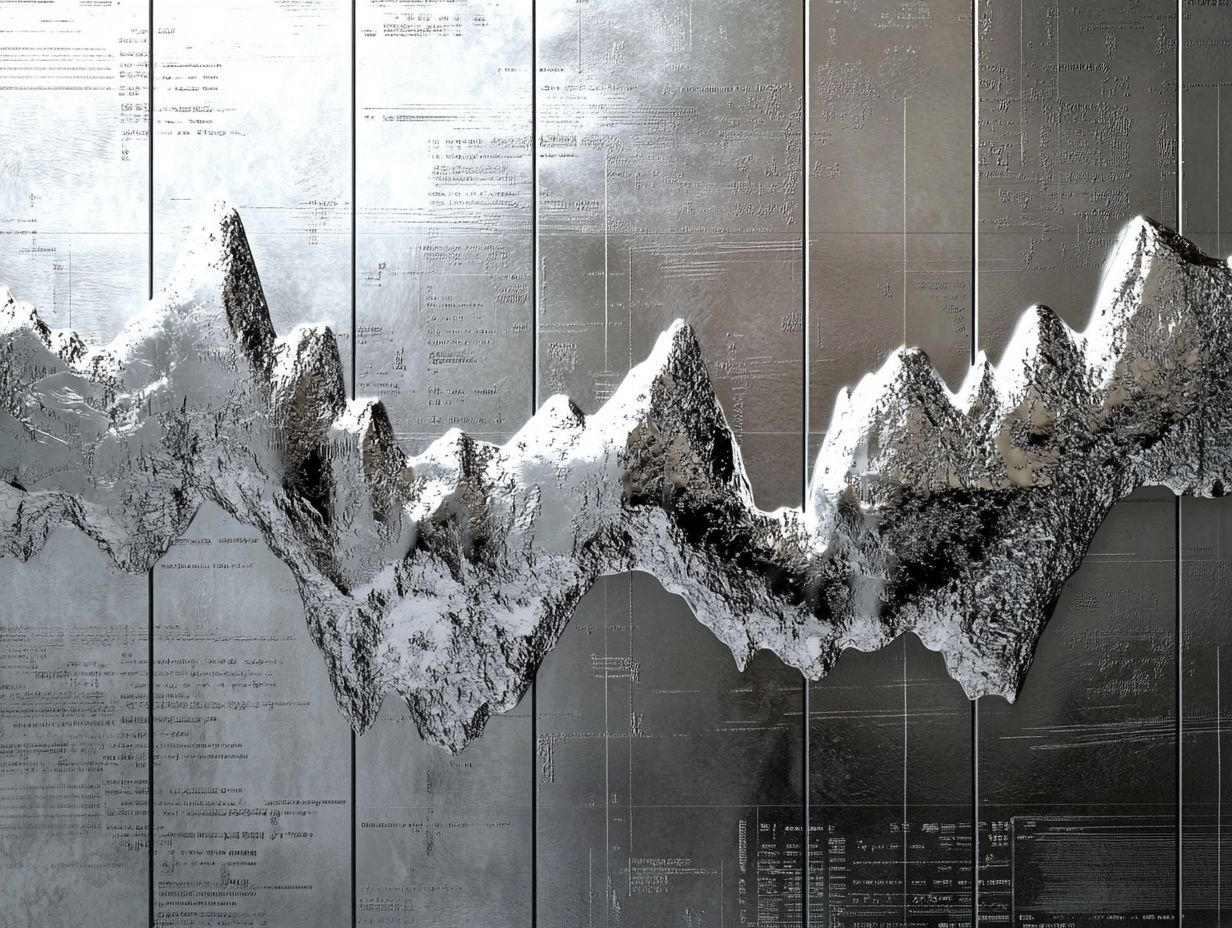

Understanding Demand Fluctuations in Silver

Silver’s allure goes beyond its stunning looks. It plays an important role in many industries, from cutting-edge technology to exquisite jewelry.

The demand for silver is influenced by several factors including industrial applications, investment trends, and consumer preferences. Economic conditions such as inflation and global trends add complexity to the market.

This article explores the nuances of silver demand fluctuations. We will discuss forecasting techniques and effective strategies for managing risks, providing valuable insights for investors and enthusiasts.

Contents

- Key Takeaways:

- Factors Affecting Silver Demand

- Impact of Economic Conditions on Silver Demand

- Forecasting Silver Demand

- Managing Risks in Silver Demand Fluctuations

- Frequently Asked Questions

- What is the definition of demand fluctuations in silver?

- What factors contribute to demand fluctuations in silver?

- Why is understanding demand fluctuations in silver important?

- What are some common trends in demand fluctuations for silver?

- How can supply affect demand fluctuations in silver?

- Is it possible to predict demand fluctuations in silver?

Key Takeaways:

- Understanding the factors that affect silver demand, like industrial uses and investment trends, is essential for predicting fluctuations.

- Economic conditions, such as inflation and interest rates, significantly influence silver demand. Monitor these closely!

- To manage risks tied to demand fluctuations, businesses should adopt forecasting methods and strategies to minimize losses.

Factors Affecting Silver Demand

Understanding what drives silver demand is crucial for investors. Fluctuating prices are influenced by global economic factors.

Demand for silver comes from many areas: industrial applications, investment potential, and cultural significance in jewelry. These areas respond to economic trends and government policies.

External elements like inflation and currency fluctuations can shift supply and demand. These changes ultimately affect silver prices and its status as a precious metal.

Industrial Uses

Silver’s industrial uses have surged, especially in technology sectors like electronics and renewable energy. The demand for solar panels drives this growth.

This rise is due to silver s excellent conductivity and antibacterial properties. It’s essential in devices like smartphones and advanced computer systems. In healthcare, silver’s ability to inhibit bacteria enhances patient safety.

As technology evolves, demand for silver is set to grow, particularly in solar innovations. Its reflective qualities improve efficiency and performance.

Investment Demand

Investors often turn to silver as a safe haven asset. Consider diversifying your portfolio with physical silver, silver bullion, and silver ETFs (Exchange-Traded Funds).

This trend spikes during economic uncertainty or inflation, as silver tends to hold its value well. It offers a tangible asset that can weather market volatility.

Silver coins, rich in history and collectible value, blend artistry with investment. Silver ETFs provide a convenient way to access this precious metal without the hassle of physical storage.

As market dynamics evolve, silver remains a compelling choice for safeguarding wealth.

Jewelry and Silverware Demand

The demand for silver in jewelry and silverware remains a substantial part of the overall silver market, driven by cultural and economic factors that influence purchases across diverse demographics.

In various cultures, silver is cherished not just for its aesthetic allure but also for its connection to wealth and status. This makes it a favored choice for everything from everyday wear to exquisite pieces. The rise of sustainable fashion trends has only heightened its desirability, as consumers seek materials that resonate with ethical values.

Silver holds an essential place in items used in ceremonies like weddings or religious events, serving as a meaningful component in everything from wedding gifts to religious artifacts, emphasizing its profound cultural significance. Interest in silver coins continues to grow. Collectors and investors see them as tangible assets that combine history with financial value.

Impact of Economic Conditions on Silver Demand

Economic conditions are fundamental in shaping the demand for silver. Factors such as inflation, interest rates, and overall economic stability directly influence investor sentiment and buying behavior in the silver market.

Understanding these dynamics helps you make smart decisions and navigate market fluctuations.

Inflation and Interest Rates

Inflation and interest rates are important economic signs that greatly influence silver demand. When inflation rises, many investors flock to precious metals like silver, seeking a hedge against economic uncertainty.

As inflation escalates, purchasing power diminishes, prompting a natural instinct to seek refuge in tangible assets. Concurrently, interest rates often rise in response to inflationary pressures. This creates a nuanced dance where higher borrowing costs can deter some from investing in physical assets.

This interplay can shift market sentiment, as looming economic instability and fluctuating interest rates may lead investors to reassess their portfolios, often resulting in an increased allocation to silver.

Therefore, grasping the relationship between these economic factors is crucial as you navigate the unpredictable landscape of market dynamics.

Global Economic Trends

Global economic trends, including recovery phases and geopolitical events, significantly influence silver demand, often resulting in notable price fluctuations and shifts in investment strategies.

As nations strive for stability and growth following recessions or conflicts, silver stands out as a vital asset, serving both investment and industrial needs. The delicate balance of supply and demand is frequently put to the test, especially when global uncertainties like trade wars or political unrest emerge, prompting investors to seek refuge in precious metals.

During recovery periods, the combination of increased industrial usage and heightened consumer confidence can elevate demand. This leads to a complex interaction between speculative investments and physical demand. Grasping this relationship is key for anyone looking to succeed in the silver market.

Forecasting Silver Demand

Forecasting silver demand necessitates a thorough grasp of market dynamics, along with the application of diverse methods and tools to accurately predict fluctuations in the silver market. Staying ahead of these trends is essential for anyone wanting to maximize their investment.

Methods and Tools for Predicting Demand Fluctuations

You can utilize various methods and tools, including market analysis and statistical models, to effectively predict demand fluctuations in the silver market.

These approaches encompass a range of techniques, such as econometric models that leverage historical data to uncover patterns and project future trends. Sentiment analysis captures the emotional responses of consumers and investors, offering valuable insights into market behavior. Trend analysis further enhances these tools by examining historical movements to identify potential future shifts.

Together, these methodologies equip you with a comprehensive understanding of silver demand, enabling you to make informed decisions in an ever-evolving marketplace.

Managing Risks in Silver Demand Fluctuations

Managing risks associated with fluctuations in silver demand is crucial for you as an investor or market participant. It requires using smart strategies designed to minimize potential losses amidst the unpredictable dynamics of the market.

Strategies for Minimizing Risks

Effective strategies for minimizing risks in the silver market involve diversifying your investments, making use of silver ETFs (Exchange-Traded Funds), and staying well-informed about market fluctuations.

You should also spread your investments across various vehicles, like mining stocks and silver bullion, to cushion against potential market downturns.

Stay alert to market trends to make timely decisions, ensuring you can react swiftly to changes in supply and demand.

Understanding how investor sentiment whether influenced by economic news or geopolitical events affects the market can further enhance your risk management practices. This insight enables you to anticipate shifts and adjust your strategies accordingly.

By combining these approaches, you can establish a robust framework for navigating the complexities of silver investments.

Frequently Asked Questions

Here are some common questions about demand fluctuations in silver.

What is the definition of demand fluctuations in silver?

Demand fluctuations in silver refer to the changes in the amount of silver that consumers are willing and able to purchase at a given price over a specific period of time.

What factors contribute to demand fluctuations in silver?

Factors such as economic conditions, industry trends, and market speculation can all impact the demand for silver and cause fluctuations.

Why is understanding demand fluctuations in silver important?

Understanding demand fluctuations in silver can help investors make informed decisions about buying and selling silver, and can also inform government policies and regulation.

What are some common trends in demand fluctuations for silver?

Demand for silver typically increases during periods of economic uncertainty and inflation and decreases during stable or prosperous economic times.

How can supply affect demand fluctuations in silver?

The availability of silver can impact demand fluctuations, as a limited supply can drive up demand and prices, while an oversupply can decrease demand and prices.

Is it possible to predict demand fluctuations in silver?

While it is not possible to predict demand fluctuations with complete accuracy, analyzing economic and market trends can provide insight into potential future fluctuations.