The Role of Technology in Precious Metals Investing

In the ever-evolving landscape of investing, precious metals have consistently served as a reliable haven for those seeking stability.

As the market shifts, understanding both traditional and modern approaches to investing in these valuable assets is essential. Let’s explore the basics of investing in precious metals, covering everything from the various types of metals to the influence of technology on trading and investing.

Discover how online platforms, blockchain, and cryptocurrencies are transforming your investment experience, along with key tips designed to enhance your strategy.

Whether you re a seasoned investor or just starting your journey, this guide will arm you with crucial insights to successfully navigate the world of precious metals.

Contents

- Key Takeaways:

- What You Need to Know About Precious Metals Investing

- Traditional Methods of Investing in Precious Metals

- How Technology is Changing Precious Metals Investing

- Benefits and Risks of Using Technology in Precious Metals Investing

- Tips for Incorporating Technology into Your Precious Metals Investment Strategy

- Frequently Asked Questions

- What is the role of technology in precious metals investing?

- How does technology impact the efficiency of precious metals investing?

- What are some technological tools used in precious metals investing?

- How has technology changed the landscape of precious metals investing?

- Is there a risk of relying too heavily on technology in precious metals investing?

- Can technology help mitigate the risks associated with precious metals investing?

Key Takeaways:

- Technology has made precious metals investing more accessible through online trading platforms and apps.

- Blockchain and cryptocurrencies are emerging as alternative methods for investing in precious metals.

- Make sure to research and choose the right platforms, and diversify your investments when incorporating technology into your strategy.

What You Need to Know About Precious Metals Investing

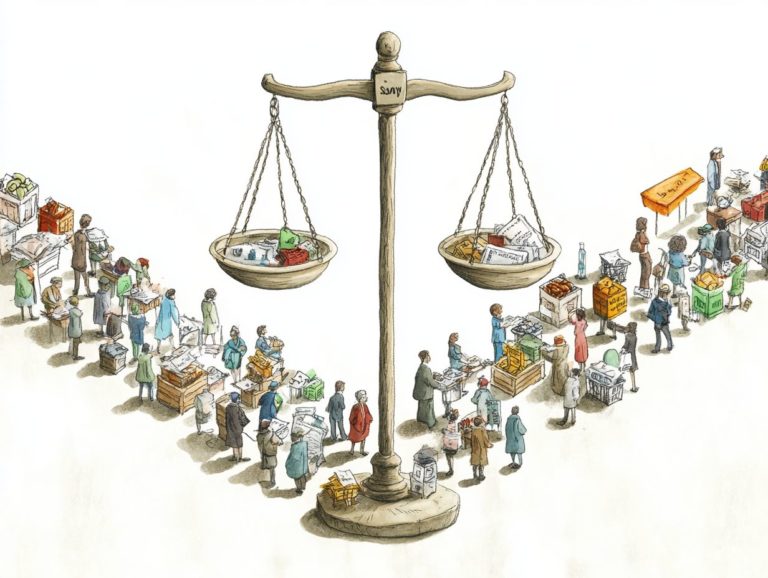

Precious metals investing is a fundamental pillar for investors navigating the intricate landscape of financial markets. Technological advancements and industrial applications constantly influence demand, making this a captivating area.

The allure of gold, silver, platinum, and palladium goes beyond aesthetics; these metals are vital in sectors like healthcare, renewable energy, and electronics. For those considering long-term investment benefits, understanding the role of precious metals in estate planning is crucial as it directly impacts the valuations of these assets and informs your investment strategies.

Understanding the Market and Types of Metals

The market for precious metals is a diverse range of commodities, including gold, silver, platinum, and palladium each with its distinct characteristics and market behaviors.

Gold, often viewed as the top choice for safety, has long been cherished for its allure and historical significance as currency, woven into the fabric of cultures worldwide.

Silver, with numerous industrial uses, is seeing a surge in demand from growing sectors like electronics and solar energy, significantly shaping today’s market trends.

Platinum and palladium are pivotal in the automotive industry, particularly in catalytic converters, exerting considerable influence on pricing dynamics.

As an investor seeking strategic allocation, carefully analyze these precious metals, fine-tuning your strategies to navigate the intricate dance of supply and demand in this ever-evolving marketplace. Understanding the role of market timing in precious metals can enhance your investment approach.

Traditional Methods of Investing in Precious Metals

When considering traditional methods of investing in precious metals, you typically think of acquiring physical assets like gold and silver or trading stocks in mining companies. Recognize that these investments can be influenced by market volatility and the ever-changing dynamics of supply and demand.

Purchasing Physical Metals and Stocks

You can invest in either physical metals or stocks tied to mining companies, with each path presenting unique investment strategies and considerations.

Choosing physical metals like gold or silver can provide a sense of security, offering a tangible asset that often retains or appreciates in value, especially during economic turmoil. This investment serves as a reliable hedge against inflation, helping safeguard your purchasing power.

Engaging in the stock market provides greater liquidity, or how quickly you can convert assets into cash, and the potential for leverage, allowing you to access capital quickly. The stock market operates with a high level of transparency, where valuation methodologies are shaped by factors like earnings reports and market sentiment, enabling you to make informed investment decisions.

How Technology is Changing Precious Metals Investing

Technological advances are transforming precious metals investing. Online trading platforms and automated trading systems are making it easier for you to invest from anywhere in the world.

Online Trading Platforms and Apps

Online trading platforms and apps are important tools for investors eager to take advantage of real-time price changes. They offer a user-friendly interface that allows you to execute trades whenever you want.

With market research tools, you can analyze trends and access historical data to make better decisions. Additionally, understanding the role of precious metals in tax-advantaged accounts can enhance your strategy. You can use advanced trading strategies, like algorithmic trading (using algorithms to make trades) and automated alerts, to maximize your investment potential.

Use of Blockchain and Cryptocurrencies

Blockchain technology and cryptocurrencies are changing precious metals investing by improving market transparency. This new way reduces fraud risk and creates a smoother platform for buyers and sellers.

Blockchain allows real-time transaction tracking, enhancing trust in the market. Its secure ledger ensures trades are verified quickly and accurately.

Cryptocurrencies provide flexibility, making it easier to exchange assets faster than traditional payment methods. As these technologies grow, they will reshape the market and boost investor confidence.

Benefits and Risks of Using Technology in Precious Metals Investing

Using technology in precious metals investing offers exciting advantages. You gain enhanced convenience and greater accessibility, but there are potential risks to consider.

Advantages of Convenience and Accessibility

The convenience of technology allows more investors to participate. Now, you can trade from home, making investing less intimidating.

Access real-time market data and analysis tools to make informed decisions based on solid evidence. Technology also helps you implement various investment strategies to improve your returns.

Leverage data-driven insights to ensure your choices are timely and aligned with market trends, especially when understanding the global precious metals market, boosting your investment efficiency.

Potential Disadvantages and Security Concerns

While technology brings a wealth of advantages, it also introduces substantial security concerns that can impact your investments in precious metals.

Among these concerns, cybersecurity threats take center stage. Hackers increasingly set their sights on financial institutions and trading platforms. These breaches can lead to misinformation, unauthorized trades, and even the loss of funds, ultimately shaking your confidence as an investor.

The rapid pace of technology can stir market volatility. An unexpected algorithm update or error can send prices into a tailspin.

To navigate these risks, use robust risk assessment methodologies. This helps evaluate potential vulnerabilities and make informed decisions.

By systematically analyzing both technological and market-related risks, you can craft strategies that protect your investments from these contemporary challenges.

Tips for Incorporating Technology into Your Precious Metals Investment Strategy

Incorporating technology into your precious metals investment strategy can significantly enhance your decision-making process. Just follow a few strategic guidelines.

By leveraging the right tools and resources, you enable yourself to make informed choices that align with your investment goals.

Researching and Choosing the Right Platforms

Researching and selecting the right online trading platforms is critical for crafting an effective precious metals investment strategy.

As you compare these platforms, carefully assess various factors. Look at user experience and the overall interface; these can significantly influence your trading efficiency.

It’s essential to evaluate the fee structures of each platform. Hidden charges can quietly chip away at your potential profits.

Consider available features such as real-time market data, advanced charting tools, and educational resources. These can help you make informed, data-driven decisions.

Understanding how these platforms support market efficiency by providing timely information can greatly enhance your investment outcomes. Choose one that aligns with your specific trading objectives.

Diversifying Your Investments

Diversifying your investments across various precious metals can significantly mitigate risks and enhance the robustness of your investment portfolio.

This approach helps spread risk among metals like gold, silver, platinum, and palladium. Each metal has distinct market behaviors and economic responses.

For example, gold typically acts as a safe haven during economic downturns. Silver might exhibit more volatility but has the potential for greater gains during industrial booms.

As you navigate your investment choices, consider your risk tolerance alongside current economic indicators, such as inflation rates and geopolitical events. These insights guide your decisions on balancing your exposure.

By thoughtfully assessing these factors, you can create a more resilient portfolio and optimize your returns, even amid fluctuating market conditions.

Frequently Asked Questions

What is the role of technology in precious metals investing?

Technology helps investors access real-time market data, making precious metals investing easier.

How does technology impact the efficiency of precious metals investing?

With technology, investors can easily and quickly buy, sell, and store precious metals. This eliminates the need for physical transactions and paperwork, making the process more efficient and less time-consuming.

What are some technological tools used in precious metals investing?

Some common technological tools used in precious metals investing include online trading platforms, mobile apps, blockchain technology for secure transactions, and automated trading algorithms.

Start exploring your precious metals investment options today!

How has technology changed the landscape of precious metals investing?

Technology has made investing in precious metals accessible for more investors. It has removed geographical barriers and increased market transparency and efficiency!

Is there a risk of relying too heavily on technology in precious metals investing?

While technology simplifies precious metals investing, thorough research is crucial. Don’t rely solely on tech; market fluctuations and external factors still affect your investments!

Can technology help mitigate the risks associated with precious metals investing?

Yes! Technology offers real-time market data, enables diversification through online trading, and provides effective tools for risk management and analysis.