How to Avoid Scams in Precious Metals Investment

Investing in precious metals can be an enriching venture, but it is crucial to be aware of the risks involved.

With a variety of metals available such as gold, silver, and platinum understanding their value is essential. The market is filled with scams, so honing your ability to spot red flags is imperative.

This article guides you through the essentials of investing in precious metals, including how to verify authenticity, conduct secure transactions, and explore alternative investment options to diversify your portfolio.

Dive in and arm yourself with the knowledge needed to navigate this market with confidence and safety.

Contents

- Key Takeaways:

- Understanding Precious Metals Investment

- Common Scams in Precious Metals Investment

- Research and Due Diligence

- Safe and Secure Transactions

- Alternative Investment Options

- Frequently Asked Questions

- 1. How can I avoid scams when investing in precious metals?

- 2. What are the warning signs of a potential scam in precious metals investment?

- 3. Is it safe to buy precious metals online?

- 4. How can I protect myself from online precious metals investment scams?

- 5. Are there any government regulations to prevent precious metals investment scams?

- 6. Think you ve been scammed? Here’s what to do next!

Key Takeaways:

- Be aware of red flags such as high-pressure sales tactics and unrealistic promises when investing in precious metals, as these are common signs of scams.

- Conduct thorough research and due diligence before purchasing precious metals to verify their authenticity and ensure safe transactions.

- Diversify your investment portfolio by considering options like purchasing physical precious metals or investing in mining companies to minimize the risk of scams.

Understanding Precious Metals Investment

Understanding precious metals investment is crucial for anyone aiming to diversify their portfolio with valuable assets like gold, silver, and platinum. You must recognize the opportunities and risks, including scams and market volatility that could lead to financial losses.

Government agencies such as the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA) ensure a more secure trading environment. By grasping the fundamentals of these investments, you can make informed decisions that align with your financial goals and risk tolerance.

Types of Precious Metals and Their Value

Precious metals like gold, silver, and platinum are prime investments, valued for their rarity and market appeal. This allure makes them attractive choices for traders and long-term investors alike.

Each metal has unique qualities that appeal to different investors. Gold is often regarded as a safe haven during economic downturns, maintaining high demand for both jewelry and industrial use.

Silver serves a dual role as both an investment and a key component in electronics, showcasing volatility that can create profitable trading opportunities. Meanwhile, platinum has garnered interest as a valuable asset due to its limited supply and role in automotive catalysts.

Understanding the dynamics of these metals equips you with the knowledge needed to make informed decisions in the trading and investment landscape.

Common Scams in Precious Metals Investment

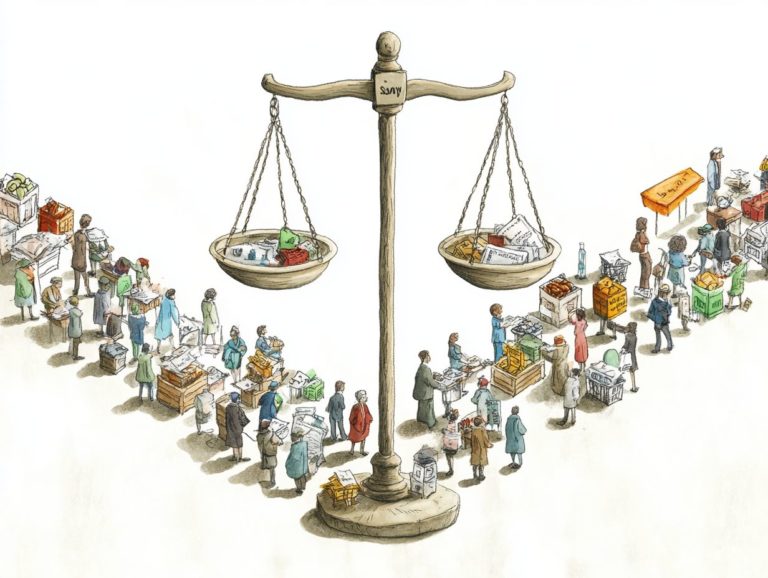

The market is filled with scams that can lead to significant financial losses for unsuspecting investors. Fraudulent trading websites often employ high-pressure tactics, making it vital for you to stay vigilant and well-informed.

The CFTC strongly advises thoroughly verifying any investment opportunities and approaching deals that seem too good to be true with a healthy dose of skepticism.

Identifying Red Flags

Identifying red flags is essential for you as an investor in the precious metals market. This knowledge helps you steer clear of scams that could lead to significant financial losses.

By being aware of certain indicators, you can protect yourself from disastrous decisions. For instance, if you encounter promises of unusually high returns with minimal risk, be cautious; these are often tactics used by fraudulent sellers.

A lack of transparency regarding pricing or sourcing is another major warning sign. Be wary of unlicensed dealers who lack proper credentials, as this often signals a lack of legitimacy.

You must conduct a thorough verification process and research before engaging in any transactions. This ensures your investments are well safeguarded.

Research and Due Diligence

Conducting thorough research and due diligence is crucial for you as an investor in precious metals. It enables you to make informed decisions while minimizing risks.

Consulting with financial advisors and checking the reputations of auction houses and dealers can significantly enhance your protection.

By implementing careful checks, you safeguard yourself against scams and fraudulent trading practices. This ensures your investments are secure and trustworthy.

How to Verify the Authenticity of Precious Metals

Verifying the authenticity of precious metals is vital for you as an investor. This step ensures your purchases are legitimate and helps you avoid financial pitfalls tied to scams.

In a market where the value of precious metals can be significant, knowing how to confirm their authenticity is crucial for making informed decisions.

Start your journey by engaging with certified dealers who are reputable and knowledgeable. This not only gives you a sense of security but also connects you with experts. Examine the hallmarks and stamps on the metals; these provide valuable insights into their quality and origin.

If you seek comprehensive verification, third-party testing services offer detailed assessments of composition and purity. This gives you peace of mind in your investments.

Safe and Secure Transactions

Ensuring safe and secure transactions is essential for you as a precious metals investor. This safeguards your investments from scams and potential financial pitfalls.

Take prudent precautions such as engaging with reputable dealers, using secure storage methods, and avoiding high-pressure tactics. These actions can significantly mitigate trading risks.

Your vigilance in these areas protects your assets and enhances your overall investment experience.

Tips for Protecting Your Investment

Protecting your investment in precious metals requires a thoughtful approach. Incorporate effective strategies such as secure storage, trusting dealers, and thorough research.

- Utilize safety deposit boxes or specialized vault services for top-notch protection.

- Verify the credentials of dealers; seek established companies with positive customer reviews and credible certifications.

- Stay informed about market trends and fluctuations to make better decisions.

By prioritizing these actions, you can safeguard your investments and ensure your precious metals are well protected against potential threats.

Alternative Investment Options

Exploring alternative investment options offers valuable opportunities for diversification. This elevates your portfolio beyond just precious metals.

Looking into digital assets, forex, and foreign currency trading has become increasingly popular. Each option presents unique benefits and risks for discerning investors like you.

Diversifying Your Portfolio

Ready to take control of your financial future? Diversifying your portfolio helps manage risks. It also maximizes investment opportunities across various types of investments like precious metals.

By spreading your investments across different sectors and instruments, you create a cushion against market volatility. This approach positions you to seize growth opportunities in diverse industries while minimizing potential losses during downturns.

Implementing a diversified strategy can lead to a more stable return profile over time. If one investment underperforms, others can help offset those losses. Ultimately, this balanced approach allows you to make flexible and informed decisions, contributing to your long-term financial health.

Frequently Asked Questions

1. How can I avoid scams when investing in precious metals?

To avoid scams, research the seller’s reputation. Look for reviews from other buyers and verify their credentials. Always ask for proof of ownership and authenticity before making a purchase.

2. What are the warning signs of a potential scam in precious metals investment?

Red flags include unrealistic returns or guaranteed profits. If a seller pressures you to make a quick decision without time to research, that’s another warning sign.

3. Is it safe to buy precious metals online?

Buying precious metals online can be safe if you choose a reputable dealer. Verify the seller’s legitimacy and use a secure payment method. Request insurance and delivery confirmation for your purchase.

4. How can I protect myself from online precious metals investment scams?

Invest only through trusted websites. Never share your personal or financial details with unverified sellers. Always do your research and be cautious of offers that seem too good to be true.

5. Are there any government regulations to prevent precious metals investment scams?

Yes, the Federal Trade Commission (FTC) and the U.S. Securities and Exchange Commission (SEC) have regulations to protect consumers. Check their websites for warnings or updates on potential scams.

6. Think you ve been scammed? Here’s what to do next!

If you suspect a scam, contact local authorities to report the incident. You can also file a complaint with the FTC or SEC. Additionally, consult a reputable financial advisor to discuss recovery options.

For more tips on investing wisely, subscribe to our newsletter or explore other resources related to precious metal investments!