How to Create a Solid Investment Plan

Investment planning is your exciting first step toward achieving financial goals and securing a prosperous future.

This article delves into the essence of investment planning, highlighting the significance of a structured approach. It guides you in setting clear financial objectives, assessing your risk tolerance, and selecting the right investments to enrich your portfolio.

This discussion highlights the necessity of monitoring your investments and making adjustments when needed. By the end, you will possess the tools to create a robust investment plan that aligns seamlessly with your aspirations.

Contents

Key Takeaways:

- Understand the importance of having a solid investment plan to achieve financial goals.

- Determine your risk tolerance and choose the right investments for diversification and asset allocation.

- Regularly review and make changes to your plan to ensure it aligns with your financial objectives and current market conditions.

Understanding Investment Planning

Understanding investment planning is essential if you’re looking to achieve financial security and reach your long-term financial goals. It involves a careful look at your personal finances, which includes evaluating different investment options and identifying your risk tolerance.

Effective investment planning not only sets the foundation for your retirement and emergency savings but also lays the groundwork for strong ways to manage your investments effectively. This approach maximizes your investment returns and fosters capital appreciation over time, ensuring that your financial future is as bright as possible. If you’re considering precious metals, learn how to invest in silver without breaking the bank to diversify your portfolio.

What is Investment Planning?

Investment planning is your pathway to crafting a tailored roadmap for your investments, ensuring they resonate with your financial goals and risk profile.

This holistic approach requires you to evaluate your current financial situation and pinpoint future objectives. You need to find the most effective strategies to reach them. It’s essential to gain a solid understanding of various investment vehicles—think stocks, bonds, and mutual funds—as well as the ability to analyze market trends and your unique circumstances. For those interested in precious metals, exploring strategic asset allocation for silver investments can provide valuable insights.

Establishing clear financial goals is crucial; they not only provide direction but also serve as benchmarks for measuring your success over time. A financial advisor becomes an invaluable ally on this journey, offering expert insights to help you navigate the intricate landscape of investment options.

By harnessing their knowledge and experience, you can make informed decisions about investments that truly reflect your aspirations and risk tolerance.

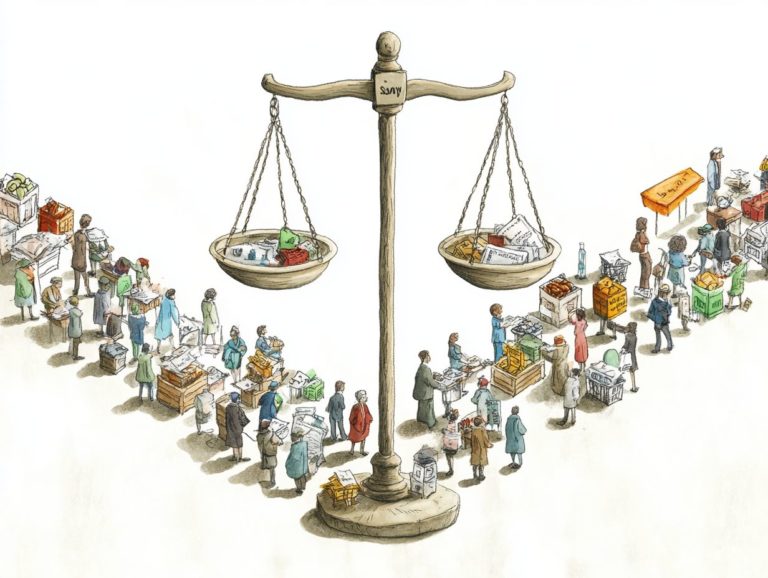

Importance of Having a Plan

Having a well-structured investment plan is essential as it provides clarity and direction in pursuing both your long-term and short-term financial goals.

By establishing such a framework, you can precisely assess your risk tolerance, which is crucial for navigating the often-volatile world of investing. This thoughtful approach not only enhances your investment strategies but also gives you the power to make informed decisions about your options.

As you gain a deeper understanding of your financial landscape, you can adjust your portfolio accordingly, diversifying your assets to mitigate potential losses. Ultimately, effective planning cultivates confidence, allowing you to stay focused on your objectives even amidst fluctuating markets.

Setting Financial Goals

Establishing financial goals is a crucial first step in your investment planning journey. It serves as a guiding beacon, directing you toward your envisioned financial future with both clarity and intention.

Don t wait start building your plan today! Ready to take charge of your financial future? Start planning your investments today!

Determining Your Investment Objectives

Determining your investment objectives is crucial for crafting a personalized investment strategy that aligns seamlessly with your overarching financial goals.

You should start this assessment by taking a thorough look at your personal circumstances, including your income level, financial responsibilities, and future aspirations. Evaluating your risk profile is also essential, as it reveals your willingness and capacity to withstand market fluctuations.

Understanding your desired asset allocation whether you lean toward stocks, bonds, or alternative investments will significantly shape your investment choices.

By synthesizing these factors, you can develop a comprehensive approach that not only addresses your immediate financial needs but also lays the foundation for long-term wealth creation.

Creating a Realistic Timeline

Creating a realistic timeline for your financial goals gives you the power to measure progress and maintain motivation on your wealth-building journey.

It s essential to break down your objectives into manageable steps. Striking a balance between the immediate actions necessary for short-term wins and the broader strategies will pave the way for long-term success.

Establishing a timeline goes beyond merely setting dates; it involves recognizing that circumstances can change, requiring your approach to be flexible.

As you navigate through the various stages of life, your financial responsibilities may shift due to job changes, unexpected expenses, or new investment opportunities. Staying adaptable empowers you to realign your goals and seize new opportunities!

Fostering a sustainable path toward financial independence is essential.

Assessing Risk Tolerance

Assessing your risk tolerance is a crucial aspect of investment planning, as it significantly shapes your investment decisions and overall financial strategy.

Understanding where you stand on the levels of risk allows you to tailor your approach, aligning your investments with your financial goals and comfort level.

Understanding Your Risk Tolerance

Understanding your risk tolerance is crucial for making informed investment decisions that align with your financial goals and comfort level.

Several factors contribute to this personal assessment, one being your age. If you’re younger, you might find yourself more willing to embrace volatility for the chance of greater returns, while those approaching retirement tend to prioritize capital preservation.

Your financial situation also plays a significant role. If you have a stable income and a solid emergency fund, you might feel comfortable taking on more risk than someone facing financial strain.

Market volatility can influence your behaviors, too. During turbulent times, even the most seasoned investors may find themselves second-guessing their strategies.

Evaluating your comfort with how easily you can access your money without losing value is vital, as this reflects your investment goals.

Lastly, reflecting on past experiences with potential losses can shape your future risk appetite. It s essential to consider both your emotional resilience and financial needs when planning your investments.

Managing Risk in Your Investment Plan

Managing risk in your investment plan is all about striking that perfect balance between potential gains and the likelihood of losses, ensuring a stable approach to your investing journey.

To achieve this balance, think about using strategies like portfolio diversification. By spreading your investments across different asset classes, you can significantly mitigate the impact of any single investment’s poor performance.

Engaging a financial advisor can also be incredibly beneficial; their expertise provides invaluable insights, helping you make informed decisions tailored to your personal financial goals.

Regularly checking your investment strategies is essential. This practice allows you to make adjustments based on market conditions, shifting priorities, or changes in your financial circumstances, ultimately leading to a more resilient investment framework.

Choosing the Right Investments

Investing wisely can unlock your financial future let’s explore how to do it right! Selecting the right investments is essential for constructing a diversified portfolio that aligns seamlessly with your financial objectives and risk appetite.

Diversification and How to Spread Your Investments

Diversification is a crucial strategy that helps you manage risk while enhancing potential growth. By strategically spreading your investments across various asset classes such as stocks, bonds, real estate, and commodities you can significantly reduce your exposure to the volatility of any single investment.

This thoughtful approach cushions the blow from market fluctuations and paves the way for more stable returns over time. Effective asset allocation requires you to carefully determine what percentage of your capital should be invested in each asset class, all while considering your risk tolerance and financial goals. If you’re considering diversifying your investments, learning how to start a silver investment fund could be a beneficial strategy.

It s vital for you to grasp the balance of risk trade-offs; higher returns often come with greater risk. A well-considered portfolio emphasizes stability, giving you the power to navigate diverse market conditions with confidence.

Types of Investments to Consider

When considering different types of investments, it’s crucial to evaluate each option for its potential returns and risk factors. You need to assess how well they align with your financial goals.

As an investor, you often find yourself weighing the stability of bonds against the growth potential of stocks. You may also ponder the income generation that real estate offers. Stocks can yield high returns, but they come with increased volatility, making them suitable for those with a higher risk tolerance.

On the other hand, bonds typically provide steadier income with less risk, appealing to those who prioritize security. Mutual funds bring diversification into the mix, pooling resources to invest across various assets. This can help mitigate risk.

By understanding these characteristics, you can assemble a balanced portfolio that aligns with your investment strategy, maximizing your potential while effectively managing inherent risks.

Monitoring and Adjusting Your Plan

Monitoring and adjusting your investment plan is essential for keeping it in sync with your financial milestones and the ever-changing market landscape. Stay proactive to ensure your strategy reflects your goals and adapts to new opportunities and challenges.

Regularly Reviewing Your Investments

Regularly reviewing your investments is crucial for assessing their performance against your financial goals. This allows you to make timely adjustments to your investment management strategy.

This ongoing process enables you to remain responsive to market changes and personal circumstances. You should conduct evaluations at least quarterly, though semi-annual reviews may suffice, depending on your portfolio’s complexity.

Key metrics to consider include:

- Return on investment

- Volatility (how much prices go up and down)

- Sector performance

- Diversification status

Engaging a financial advisor can be invaluable during this review process. Their expertise and objectivity can help you interpret these metrics and provide tailored recommendations that align with your evolving financial landscape, including how to plan for taxes when investing in precious metals.

Making Changes as Needed

Adjusting your investment plan helps you stay on course to achieve your financial goals. This is essential, especially when market conditions change.

You need to be aware of your financial landscape. Evaluate how various elements, like changes in the economy, interest rate changes, or unexpected personal expenses, can impact your portfolio.

Regular check-ins on your investment performance are crucial. This allows you to assess your risk level and make necessary adjustments.

For example, during market downturns, consider reallocating assets to protect against losses. You might also seize the opportunity presented by lower prices.

Life changes can trigger a reassessment of your goals. Starting a new job or making significant purchases may require timely adjustments to align with both market trends and your personal aspirations.

Frequently Asked Questions

What makes a winning investment plan?

A winning investment plan is a well-thought-out strategy for managing your money. It helps you achieve specific financial goals, such as saving for retirement, buying a house, or funding your child’s education.

This plan involves identifying how much risk you’re comfortable with, setting clear goals, and diversifying your investments to maximize returns while minimizing risks.

Why is it important to have a strong investment plan?

A strong investment plan keeps you focused on your long-term financial goals. It also helps you make informed investment decisions and avoid impulsive choices that could harm your financial future.

How do I find out my risk level?

Finding your risk level involves understanding your financial goals, time frame, and comfort with potential losses. If you can handle fluctuations in your investments over a longer time frame, you might be more open to risk.

Conversely, if you prefer stability and have shorter time frames, you may lean toward being more conservative.

What are some key elements of a successful investment plan?

Key elements include setting realistic and clear goals, diversifying your portfolio, regularly reviewing your investments, and maintaining discipline in your approach.

It s vital to consider your risk tolerance, time frame, and unique financial situation.

How can I diversify my investments?

Diversifying means spreading your money across different asset types, like stocks, bonds, real estate, and cash. This helps reduce the risk of losing everything if one investment fails.

Be sure to diversify within each asset type by investing in various industries, companies, or regions.

Do I need help from a professional to create a solid investment plan?

You can create a solid investment plan on your own. However, working with a financial advisor can provide valuable expertise and guidance.

An advisor helps you assess your risk tolerance, set achievable goals, and develop a personalized investment strategy that aligns with your needs.

Ready to secure your financial future? Start crafting your investment plan today!