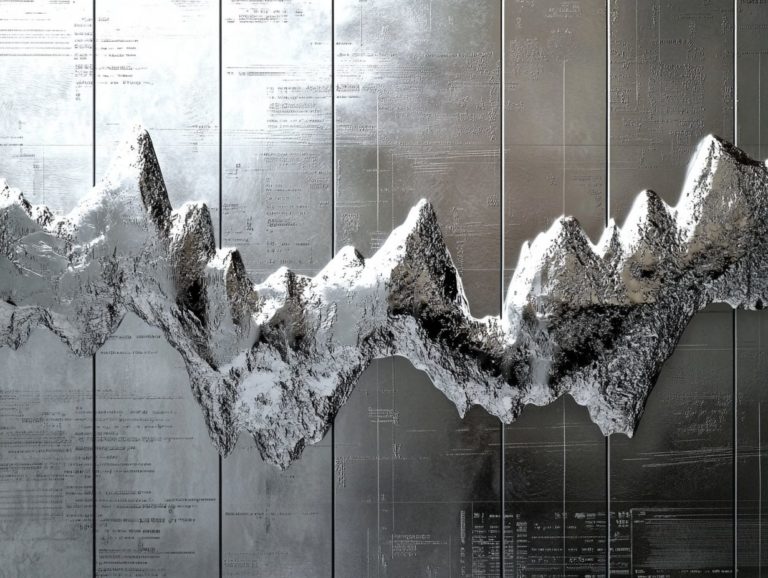

Palladium vs Platinum: Market Analysis

The precious metals market presents a dynamic arena where two key players, palladium and platinum, vie for your attention and investment.

Each metal has unique industrial applications and investment potential, shaped by shifting market trends and demand factors. This article delves into the uses and demand for palladium and platinum, comparing their price fluctuations and the elements that influence their markets.

You will weigh the pros and cons of investing in these metals, gaining valuable insights as you consider diversifying your portfolio.

Dive into the exciting world of precious metals now!

Contents

- Key Takeaways:

- Overview of the Precious Metals Market

- Uses and Demand for Palladium

- Uses and Demand for Platinum

- Comparison of Market Trends

- Investment Considerations

- Frequently Asked Questions

- What is the difference between palladium and platinum in terms of market analysis?

- Which metal has a higher value in the market, palladium or platinum?

- How do the prices of palladium and platinum fluctuate in the market?

- What are the key factors that influence the market analysis of palladium and platinum?

- Which metal is considered a safer investment option, palladium or platinum?

- How can I stay updated on the market analysis of palladium and platinum?

Key Takeaways:

- Palladium and platinum are valuable metals with wide industrial and investment uses.

- Palladium’s demand is rising due to its automotive applications.

- Investing in these metals can offer potential benefits, but it’s important to consider their pros and cons before making investment decisions.

Overview of the Precious Metals Market

The precious metals market, which includes valuable metals like palladium and platinum, is crucial to the global economy. It is influenced by a variety of factors, including price fluctuations, demand dynamics, and political events in key countries, especially those related to major producers such as Russia and South Africa.

This market is inherently volatile, marked by continuous changes in supply and recycling practices, which significantly impact investor decisions and the overall stability of the market.

Uses and Demand for Palladium

Palladium finds its primary application in the automotive sector, particularly in parts that clean car exhaust. These components are essential for reducing emissions and adhering to strict environmental regulations.

This necessity boosts demand across various industrial applications and enhances its appeal within investment portfolios.

Industrial and Investment Applications

Palladium plays a pivotal role in a variety of industrial applications, notably in electronics and the growing use of hydrogen as a clean energy source. Its potential for high returns, coupled with its status as a precious metal, makes it particularly enticing for investors.

In the electronics sector, palladium is critical for manufacturing connectors and circuit boards, thanks to its remarkable conductivity and resistance to corrosion. As the hydrogen economy accelerates, fueled by increasing investments in fuel cell technology and renewable energy, the demand for palladium as a catalyst in hydrogen production and storage processes is poised for significant growth. For insights into this market, check out palladium price trends.

This situation creates an appealing opportunity for you as an investor, especially in market conditions that favor precious metals amid economic uncertainty. By diversifying your portfolio with palladium, you can capitalize on these investment trends: palladium vs. platinum, making it a smart choice for both individuals and institutional investors seeking to hedge against inflation.

Uses and Demand for Platinum

Platinum finds its way into numerous sectors, from the automotive industry where it’s essential for parts that clean car exhaust to its esteemed presence in jewelry and various industrial applications. This versatility highlights a sophisticated interplay of demand factors and investment potential that intricately influences market dynamics.

Start exploring your investment options in palladium and platinum today!

Industrial and Investment Applications

Platinum’s industrial applications range from catalytic converters devices that reduce harmful gases from car exhaust to advanced electronics. Its appeal in the jewelry market also significantly enhances its investment allure among precious metals.

This noble metal is important in the automotive industry, where its unmatched ability to reduce harmful emissions is critical. With exceptional electrical conductivity, platinum is the preferred choice for high-end electronics, especially in connectors and hard drives. Additionally, palladium: a rising star in precious metals is gaining attention for its valuable properties in various applications.

In the jewelry sector, platinum elevates its demand further. It is celebrated for its remarkable durability and luxurious aesthetic, attracting discerning consumers. These factors create compelling investment opportunities, as shifts in demand across these industries can result in notable price fluctuations.

Recently, interest from individual and institutional investors has surged, reinforcing platinum’s status as a valuable asset in diversified portfolios.

Comparison of Market Trends

When comparing market trends between palladium and platinum, you will discover distinct price behaviors, unique demand growth patterns, and varying volatility.

These factors are influenced by broader economic conditions, investor sentiment, and the shifting dynamics of emerging markets that affect both of these precious metals.

Price Fluctuations and Factors Impacting Demand

Price fluctuations in palladium and platinum are influenced by various factors, including market dynamics, economic conditions, and supply risks that can significantly affect demand and your investment decisions.

You’ll notice these fluctuations are often tied to historical trends, especially in the automotive sector, where both metals are essential for catalytic converters. For insights on platinum demand and current trends, consider how supply chain challenges such as geopolitical tensions, or political issues between countries that can affect trade, and production disruptions in key mining regions add to the price volatility.

Market dynamics, including shifts in industrial demand and investment strategies, play a crucial role in shaping the trading landscape. Stay alert to these elements to make informed decisions by adjusting your positions based on anticipated supply shortages and evolving market conditions. This highlights the intricate relationship between demand, production, and pricing that defines the metal market, particularly when considering the risks of palladium investment.

Investment Considerations

When evaluating investments in palladium and platinum, it is essential to assess potential returns in light of prevailing financial conditions, inflation, and the overarching dynamics of the precious metals market. These factors can significantly shape your decision-making process, guiding you toward more informed and strategic choices.

Pros and Cons of Investing in Palladium and Platinum

Investing in palladium and platinum presents a distinct set of advantages and drawbacks that you should thoughtfully consider, particularly regarding potential returns and the dynamic market forces affecting these precious metals.

Palladium, for example, has gained significant attention due to its rising demand in the automotive sector, particularly for catalytic converters. This trend could lead to substantial returns for savvy investors. Conversely, platinum demand is often seen as a more stable long-term investment, making it appealing for those looking to hedge against economic uncertainties.

However, it s vital to remember that market volatility driven by geopolitical events and shifting supply chains can lead to unexpected price fluctuations. Staying updated on these trends will help you refine your investment strategies, balancing the allure of high returns with the inherent risks that accompany these metals.

Frequently Asked Questions

What is the difference between palladium and platinum in terms of market analysis?

Both palladium and platinum are precious metals used in various industries. They are used in different ways, which affects their prices and market behavior. Palladium is primarily employed in the automotive and technology sectors, while platinum is mainly used in jewelry and investment.

Which metal has a higher value in the market, palladium or platinum?

Currently, palladium has a higher value in the market compared to platinum. The demand for palladium is rising in the automotive industry. It is especially needed for catalytic converters in vehicles, but its supply is limited.

How do the prices of palladium and platinum fluctuate in the market?

The prices of both palladium and platinum are subject to market forces such as supply and demand, economic conditions, and global events. Palladium’s prices fluctuate more due to its smaller market and supply compared to platinum. Platinum, on the other hand, is less affected by short-term fluctuations and maintains a longer-term stable market trend.

What are the key factors that influence the market analysis of palladium and platinum?

The main factors affecting the market analysis of palladium and platinum include demand from industries, supply from mining companies, economic conditions, and investor sentiment. Changes in these factors can impact the prices and trends of these precious metals.

Which metal is considered a safer investment option, palladium or platinum?

Palladium and platinum are both exciting and safe investment choices, especially in today’s market. However, platinum has historically been seen as a more stable and long-term investment compared to palladium, which carries a higher risk due to its volatile market trends.

How can I stay updated on the market analysis of palladium and platinum?

You can stay updated on the market analysis of palladium and platinum by following financial news and monitoring price trends. Consulting trusted investment advisors is also essential. Conduct thorough research to understand the factors influencing the market analysis of these precious metals before making any investment decisions.