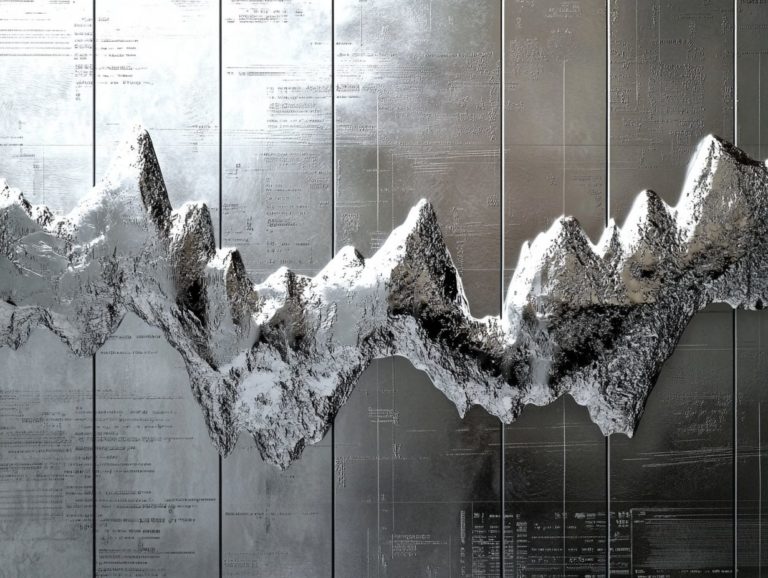

Future Trends in Palladium Investments

Palladium, often eclipsed by the glimmer of gold and silver, has recently risen to prominence as a coveted asset in the investment landscape.

With its distinctive properties and surging demand particularly from the automotive sector it is essential to grasp the current dynamics of the palladium market if you are considering an investment.

This article delves into the intricate interplay of supply and demand, outlining the benefits and risks associated with palladium investment while also highlighting the emerging trends that are shaping its future.

Whether you are a seasoned investor or just starting to explore the world of investments, get ready to learn how to include palladium in your investment portfolio, enhancing both diversification and potential growth.

Contents

- Key Takeaways:

- Current State of the Palladium Market

- Benefits of Investing in Palladium

- Risks and Challenges of Palladium Investments

- Emerging Trends in Palladium Investments

- How to Incorporate Palladium into Your Investment Portfolio

- Frequently Asked Questions

- What are some current trends in palladium investments?

- What are the risks associated with investing in palladium?

- What can we expect for future trends in palladium investments?

- Are there any potential risks associated with investing in palladium?

- What are some ways to invest in palladium?

- Are there advantages to investing in palladium compared to other precious metals?

- How can I stay informed about future trends in palladium investments?

Key Takeaways:

- Palladium is a rare and valuable metal used in various industries, making it an attractive investment option.

- The current market for palladium is strong, driven by high demand and potential for growth.

- Investing in palladium comes with risks, such as volatility, that should be carefully considered before adding it to your portfolio.

What is Palladium?

Palladium is a valuable metal that is part of the platinum family, distinguished by its unique properties that make it essential in various industrial applications, particularly in reducing harmful emissions from cars.

This metal has a fascinating history, first discovered in the early 19th century and swiftly recognized for its remarkable catalytic abilities. With a high melting point, exceptional corrosion resistance, and superior electrical conductivity, palladium is crucial in transforming toxic gases like carbon monoxide into harmless substances.

As technology progresses, the automotive sector continues to depend on palladium, enhancing its value among precious metals and underscoring its pivotal role in promoting sustainable practices within the industry.

Current State of the Palladium Market

The current palladium market presents a landscape marked by fluctuating price trends and heightened volatility. This dynamic is influenced by several factors, including supply constraints and shifting demand projections, particularly from the automotive sector.

As an investor, thoroughly assess the market outlook to navigate the potential investment opportunities and risks that come with palladium stocks and related assets.

Supply and Demand Factors

Supply and demand factors play a critical role in shaping the palladium market, with tight supply constraints arising from geopolitical issues and fluctuating mining outputs. Concurrently, demand projections from the automotive sector especially with the rise of electric vehicles create a complex and dynamic marketplace.

Palladium recycling is also pivotal in meeting industrial needs without relying solely on primary extraction. As the automotive industry places greater emphasis on emissions reduction and the shift toward cleaner technologies, reliance on palladium for catalytic converters intensifies.

This essential metal facilitates more efficient exhaust systems in gasoline-powered vehicles, even as electric alternatives continue to gain ground. Geopolitical tensions and supply disruptions in key mining regions further complicate the situation, underscoring the fragile balance of the palladium market.

Enhanced recycling efforts can significantly alleviate some of these supply constraints, allowing industries to make better use of existing resources while promoting sustainability.

Benefits of Investing in Palladium

Investing in palladium presents you with a host of advantages, particularly as this precious metal continues to experience remarkable growth driven by its unique industrial applications, especially within the automotive sector.

You can also seize the opportunity to capitalize on burgeoning investment prospects through Palladium stocks and ETFs.

To make the most of this opportunity, it s essential to keep a close eye on the trends among leading palladium producers.

High Demand and Potential for Growth

The soaring demand for palladium, particularly due to its vital role in emission control devices, opens up substantial avenues for growth and investment. Industry forecasts indicate that future demand will rise, driven not only by traditional combustion engines but also by the transition to electric vehicles.

As you consider entering this market, it’s essential to keep an eye on volatility and craft robust investment strategies that can help you fully capitalize on the potential of this precious metal.

With governments worldwide tightening emissions regulations, the urgent need for palladium in reducing pollutants has never been more critical. Its importance is rapidly growing in hybrid vehicles, which only amplifies its demand.

Industry experts suggest that as manufacturers strive to harmonize electric and combustion technologies, the value of this precious metal is likely to skyrocket.

Navigating the landscape of precious metals requires you to stay informed about market trends and price fluctuations. Spreading your investments across different assets to reduce risk and considering palladium as a component of a broader portfolio can effectively hedge against economic uncertainty, enhancing your investment potential.

Risks and Challenges of Palladium Investments

Investing in palladium comes with its fair share of risks and challenges. Market volatility, often swayed by external factors like geopolitical tensions and evolving environmental regulations, can result in unpredictable price fluctuations that impact your investment strategies.

It s essential for you to grasp the delicate balance of supply and demand in this dynamic market, as doing so will help you navigate potential risks and make informed decisions.

Volatility and Other Considerations

Palladium market volatility stems from many factors, including economic conditions that influence market fluctuations and the role of palladium in diverse industrial applications. If you re interested in this precious metal, a comprehensive approach to your investment strategy is essential. Staying vigilant will help you adapt to the ever-changing landscape.

Several key elements are crucial in this arena, such as supply chain dynamics, geopolitical influences, and shifts in automotive manufacturing, particularly concerning emission control devices where palladium is extensively used. Broader economic indicators, like interest rates and employment statistics, can send ripples through the market, dramatically impacting prices.

Therefore, crafting a thoughtful investment strategy can involve diversifying your portfolio, employing hedging techniques, or even considering exchange-traded funds that focus on precious metals. By recognizing these market trends, you can take charge of your investments and mitigate risks effectively while maximizing potential gains, even amidst uncertainty.

Emerging Trends in Palladium Investments

Emerging trends in palladium investments reveal the profound influence of technological advancements and shifting market dynamics, which are shaping your interest in this vital precious metal.

As diverse industries increasingly embrace sustainable practices, grasping these trends is crucial for forecasting future demand and evaluating the investment potential in PGM assets.

New Technologies and Applications

New technologies and applications for palladium are evolving rapidly, driven by the increasing demand for electric vehicles and advancements in sustainable practices within the automotive sector. By understanding palladium treatment methods, you can gain valuable insights into the market’s future direction.

As electric vehicles gain momentum, the role of palladium in catalytic converters is being redefined. Innovative approaches are enhancing efficiency and reducing emissions. The integration of palladium into hydrogen fuel cells devices that convert hydrogen into electricity represents a significant leap toward sustainability and opens new avenues for research and development.

These advancements highlight the metal’s crucial role in minimizing carbon footprints and point to emerging investment opportunities. The demand for palladium is set to skyrocket don’t miss out!

Shifts in Global Economy and Politics

Shifts in the global economy and political landscape significantly impact the palladium market. Understanding these changes can offer you critical insights into market dynamics and their potential implications for your portfolio.

Fluctuations in trade policies between major economies can lead to sudden spikes or drops in demand, directly influencing prices. Keep a close eye on geopolitical tensions such as unrest in palladium-producing regions or changes in regulatory frameworks to anticipate market movements.

Economic indicators like inflation rates and currency fluctuations also play a vital role in shaping the future of the palladium market. By staying vigilant about these shifts, refine your strategies today!

How to Incorporate Palladium into Your Investment Portfolio

Incorporating palladium into your investment portfolio demands strategic planning and a clear understanding of diversification-focused investment strategies, particularly considering its distinctive role among precious metals.

You have various options, including palladium stocks and ETF investments exchange-traded funds that allow you to invest in a diversified portfolio of assets. Customize your portfolio to seize the growth potential of PGM assets while managing risk effectively.

Strategies and Tips for Diversification

Implementing effective strategies for diversification is crucial when considering palladium investments. This approach allows you to benefit from the precious metal’s unique characteristics while mitigating potential risks due to market fluctuations.

Analyze market trends and explore various investment vehicles such as palladium stocks and ETFs to significantly enhance your portfolio. This strategy cultivates a more resilient investment framework and ensures you have balanced exposure to price movements.

Understanding the dynamics of palladium demand especially its vital role in the automotive industry provides a solid foundation for making informed decisions. Incorporating palladium-focused ETFs offers an accessible option for diversifying without direct purchases of the metal.

By blending stocks and ETFs, you gain greater flexibility and liquidity, essential for navigating the often-volatile landscape of precious metals. These strategies empower you to manage risks more effectively while maximizing your potential returns.

Frequently Asked Questions

What are some current trends in palladium investments?

Currently, there is high demand for palladium due to its use in the automotive industry for catalytic converters. This has caused a rise in its price and increased interest in investing in the metal.

What are the risks associated with investing in palladium?

Investing in palladium carries risks such as price volatility and geopolitical uncertainties. Understanding these factors is essential for making informed investment choices.

Ready to invest in palladium? Start exploring your options today!

What can we expect for future trends in palladium investments?

Experts expect palladium demand to keep rising. Stricter emission regulations worldwide are driving this trend.

Are there any potential risks associated with investing in palladium?

Investing always carries risks. Palladium prices can fluctuate due to economic conditions, supply and demand, and geopolitical events.

What are some ways to invest in palladium?

Investors can buy physical palladium as bars or coins. They can also invest in mining companies or palladium-backed exchange-traded funds (ETFs), which are investment funds traded on stock exchanges.

Are there advantages to investing in palladium compared to other precious metals?

Palladium has a lower supply than gold and silver. This scarcity makes it attractive for diversifying investments. Its strong industrial demand helps it avoid the whims of consumer sentiment.

How can I stay informed about future trends in palladium investments?

Stay updated on news that affects palladium prices. Follow reliable financial news sources and consult with a financial advisor for the best investment decisions.