Silver Market Insights: What You Need to Know

The silver market boasts a rich history, functioning not only as a precious metal but also as an essential industrial resource. Today, it continues to captivate you as you navigate its complexities. This article provides a thorough overview, delving into the historical context and current landscape of silver, while highlighting the key factors that influence supply and demand.

You ll find a discussion on various investment avenues, weighing their associated risks and benefits, along with insights into future trends and global impacts that could shape the market. Join us as we explore the fascinating world of silver! Now is the time to understand the silver market and seize potential investment opportunities!

Contents

Key Takeaways:

Silver is a highly sought-after commodity with a rich history and strong demand, making it a valuable investment option. The silver market is influenced by many factors, including supply and demand dynamics, industrial and investment uses, and global events.

Investing in silver can offer potential benefits but also comes with risks that should be carefully considered.

Overview of the Silver Market

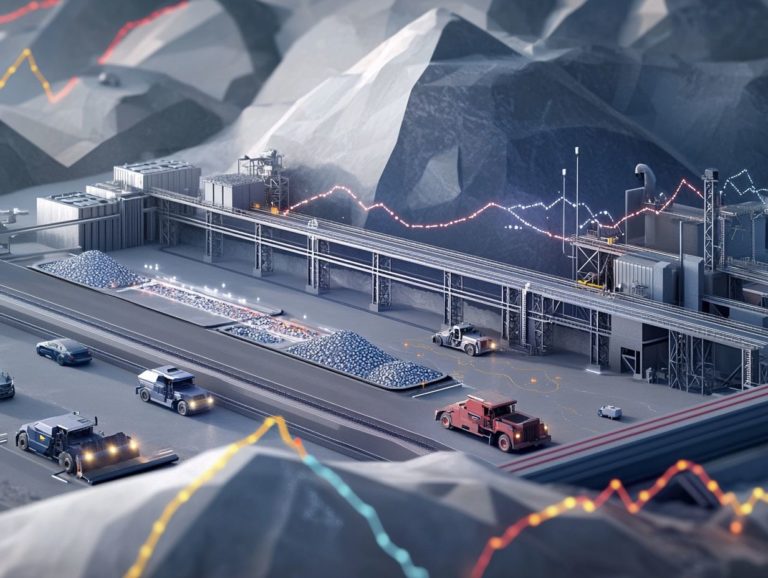

The silver market is an important part of the global economy. It has a fascinating history with many uses, from beautiful jewelry to vital industrial applications. Silver is represented by the chemical symbol Ag and atomic number 47. It is cherished not just for its aesthetic appeal but also for its exceptional electrical conductivity.

This unique property makes it an important player in the ongoing energy transition and the green revolution. Increasingly regarded as a safety-net investment, silver plays a crucial role in devices that convert sunlight into electricity, which power solar energy and electric vehicles, mirroring the dynamic landscape of commodities and market trends.

History and Current State

Throughout history, silver has captivated people as a highly coveted metal, treasured for its use as currency, in exquisite jewelry, and for a variety of industrial applications. This demonstrates its lasting allure as a precious metal.

From the days of the ancient Egyptians, who revered silver for its rarity and beauty, to the powerful empires of Greece and Rome, where it served as a vital currency, this metal has been instrumental in shaping economies and cultures alike.

In modern times, silver’s uses have transformed dramatically, integrating seamlessly into contemporary technology as a crucial component in electronics and renewable energy solutions. According to The Silver Institute, in 2022, global silver demand reached approximately 1.15 billion ounces, with industrial applications representing nearly 60% of that figure. The mining supply hovered around 1.05 billion ounces, underscoring the enduring importance of silver in both traditional and modern contexts.

Factors Affecting the Silver Market

The silver market is shaped by a multitude of factors. Fluctuations in supply and demand play an important role in determining its value and accessibility as a precious metal. Understanding these dynamics is essential for anyone looking to navigate the complexities of this market effectively.

Supply and Demand

The balance of silver supply and demand is a crucial factor influencing its market price, with fluctuations arising from both industrial uses and investment interests.

Recent changes in the supply chain reveal that mining companies are increasingly committing to environmentally sustainable practices. This shift impacts production costs and attracts investors who care about the environment. Demand for silver is skyrocketing in industries such as electronics where its conductivity is vital and solar power, where it plays a pivotal role in photovoltaic cells.

This surge in demand, combined with a limited supply, typically exerts upward pressure on silver prices, making it an appealing choice for investors seeking a hedge against inflation. As various sectors vie for this precious metal, understanding paper assets becomes crucial, as the intricate dance between supply chain dynamics and market demand continues to shape its valuation and overall market stability.

Industrial and Investment Uses

Silver is a versatile asset, important in various sectors, from electrical contacts to solar power technologies.

Its exceptional conductivity and corrosion resistance make silver critical in electronics, enhancing the functionality of smartphones and computers.

In healthcare, silver compounds are gaining traction for their antimicrobial properties, contributing to medical advancements.

As an investor, keep a close eye on market trends indicating rising demand for silver, particularly as economies shift toward renewable energy.

The surge in electric vehicle production and solar panel installations boosts silver’s appeal as a green investment.

Investing in Silver

Investing in silver offers a unique opportunity to diversify your portfolio and hedge against inflation.

It also allows you to embrace the true worth of this precious metal.

Types of Silver Investments

There are several options to explore when considering silver investments: physical silver, exchange-traded funds (ETFs), or shares in mining companies.

Each option has benefits and challenges. Physical silver is a tangible asset that serves as a reliable hedge against inflation and economic uncertainty. However, it incurs storage and insurance costs.

On the other hand, ETFs offer liquidity and ease of trading, making them ideal for a hands-off investment strategy. Yet, they may lack the intrinsic value of physical silver.

Investing in mining companies adds another dimension. These firms contribute to silver production and can boost returns through efficiency and market demand, but they come with operational risks and stock price volatility.

Benefits and Risks

Investing in silver has both benefits and risks. It’s essential to weigh these factors before committing to this precious metal.

Historically, silver has been a reliable hedge against inflation, gaining value when traditional currencies lose purchasing power. Its intrinsic value makes it especially appealing in uncertain economic times.

Recent trends show a surge in interest in silver, driven by industrial demand in technology and renewable energy. However, be cautious of market volatility, as prices can fluctuate significantly.

Interruptions in supply chains can affect availability and pricing, adding another layer of risk for investors navigating this dynamic market.

Future Outlook for the Silver Market

The silver market s future looks promising. Increasing demand across multiple sectors and a strong focus on sustainability position silver as a valuable asset.

Trends and Predictions

Emerging trends indicate rising demand, particularly driven by the expansion of photovoltaic cells and industrial applications.

This demand is amplified by advancements in technologies like electric vehicles and advanced electronics, where silver is crucial as a conductor. Consumers increasingly favor products that embrace sustainable practices, enhancing silver’s demand in solar technology.

Market analysts predict that this shift in consumer preferences, combined with a boost in industrial output, could lead to significant price fluctuations. Savvy investors must stay alert to these trends to maximize returns in an evolving market landscape.

Impact of Global Events

Global events whether economic troubles, geopolitical tensions, or environmental changes significantly influence the silver market. These factors lead to fluctuations in demand and disruptions in the supply chain.

When nations grapple with financial crises, the appeal of silver as a low-risk investment tends to surge. This prompts increased buying activity. Geopolitical conflicts introduce a layer of uncertainty that can disrupt trade routes and production capabilities, tightening supply and potentially driving up prices. To navigate these complexities, it’s essential to understand physical vs. paper assets in investing.

Conversely, during times of global stability, industrial demand may diminish as investment sentiments shift. This interconnectedness starkly illustrates how closely linked global economies truly are.

Looking ahead, ongoing technological advancements and the rise of green energy initiatives will continue to transform silver’s role across various industries. This ultimately shapes both its demand and the overall dynamics of the market in the future.

FAQs About Silver

What is the current state of the silver market?

The silver market is currently experiencing high demand due to its use in various industries, particularly in technology and solar energy. As a result, silver prices are steadily increasing.

What factors influence the price of silver?

The price of silver is influenced by several factors, including supply and demand, economic and political conditions, and currency fluctuations. The production and mining costs of silver also affect its price.

Is investing in silver a good option?

Silver has historically been considered a safe haven for investors during times of economic uncertainty. Its value tends to increase during market downturns, making it a popular choice for diversifying investment portfolios.

What are the different forms of silver available in the market?

Silver is available in various forms, including bullion coins, bars, and rounds. It can also be found in jewelry, silverware, and industrial products like electronics and medical instruments.

What are the current trends in the silver market?

Currently, there is a growing trend towards sustainable and environmentally friendly practices. This has led to increased demand for silver in producing solar panels and electric vehicles. Staying informed is crucial in this fast-changing market.

How can one stay updated on the silver market?

To stay informed about the silver market, follow industry news and updates, monitor silver prices, and consult with a financial advisor. Keeping track of global events and economic conditions can also provide insights into future trends in the silver market.