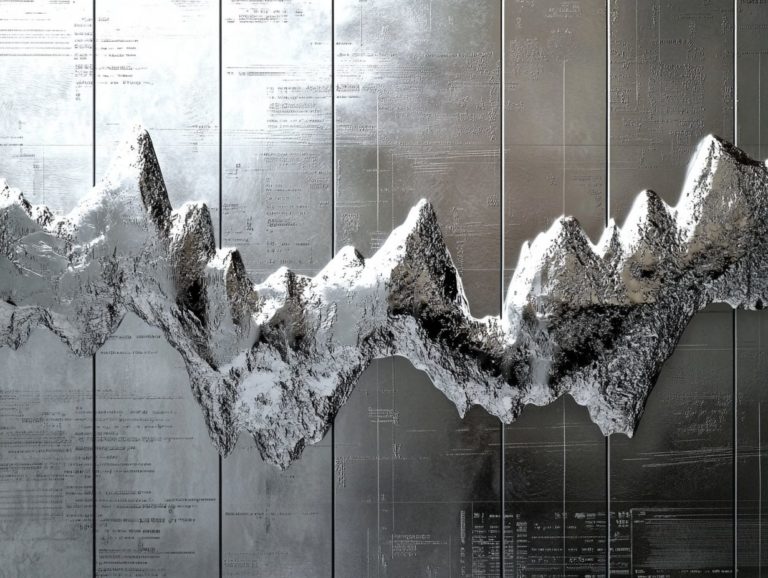

Analyzing the Impact of COVID-19 on Silver

Silver has long held an important place as a valuable commodity, valued for its use in industry and as an investment.

The COVID-19 pandemic has significantly transformed the silver market, creating shifts in supply and demand that few anticipated.

Let s explore how the pandemic has changed the silver market, drawing comparisons to previous crises and illuminating essential lessons learned.

This analysis examines the potential risks and rewards of investing in silver during these uncertain times, providing insightful predictions and recommendations tailored for discerning investors.

Contents

- Key Takeaways:

- The Effects of COVID-19 on the Silver Market

- Impact on Silver Prices

- Comparing COVID-19 to Previous Market Crises

- Investing in Silver During COVID-19

- Frequently Asked Questions

- How has the COVID-19 pandemic impacted the demand for silver?

- In what ways has the supply of silver been affected by the COVID-19 pandemic?

- How has the price of silver been affected by the COVID-19 pandemic?

- What industries have been most impacted by the changes in the silver market during the COVID-19 pandemic?

- How has the COVID-19 pandemic affected the long-term outlook for silver?

- What are the potential risks and opportunities for investing in silver during the COVID-19 pandemic?

Key Takeaways:

- The COVID-19 pandemic has significantly affected the demand and supply of silver, resulting in price fluctuations and changes in market trends.

- Compared to previous market crises, the impact of COVID-19 on the silver market has been unprecedented, highlighting the need for risk management strategies for investors.

- While investing in silver during COVID-19 may come with potential risks, it also presents opportunities for investors to diversify their portfolios and potentially reap rewards in the long term.

Overview of Silver as a Commodity

Silver has long been revered as a crucial asset within the financial realm, serving not just as a precious metal but also as a safe place to invest during tough economic times. Its unique duality as both an industrial metal and an investment vehicle draws in a diverse array of participants, from retail investors to large investors.

With demand surging across various sectors from jewelry to electronics silver’s importance in the commodity markets has intensified, particularly amid market volatility and financial upheavals.

Historically, silver has experienced considerable swings, often reflecting broader economic cycles alongside gold. While gold is celebrated for its ability to preserve value, silver distinguishes itself through extensive industrial applications, ranging from solar energy technologies to medical instruments, boosting its robust demand.

This presents a striking contrast to gold, whose allure primarily stems from its scarcity and status as a luxury asset. Recent trends point to a growing interest in silver, driven by the expansion of industrial sectors, while maintaining its appeal as a viable investment.

This creates a distinctive profile for silver in the commodity markets. Investors closely monitor silver’s performance, recognizing its role not only as a hedge against inflation but also as a pivotal player in the ever-evolving landscape of the global economy.

The Effects of COVID-19 on the Silver Market

The COVID-19 pandemic has dramatically reshaped the silver market, resulting in extraordinary changes in demand and supply dynamics worldwide. As lockdowns and restrictions were implemented, the economic repercussions rippled through nearly every sector, including precious metals.

Silver, often regarded as a safe-haven asset, faced considerable price fluctuations and heightened volatility as investors responded to the market upheaval. Mining disruptions in key countries have affected supply and shifted government policies, further intensifying the effects on silver prices and investment demand.

Changes in Demand and Supply

The COVID-19 pandemic has sparked significant changes in the demand and supply of silver, causing noteworthy shifts in market dynamics. You ve probably seen that mining disruptions in key countries have led to supply shortages. Meanwhile, industrial demand has taken a hit as operations across various sectors came to a halt.

On the flip side, retail demand has surged as investors look to silver as a safe haven against economic uncertainty. This exciting surge in interest adds further complexity to the supply-demand equation.

Industries like automotive and electronics, which typically rely on silver for manufacturing components, experienced production slowdowns. This has led to a decline in their consumption of this precious metal.

The combination of factory closures and logistical hurdles has created a noticeable dip in industrial applications. This situation increases the pressure on silver’s availability in the market, making it essential to understand the impact of tax changes on silver investments.

Meanwhile, the economic turbulence from the pandemic has created a growing trend among retail investors, many of whom have turned to physical silver and funds that trade on the stock market to protect their assets. This unusual surge in interest, set against a backdrop of diminished supply, has resulted in unique volatility in silver prices, creating a noteworthy upward trajectory. It underscores the delicate balance between enthusiastic investment and the constraints of the underlying market.

Impact on Silver Prices

The COVID-19 pandemic has dramatically influenced silver prices, showcasing extreme volatility and fluctuating price trajectories that mirror broader trends in the global economy and commodity markets.

As the economic repercussions of the pandemic unfolded, silver prices experienced dramatic swings. These swings were driven by shifting demand patterns, government policies, and evolving market sentiment.

In this complex landscape, futures markets became pivotal in establishing price levels. Investors navigated the uncertain economic terrain and contemplated the potential for future demand recovery.

Fluctuations and Trends

In the wake of the COVID-19 pandemic, you ve likely noticed the wild fluctuations in silver prices, which highlight the metal’s inherently volatile nature. These fluctuations often echo the broader economic climate. Prices have taken varied paths, influenced by changing investment demand and market speculation, especially in futures trading.

This volatility has caught the eye of both retail investors and institutional players eager to capitalize on silver’s safe-haven status amid uncertainty. Over the past several months, silver has danced between significant highs and lows.

At one point, it even reached near $30 per ounce before pulling back due to profit-taking and shifts in investor sentiment, prompted by macroeconomic indicators.

The futures markets have reacted in kind, with contract volumes reflecting a surge in activity as traders adjust their positions in response to global demand shifts, driven by industrial needs and ways to protect investments against rising prices.

This evolving landscape may prompt you to consider your next move carefully. Factors like currency strength and economic recovery cycles will ultimately shape how you engage with silver as a vital asset in your portfolio.

Comparing COVID-19 to Previous Market Crises

When you compare the effects of COVID-19 on the silver market to past market crises, you ll find both striking similarities and noteworthy differences. These differences show how economic impacts influence investment demand and commodity prices.

Reflecting on historical performance during events like the 2008 financial crisis offers valuable insights into silver’s behavior as both a precious metal and a financial asset. While both crises sparked market volatility and drove investors toward safe-haven assets, understanding the impact of inflation on silver prices can shed light on the distinct outcomes for the silver market during the unique circumstances of the pandemic.

Lessons Learned and Potential Future Scenarios

The COVID-19 pandemic has greatly impacted the silver market. This offers important insights into future scenarios amid ongoing economic uncertainty.

As market sentiment shifts and investment demand evolves, it’s essential to consider how making commodities like silver more like financial assets might shape silver’s trajectory.

In a world increasingly focused on environmental concerns and responsible investing, the significance of making sure we use resources responsibly could become even more pronounced.

Monitor changes in consumer behavior, especially in sectors that rely heavily on silver, such as electronics and renewable energy. This vigilance presents an opportunity to assess future demand trends and their effects on pricing dynamics.

Economic uncertainties may lead to a greater focus on hedging strategies, prompting more investors to view silver as a safe haven. As a result, the rising demand for sustainably mined resources could transform the operational practices of extraction companies and reshape the overall market landscape.

This underscores the critical importance of ethical sourcing as a competitive advantage.

Investing in Silver During COVID-19

Investing in silver during the tumultuous COVID-19 period has presented you with a blend of challenges and opportunities. The metal’s stature as a safe-haven asset gained prominence amidst market volatility.

This made silver a focal point for astute investors like yourself.

The pandemic didn’t just sway silver prices; it reshaped the entire financial investment landscape. A surge in retail investment occurred as individuals sought to diversify their portfolios.

Navigating the complexities of the silver market during this era demands a keen understanding of the underlying dynamics. Stay attuned to shifts in supply and demand and how these fluctuations affect commodity prices.

This knowledge is vital for making informed decisions and capitalizing on the unique opportunities presented by the market.

Potential Risks and Rewards

Investing in silver during times of economic upheaval can be thrilling, offering both risks and amazing rewards. This is especially true against the backdrop of fluctuating prices and shifting investment demand.

The allure of silver as a financial asset is clear, but understanding the associated risks driven by market volatility and external economic factors is crucial for making informed decisions.

As a retail investor, you ll navigate a complex landscape where the promise of significant returns must be balanced against the reality of possible losses.

As global markets undergo unexpected changes, recognize the likelihood of sudden price swings whether sharp surges or steep declines. These can be prompted by geopolitical tensions, shifts in industrial demand, or fluctuations in currency strength.

Silver s unique position as both a precious metal and an industrial commodity adds even more layers of complexity to its valuation.

To effectively manage these inherent risks, adopt a diversified approach by combining silver investments with a variety of other assets. Strategies such as dollar-cost averaging or establishing clear entry and exit points can also serve you well.

By staying informed about market trends and economic indicators, empower your decision-making. This will enable you to capitalize on favorable conditions while protecting your portfolio from adverse movements.

Predictions and Recommendations

Predictions for silver prices and market trends post-COVID-19 rely on a blend of historical data and current investment demand. This gives you a solid framework for making strategic financial decisions. As the global economy begins to recover, grasping how silver moves within evolving commodity markets will be essential for seizing future opportunities.

Particularly noteworthy is the surge in industrial applications for silver, especially in renewable energy technologies and electronics. This could elevate its demand and potentially push prices upward.

To navigate the silver market’s trajectory, analyze macroeconomic indicators and global political events closely. Experienced investors like you might consider strategies such as investing in silver exchange-traded funds (ETFs), which are investment funds that you can buy and sell like stocks, or mining stocks that closely track performance.

Stay informed about inflation trends and central bank policies. This will empower you to make timely and informed choices in this volatile yet promising landscape.

Frequently Asked Questions

How has the COVID-19 pandemic impacted the demand for silver?

The COVID-19 pandemic has significantly increased the demand for silver due to its use in various medical equipment and devices, such as ventilators and hospital equipment. Additionally, the economic uncertainty caused by the pandemic has led to increased investment in silver as a safe-haven asset.

In what ways has the supply of silver been affected by the COVID-19 pandemic?

The supply of silver has been impacted by the pandemic in several ways. With many mines and refineries temporarily shutting down or operating at reduced capacity, there has been a decrease in the production of silver. Furthermore, disruptions in global trade and transportation have affected the supply chain of silver, leading to potential shortages.

How has the price of silver been affected by the COVID-19 pandemic?

The price of silver has been quite volatile during the COVID-19 pandemic. In the initial stages, the price of silver decreased due to the overall market crash and economic uncertainty. However, as the pandemic persisted and the demand for silver increased, the price started to rise and reached record highs in August 2020.

What industries have been most impacted by the changes in the silver market during the COVID-19 pandemic?

The industries that have been most affected by the changes in the silver market include the jewelry industry, which saw a decline in demand due to economic slowdowns, and the solar industry, which relies heavily on silver for solar panel production. The medical industry, on the other hand, has seen an increase in demand for silver due to its use in medical devices.

How has the COVID-19 pandemic affected the long-term outlook for silver?

The COVID-19 pandemic has brought about long-term changes in the outlook for silver. With increased demand for silver in various industries, there is potential for long-term growth in the silver market. Moreover, the economic uncertainty caused by the pandemic has increased the appeal of silver as a safe-haven asset, which could further impact its long-term outlook.

What are the potential risks and opportunities for investing in silver during the COVID-19 pandemic?

The main risk of investing in silver during the pandemic is the potential for market volatility and price fluctuations. However, there are also opportunities for potential gains, especially for long-term investors, as the demand for silver continues to rise across various industries. Furthermore, the current low prices of silver may present a buying opportunity for investors looking to diversify their portfolio.

Don’t miss out on the chance to invest in silver as its demand surges! Want to stay updated on silver trends? Subscribe to our newsletter!