The Historical Performance of Physical Assets

In today s ever-evolving financial landscape, physical assets such as real estate, commodities, and collectibles have garnered considerable attention. Investors like you are seeking stability and growth.

This article delves into the multifaceted role these tangible assets play in investment portfolios, shedding light on their benefits, risks, and historical performance. You ll discover how they compare to other investment options, explore the factors that influence their performance, and understand how they can enhance the diversification of your portfolio.

As you navigate the complexities of investing, you’ll be equipped with key considerations and risk management strategies to help you make informed decisions.

Get ready to boost your investment knowledge! Let s jump right in!

Contents

- What You Should Know:

- The Role of Physical Assets in Investment Portfolios

- Historical Performance of Physical Assets

- Factors Affecting the Performance of Physical Assets

- Diversifying with Physical Assets

- Considerations Before Investing in Physical Assets

- Frequently Asked Questions

- What is meant by the historical performance of physical assets?

- Why is it important to track the historical performance of physical assets?

- What factors can influence the historical performance of physical assets?

- How can one analyze the historical performance of physical assets?

- Can the historical performance of physical assets predict future performance?

- What are some common ways to measure the historical performance of physical assets?

What You Should Know:

- Physical assets have been a reliable investment option with a long history of performance, providing stability and diversification to portfolios.

- Investing in physical assets requires thorough research and consideration of economic trends and market conditions, as well as proper risk management.

- Physical assets can enhance portfolio diversification and act as a hedge against inflation, making them a valuable addition to investment portfolios.

Defining Physical Assets

Physical assets are the tangible properties you own, encompassing everything from machinery and vehicles to real estate and infrastructure. These assets are vital to effective management, which involves employing strategies and software to optimize their performance throughout their lifetime.

The intrinsic value of these assets can significantly influence your organization s financial stability and operational efficiency. Their definition and management are essential for long-term success.

Specifically, tangible assets can include anything from furniture and computers to production equipment and inventory. Each type of asset not only supports your daily operations but also demands careful monitoring and maintenance to ensure they remain in peak condition.

Organizations often utilize asset management software to gain visibility into these physical assets, offering insights into their usage, condition, and depreciation over time. This approach helps streamline processes, improve accountability, and reduce risks, ultimately leading to enhanced operational efficiency and knowledge-based decision making as you navigate the complexities of the asset’s lifetime.

The Role of Physical Assets in Investment Portfolios

Physical assets are essential to your investment portfolio, providing you with a tangible way to diversify your holdings and reduce risks. Consider assets like real estate, machinery, and transportation vehicles; they can deliver stable returns and are crucial for your capital expenditure strategies.

By effectively managing these assets, you enhance their performance and bolster your overall financial stability, especially during economic downturns.

Benefits and Risks of Investing in Physical Assets

Investing in physical assets presents a distinctive blend of benefits and risks that you must evaluate with care. On one hand, tangible assets like real estate and machinery can yield substantial returns while enhancing operational efficiency. On the other hand, you face risks such as upkeep costs, compliance requirements, and exposure to economic downturns and market volatility.

The stability offered by physical assets is particularly attractive for those seeking a hedge against inflation and a reliable source of cash flow. Take real estate, for example; it has the potential to appreciate significantly over time, especially in thriving markets. This appreciation, coupled with rental income, can generate a steady revenue stream.

However, it’s essential to remain mindful of the associated risks. Upkeep costs can chip away at your profits, and dealing with regulatory compliance can be a cumbersome process, consuming time and resources that could be better spent on growth. Economic fluctuations can unpredictably influence the value and demand for these assets, making it crucial for you to stay informed and agile in your investment decisions.

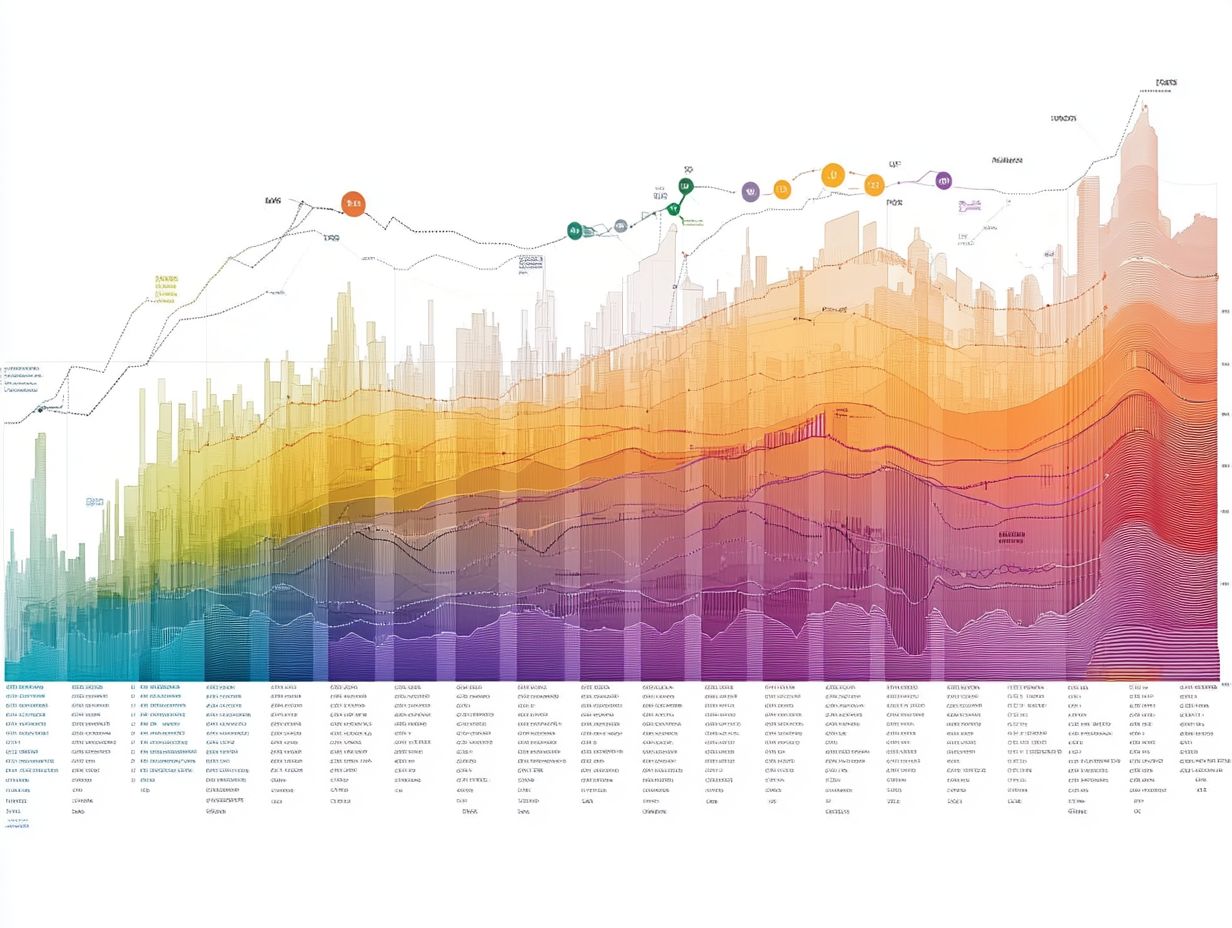

Historical Performance of Physical Assets

The historical performance of physical assets showcases remarkable resilience and adaptability. They often act as a safeguard against inflation and market fluctuations.

When you invest in tangible assets like gold, silver, real estate, and manufacturing properties, you typically find returns that outpace inflation and contribute positively to Gross Domestic Product (GDP) growth.

During financial crises, these assets usually maintain their intrinsic value, making them appealing for those who want to minimize risk.

Comparison to Other Investment Options

Comparing physical assets to other investment options involves several key factors, including risk management and return on investment. Unlike assets tied to the stock market, physical assets like real estate and utilities offer tangible benefits and reduced volatility.

This makes them ideal for enhancing asset utilization and securing stable returns.

These physical assets often act as a hedge against inflation, as their value typically appreciates over time. This stands in stark contrast to the unpredictable swings of traditional financial instruments like stocks and bonds.

Consider the liquidity aspect; selling a physical asset can be lengthy, unlike the ease of trading shares on an exchange.

While physical assets may present lower volatility, they often require more active management and upfront capital, which may deter some independent investors. By balancing these factors, you can strategically diversify your portfolio to optimize growth while mitigating risks.

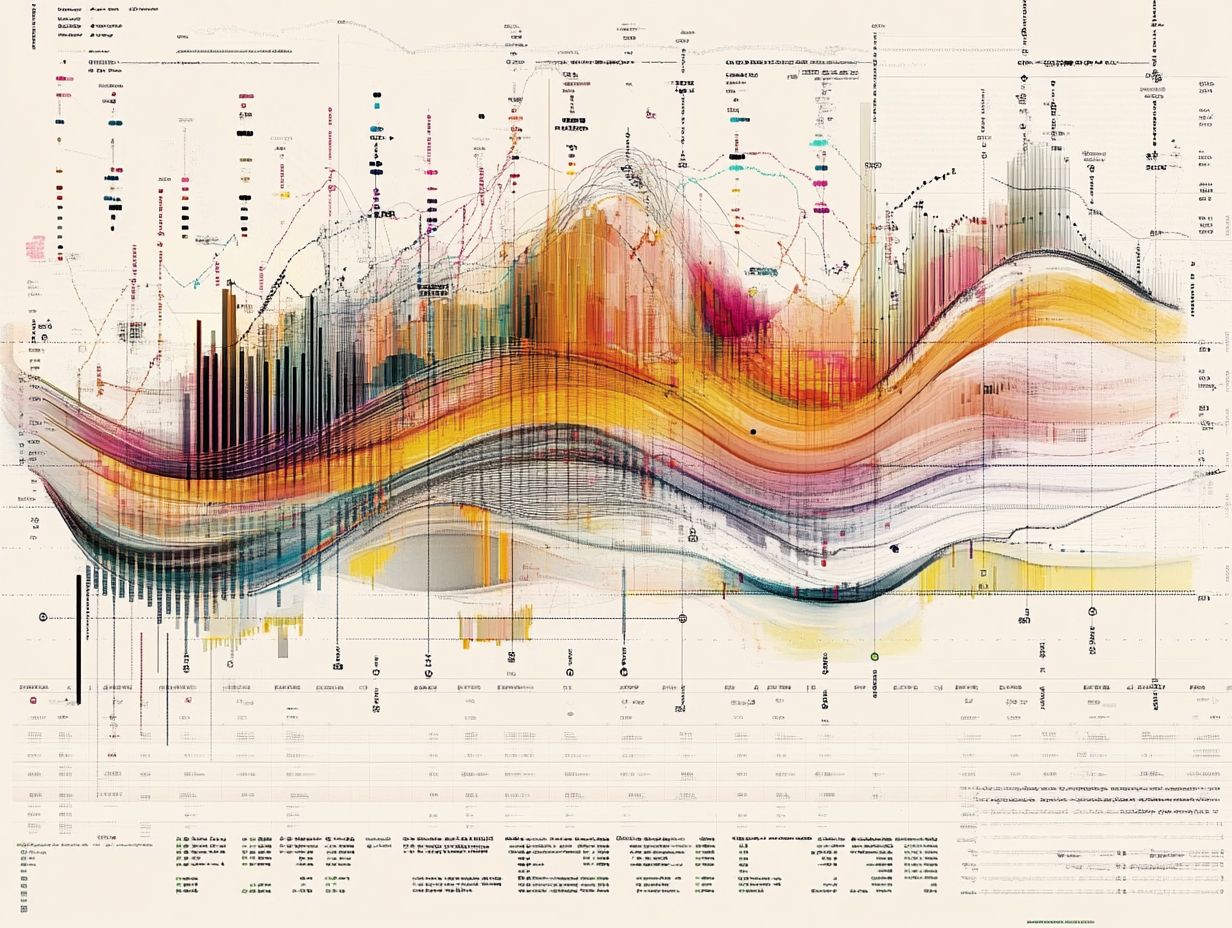

Factors Affecting the Performance of Physical Assets

The performance of physical assets is shaped by various factors, including economic trends, market conditions, and strong asset management practices. Understanding these influences helps you implement proactive asset management strategies.

These strategies effectively address maintenance schedules and risk management. They enhance asset performance and extend their lifespan, ensuring optimal value for your organization.

Economic Trends and Market Conditions

Economic trends and market conditions play a pivotal role in shaping the performance and valuation of your physical assets. They impact everything from inflation rates to GDP growth.

As an investor, you should consider these factors when crafting your investment strategies. Fluctuations can lead to asset depreciation or bolster financial stability.

For example, during periods of rising inflation, tangible assets often appreciate, serving as a reliable hedge against currency devaluation.

Conversely, during economic stagnation or recession, demand for assets like real estate or commodities may decline, reducing market value.

Increased consumer spending can ignite growth in the real estate sector. This prompts you to adjust your investment strategies towards acquiring more physical assets. Recognizing these trends is essential for achieving long-term financial success.

This underscores the importance of adaptive strategies in navigating the complexities of the asset landscape.

Diversifying with Physical Assets

Diversifying with physical assets can significantly elevate your portfolio’s resilience. It acts as a safeguard against market fluctuations.

By incorporating tangible assets such as real estate, manufacturing equipment, and commodities into your investment strategy, you reduce risk while establishing a stable financial foundation.

This approach enhances diversification and positions you to navigate market complexities with greater confidence.

How Physical Assets Can Enhance Portfolio Diversification

Physical assets can significantly enhance your portfolio diversification by offering an alternative investment vehicle that helps mitigate risk while increasing potential returns. Their tangible nature enables you to implement more effective asset allocation strategies, which can yield considerable benefits, especially during times of economic uncertainty.

You might consider incorporating real estate, commodities, and collectibles into your investment strategy. By balancing these physical assets with traditional financial instruments, you can effectively reduce volatility and potentially enhance your overall returns. For instance, dedicating a portion of your portfolio to real estate can serve as a hedge against inflation while also generating rental income.

To assess the impact of physical assets on your return on investment, you can utilize metrics such as cash flow and appreciation rates.

Regularly reviewing these assets gives you the power to make informed decisions, optimizing your overall performance in ever-fluctuating markets.

Considerations Before Investing in Physical Assets

Before you invest in physical assets, it’s crucial to evaluate several key considerations. Risk management, due diligence, and potential maintenance costs should all be on your radar.

You need to grasp the rules you must follow and be aware of market volatility to make informed investment decisions that align with your organization’s success.

Risk Management and Due Diligence

Effective risk management and due diligence are essential when investing in physical assets; they enable you to identify potential compliance requirements and maintenance schedules.

By adopting a systematic approach, you can uncover hidden liabilities and optimize the lifecycle of your investments. This proactive stance boosts asset value and shields you against unexpected disruptions.

Regular inspections, combined with new tools that help track asset condition, enable timely interventions that can significantly minimize repair costs and downtime.

Establishing clear protocols for assessing vendor reliability and conducting routine audits reinforces your confidence in asset performance.

Ultimately, maintaining a diligent focus on risk management and due diligence transforms your physical asset investments into sustainable and profitable ventures.

Watch this video to learn more about how physical assets can strengthen your investment strategy.

Frequently Asked Questions

What is meant by the historical performance of physical assets?

The historical performance of physical assets refers to the past performance of tangible assets such as real estate, commodities, and infrastructure. This includes factors such as price fluctuations, growth trends, and returns on investment over a specific period of time.

Why is it important to track the historical performance of physical assets?

Tracking the historical performance of physical assets allows investors and analysts to make informed decisions about future investments. It provides insight into the potential risks and returns associated with a particular asset and can help determine its value and potential for growth.

What factors can influence the historical performance of physical assets?

Several factors can influence the historical performance of physical assets, including economic conditions, market trends, and political stability. Supply and demand also play a role, as do technological advancements and natural disasters, which can impact the performance of these assets.

How can one analyze the historical performance of physical assets?

Analyzing the historical performance of physical assets often involves conducting market research, studying past trends and patterns, and analyzing financial statements. It may also involve consulting with industry experts and considering macroeconomic factors.

Can the historical performance of physical assets predict future performance?

While past performance is not a guarantee of future results, analyzing the historical performance of physical assets can provide valuable insights into potential future performance. It is not a definitive indicator, but it can help investors make more informed decisions.

What are some common ways to measure the historical performance of physical assets?

Common measures include return on investment (ROI), capital growth, and income generation. These help you see how well an asset has performed over time.

Using these measures gives you a clear picture of an asset’s profitability. Understanding these factors is crucial for making smart investment decisions!