well-maintained pieces, but be cautious not to over-polish as it could damage the surface.

When is the best time to sell my silver investments?

Sell when the market is favorable and prices are high.

Also, consider your financial needs. If you need cash urgently, selling at a lower price might be wiser than waiting.

Do I need to keep records and documentation for my silver investments?

Yes, keeping all records is crucial. This includes purchase receipts and certificates of authenticity.

These documents will help verify the authenticity and value of your silver when selling.