5 Must-Watch Documentaries About Silver Investing

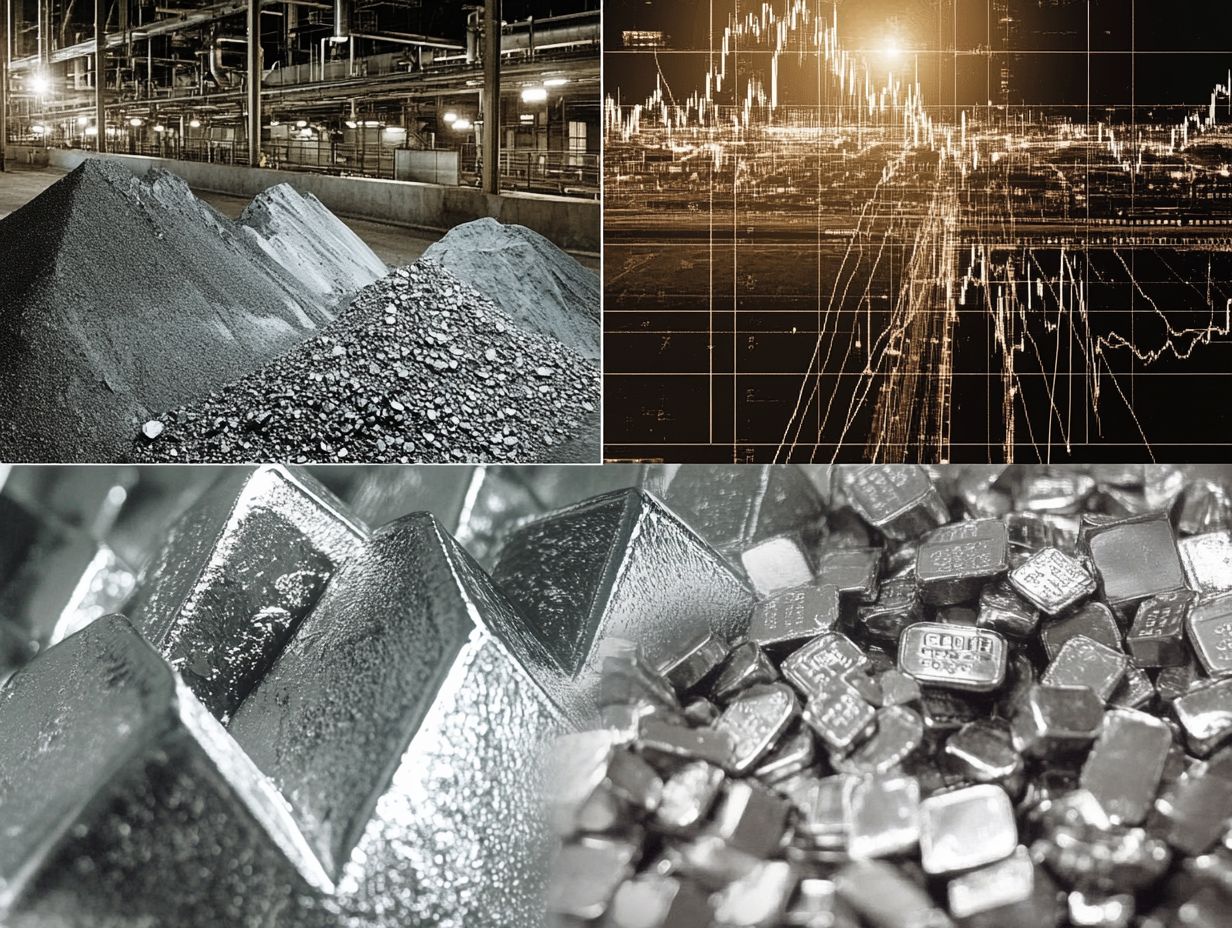

Silver has long captivated investors like you with its beauty, utility, and potential for wealth protection.

Understanding silver’s history and future prospects is essential for navigating the financial landscape. This article explores silver investing, its rich history, the debate with gold, and the impacts of mining.

You will find practical investment strategies, along with the risks and rewards of adding silver to your portfolio. Discover why silver deserves a prominent place in your investment strategy!

Contents

- Key Takeaways:

- 1. The Silver Rush: The History and Future of Silver Investing

- 2. The Power of Silver: How This Precious Metal Can Protect Your Wealth

- 3. Silver or Gold? The Debate on Which Precious Metal Is a Better Investment

- 4. The Dark Side of Silver Mining: Environmental and Social Impacts

- 5. The Silver Conspiracy: Uncovering the Truth Behind Price Manipulation

- Why Should Investors Consider Silver in Their Portfolio?

- Frequently Asked Questions

- 1. What are the top 5 must-watch documentaries about silver investing?

- 2. What is the main focus of these documentaries?

- 3. Are these documentaries suitable for beginners in silver investing?

- 4. Can these documentaries be found online?

- 5. Are these documentaries biased towards a certain perspective on silver investing?

- 6. Will these documentaries provide specific investment advice?

Key Takeaways:

1. The Silver Rush: The History and Future of Silver Investing

The history of silver investing is captivating. It showcases the precious metal’s role in financial markets and mirrors broader economic trends.

During the silver rushes of the 19th century, silver symbolized hope and prosperity, attracting miners and speculators during economic booms. In financial turmoil, silver has offered a hedge against inflation and currency devaluation, proving its lasting appeal.

Notable investors like Paul Tudor Jones emphasize silver’s potential in their portfolios. To navigate today’s fluctuating currencies and rising demand, understanding this legacy is crucial!

2. The Power of Silver: How This Precious Metal Can Protect Your Wealth

Silver is celebrated for its exceptional qualities as an asset for wealth protection, especially during economic uncertainty. It provides a tangible way to hedge against inflation and market volatility, standing alongside gold in a diversified investment portfolio.

This precious metal shows remarkable resilience during downturns, often keeping or increasing its value when traditional stocks falter. It serves as an indicator of economic health and complements gold with its unique advantages.

While gold is a secure store of value, silver is more accessible and versatile. This dynamic makes silver an attractive option for safeguarding your financial future during inflation or economic distress!

3. Silver or Gold? The Debate on Which Precious Metal Is a Better Investment

The debate over whether silver or gold is a better investment is common. Traders and analysts are passionate about their views.

Each metal has unique advantages and challenges that you must consider based on your financial goals and the prevailing market conditions.

In recent years, both metals have fluctuated due to economic factors like inflation, interest rates, and geopolitical tensions. Historically, gold has earned its reputation as a safe haven a place investors feel secure during financial downturns. It often outperforms silver when uncertainty looms.

However, silver s industrial applications can provide a boost during periods of economic growth, making it an intriguing option if you re seeking potential upside.

Financial experts stress the importance of diversifying your portfolio to mitigate the inherent risks of both investments. They advocate for a balanced approach to maximize returns while navigating the complexities of the precious metals market.

4. The Dark Side of Silver Mining: Environmental and Social Impacts

While silver mining offers enticing investment opportunities, it casts a shadow over environmental and social landscapes. It raises critical concerns about the often-overlooked consequences of corporate greed and unsustainable practices. These issues can trigger significant economic and ecological crises.

The extraction processes frequently lead to the pollution of local water sources, jeopardizing the health of nearby communities and wildlife. The displacement of indigenous populations ignites social unrest and worsens inequality, creating a ripple effect that destabilizes entire regions.

Plans to handle crises become essential in addressing these challenges. They establish frameworks aimed at mitigating negative impacts through enhanced regulatory oversight and meaningful community engagement. Innovative initiatives are emerging that promote sustainable mining practices, emphasizing responsible sourcing and considering the welfare of both people and ecosystems. This approach opens doors to a more ethical way to extract resources. It s a crucial step for our planet s future!

5. The Silver Conspiracy: Uncovering the Truth Behind Price Manipulation

The silver price manipulation narrative is filled with conspiracy theories about collusion in the financial industry. This raises important questions about the transparency and integrity of Wall Street, as well as the implications of these practices for investors and overall market stability.

You may find yourself ensnared in a convoluted system where traders, large corporations, and regulatory bodies seem to have conflicting interests. This scenario breeds skepticism about the motivations behind price fluctuations are they genuinely reflective of market demand, or are they being artificially manipulated by powerful entities?

Several analysts highlight unusual trading patterns and sudden price drops as potential signs of manipulation. The repercussions of such actions extend far beyond financial loss; they can undermine public confidence in the entire market ecosystem. This situation often prompts a critical reevaluation of regulatory practices and the effectiveness of existing safeguards meant to protect your interests as an investor.

Understanding these dynamics is crucial for any investor. Stay informed to protect your investments!

Why Should Investors Consider Silver in Their Portfolio?

Consider adding silver to your portfolio. It has proven to be a safe-haven asset during economic downturns.

It also helps diversify your investment strategies. Silver can protect your wealth from inflation and market ups and downs, solidifying its role in a well-rounded financial approach.

Historically, silver has often outshined other assets during economic crises. It provides a reliable means of wealth preservation when traditional markets struggle.

Expert insights consistently emphasize silver s unique qualities, especially its industrial uses and physical presence, which can serve as a safeguard in uncertain times.

By incorporating silver into your investment portfolio, you can effectively reduce overall risk while enhancing stability and growth potential. Understanding these dynamics allows you to make informed decisions, ensuring that silver enriches your asset mix and plays a pivotal role in your portfolio management strategies.

What Are the Different Ways to Invest in Silver?

You have multiple avenues for entering the silver market. You can purchase physical silver bullion and coins or invest in exchange-traded funds (ETFs) and other financial instruments that provide exposure to this precious metal.

Every option has its pros and cons to weigh, so carefully consider your investment goals before making a move. For instance, while owning physical silver grants you tangible ownership, it also requires secure storage and insurance expenses that could chip away at your profits. To deepen your understanding, check out these must-read books about silver investing.

On the other hand, ETFs offer a more convenient and liquid way to invest without the burdens of physical storage. However, be aware that management fees might nibble at your overall returns.

Futures contracts allow for leveraged investments and the allure of high returns, but they come with significant risks, including the chance of losing more than your initial investment.

Financial professionals often suggest assessing your risk tolerance and investment horizon to determine the best strategy for gaining exposure to silver. For those considering this option, here are the top 5 reasons to invest in silver now.

What Are the Factors That Affect the Price of Silver?

The price of silver is influenced by a multitude of factors, including market dynamics, economic indicators, and global demand and supply. Stay informed to seize the best investment opportunities.

As a trader, take into account how fluctuations in currency values, particularly the U.S. dollar, can significantly impact silver prices. A stronger dollar typically leads to lower prices.

Additionally, geopolitical events, such as tensions or conflicts, can drive investors toward safe-haven assets like silver, resulting in sudden spikes in demand.

Economic conditions, including inflation rates and interest policies, play essential roles in shaping market sentiment. Expert analyses suggest that by monitoring these interconnected elements, you can gain valuable insights that guide you in anticipating market trends and adjusting your strategies accordingly.

How Can One Safely Store and Protect Their Silver Investments?

Safeguarding your silver investments demands thoughtful consideration of storage options and security measures. This vigilance offers peace of mind for anyone concerned about their financial future.

The environment you select can greatly influence both the longevity and value of your silver. For instance, utilizing safety deposit boxes in banks provides a highly secure storage solution, effectively shielding your assets from home hazards and potential break-ins.

Alternatively, you might explore home storage solutions like safes or locked cabinets, as long as they re discreet and well-hidden.

Regardless of your chosen method, it’s essential to consider insurance options that can offer an additional layer of protection.

Proper storage not only preserves the physical integrity of your silver but also enhances the overall security of your financial portfolio, a critical component of informed investment strategies.

Start exploring silver investments today and secure your financial future!

What Are the Potential Risks and Rewards of Investing in Silver?

Investing in silver offers a mix of potential risks and rewards. Market volatility and changing economic factors can greatly influence your returns.

Global political issues can add another layer of complexity to the equation. Changes in political power or conflict can trigger sudden price fluctuations. It is imperative to stay informed about global events and market sentiment, especially if you re considering silver as a hedge against economic downturns.

Keep an eye on the potential for manipulation of silver prices, which can lead to unexpected losses. Maintaining a diversified portfolio with a variety of investments to spread out risk and establishing clear financial goals will provide a balanced approach that addresses the risks and rewards of silver investing.

How Can Silver Investing Help Diversify a Portfolio?

Integrating silver into your investment portfolio can be a savvy move for diversification. Unlike traditional assets like stocks and bonds, silver often behaves differently, allowing you to manage risk more effectively and enhance your overall financial stability.

By incorporating silver, you have the potential to counteract the volatility frequently seen in equity markets. For instance, during economic downturns, silver prices may rise even as stocks decline, serving as a shield against losses.

This inverse correlation can be particularly advantageous in turbulent times. A well-crafted diversification strategy might involve allocating a portion of your portfolio to silver, alongside equities and real estate. This balanced approach not only captures growth opportunities but also maintains stability.

Such strategies not only mitigate overall portfolio risk but also leverage the unique qualities of silver as a tangible asset, enriching your investment journey with must-know facts about silver investing.

Frequently Asked Questions

1. What are the top 5 must-watch documentaries about silver investing?

- The Silver Rush: The Great Silver Heist by CNBC

- The Secret World of Gold and Silver by National Geographic

- The Power of Silver by Real Vision

- The Silver Conspiracy by Journeyman Pictures

- The Silver War: Inside the Battle for Silver by The Financial Times

2. What is the main focus of these documentaries?

These documentaries focus on the history, current state, and future predictions of silver investing. They also delve into the role of silver in the global economy, its use in industries, and the potential impact of government policies on its value.

3. Are these documentaries suitable for beginners in silver investing?

Yes, these documentaries are suitable for beginners as they provide a comprehensive overview of silver investing and its importance in the financial world. They include interviews with experts and insights from experienced investors, making them valuable resources for those new to silver investing.

4. Can these documentaries be found online?

Yes, most of these documentaries can be found online through streaming services or on the production company’s website. Some may require a subscription or rental fee, but others may be available for free on platforms like YouTube or Vimeo.

5. Are these documentaries biased towards a certain perspective on silver investing?

While these documentaries may present a certain viewpoint on silver investing, they also offer a balanced perspective by featuring various experts and discussing different opinions. It is important to watch multiple documentaries and do your own research to form a well-rounded understanding of silver investing.

6. Will these documentaries provide specific investment advice?

No, these documentaries are not meant to provide specific investment advice. They serve as educational resources to help viewers learn about silver investing and make informed decisions on their own. It is always recommended to consult with a financial advisor before making any investment decisions.

Curious about silver investing? Dive into these documentaries to deepen your understanding of silver investing!