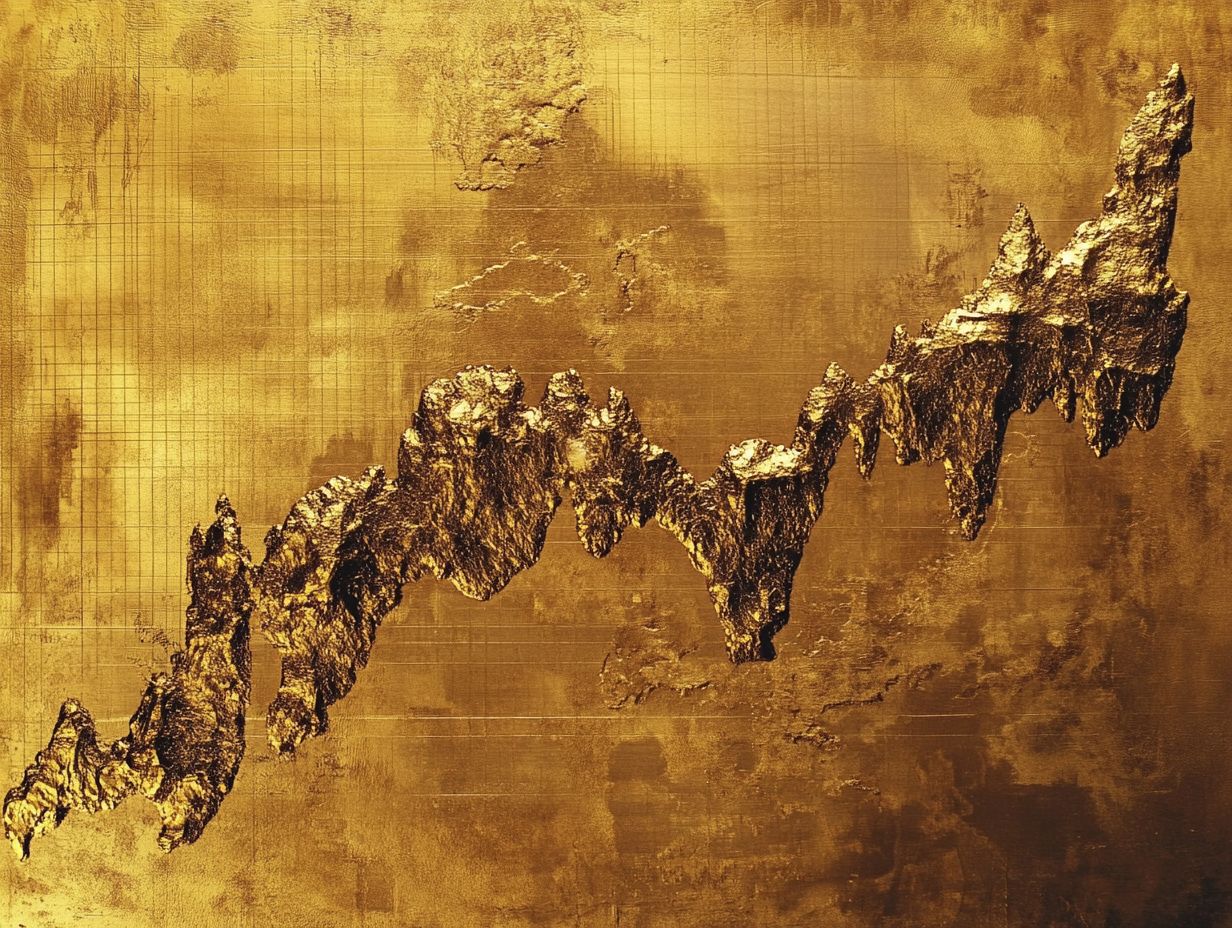

Analyzing Historical Gold Price Movements

Gold has always been seen as a safe haven for investors. Its market captivates and intrigues.

You’ll discover the various factors that influence gold prices, such as global economic conditions, political developments, and inflation rates.

Historical trends and pivotal events that have shaped the gold market will be thoroughly examined. This will offer you insights and investment strategies to successfully navigate this landscape.

Whether you re a seasoned investor or simply curious about gold, this article will equip you with the knowledge to appreciate its allure and volatility.

Contents

- Key Takeaways:

- Understanding the Gold Market

- Factors Affecting Gold Prices

- Historical Trends in Gold Prices

- Interpreting Gold Price Movements

- Investing in Gold

- Frequently Asked Questions

- What is the significance of analyzing historical gold price movements?

- How can I access historical gold price data?

- What are the key factors that influence gold prices?

- What are some common trends in historical gold price movements?

- How can I use historical gold price data to make investment decisions?

- Can historical gold price movements predict future prices?

Key Takeaways:

- Gold prices are affected by a variety of global economic, political, and inflationary factors, making it a complex commodity to analyze.

- Historical trends in gold prices can be influenced by major events, such as economic crises or political upheavals. Understanding these events can help predict future movements.

- When considering investing in gold, it’s important to conduct thorough research. Consider factors such as risk tolerance and long-term goals, and seek expert analysis and predictions of future price movements.

Understanding the Gold Market

Understanding the gold market is essential for any investor eager to leverage the metal’s esteemed reputation as a store of value and a hedge against inflation. This is especially relevant in today’s landscape of shifting geopolitical tensions and unpredictable market conditions.

Gold isn’t just a commodity; it’s a cornerstone of smart investing. You must familiarize yourself with the myriad factors that influence gold prices and their connections to economic indicators and historical fluctuations.

Overview of Gold as a Commodity

Gold is a precious metal that has captivated humanity for centuries. It is celebrated not just for its alluring beauty but also for its remarkable properties that make it a steadfast store of value.

Its flexibility, resistance to tarnish, and excellent conductivity have solidified gold s reputation across diverse industries, from electronics to jewelry manufacturing.

Gold bullion and physical gold are essential financial assets that draw investors seeking stability in turbulent markets. The importance of gold also resonates in culturally rich contexts, where it serves as a powerful symbol of wealth and prosperity.

Gold mining companies are pivotal in this narrative, diligently extracting and supplying the metal to satisfy global demand. They contribute to the economy while carefully navigating the complex landscape of environmental and ethical considerations.

Factors Affecting Gold Prices

Various factors intricately influence gold prices. It is essential for you to grasp the interplay between market conditions, geopolitical tensions, inflation, and interest rates as you develop your investment strategies.

Understanding these elements will empower you to navigate the complexities of the market with confidence and precision.

Global Economic Conditions

Global economic conditions significantly influence gold prices. This is especially true when you seek refuge in this precious metal during times of financial turmoil and uncertainty.

Take the 2008 financial crisis, for example. The S&P 500 plummeted, prompting many investors to turn to gold as a safe haven asset.

Inflation can further intensify this trend. As living costs rise and purchasing power diminishes, gold emerges as an appealing option for wealth preservation.

Historical data reveals that countries grappling with hyperinflation often see a spike in gold demand, as citizens look to safeguard their assets. The connection between these economic indicators and gold prices showcases a clear pattern: when market volatility increases, the allure of gold amplifies, solidifying its reputation as a dependable store of value. For a deeper understanding of these trends, check out the gold price trends: analysis for investors.

Political and Geopolitical Events

Political and geopolitical events exert a profound influence on gold prices. Uncertainties in areas like China and the Middle East often lead you to view gold as a safer asset.

Consider periods of heightened tension, such as military conflicts or trade disputes, that can trigger significant fluctuations in market confidence. When political unrest arises in countries like China or tensions escalate in the Middle East, you’ll see a sharp rise in demand for gold, as it is seen as a reliable hedge against instability. To better navigate these changes, learn how to analyze precious metals market trends.

Events such as Brexit and potential trade wars among major economies further impact global markets, prompting you to seek refuge in precious metals. This behavior underscores the intricate relationship between geopolitical dynamics and market conditions, guiding you towards gold in your pursuit of security and value preservation.

Inflation and Interest Rates

Inflation and interest rates are key factors that influence gold prices. Rising inflation often drives investors to seek gold as a protection against rising prices.

When inflation rates surge, the purchasing power of your currency diminishes. This creates a climate of uncertainty that pushes individuals toward safe-haven assets investments that people turn to during economic uncertainty like gold.

On the flip side, when central banks adjust interest rates in response to economic conditions, this can significantly impact the appeal of gold as an investment. Higher interest rates typically lead to increased yields from bonds and savings accounts, making gold less attractive compared to interest-bearing options.

Understanding how these factors work together is essential for anyone considering gold in their investment strategy, especially during periods of economic upheaval. For insights on the value of gold, learning about historical returns on gold can provide valuable context. Ultimately, those who diligently monitor shifts in monetary policy decisions made by central banks about money supply and interest rates will be better equipped to navigate the complex landscape of investment opportunities shaped by fluctuating inflation and interest rates.

Historical Trends in Gold Prices

When you examine historical trends in gold prices, you’ll uncover significant patterns shaped by market conditions, financial crises, and long-term data. This analysis is a valuable tool for investors, helping you to grasp the metal’s performance over time.

Key Events and Their Impact

Key events such as the financial crisis of 2008 and the COVID-19 pandemic have profoundly influenced gold prices. These events often lead to notable fluctuations as you, the investor, react to uncertainty.

During these turbulent times, you will likely see gold as a safe haven asset, prompting a rush toward it whenever market confidence begins to falter. The 2008 crisis, triggered by the collapse of major financial institutions, witnessed a dramatic surge in gold prices as fears of economic instability drove many to seek refuge in tangible assets. Understanding analyzing precious metals’ market cycles can provide valuable insights into these trends.

Similarly, when the pandemic hit in 2020, it sparked a gold rally, with global lockdowns and economic anxieties amplifying the demand for this precious metal. These pivotal events underscore how external shocks can dramatically reshape market dynamics, compelling you to reassess your strategies in the quest for stability and security.

Interpreting Gold Price Movements

Interpreting gold price movements necessitates a refined understanding of market trends, expert analysis, and insightful predictions. This knowledge gives you the power to craft effective investment strategies tailored to navigating the complexities of the market.

Expert Analysis and Predictions

Expert analysis and predictions about gold price fluctuations can offer you invaluable insights as you navigate market trends effectively.

This analysis often considers a range of economic factors that affect the market, such as inflation rates, geopolitical tensions, and shifts in currency values. All of these can greatly influence market dynamics.

Analysts frequently highlight historical trends in gold prices, noting that economic uncertainty tends to drive demand for this precious metal, serving as a hedge against potential downturns.

They also highlight the significant role of central banks in shaping the investment landscape. As these institutions adjust interest rates and implement monetary policy measures, the ripple effects can profoundly affect gold s appeal as an investment. Act now and stay informed to position yourself for success in a fluctuating market.

Investing in Gold

Investing in gold opens up exciting opportunities! You can choose from physical gold, exquisite jewelry, or even gold mining companies and exchange-traded funds. Each option presents its unique advantages and considerations that can significantly enhance your investment strategy.

Strategies and Considerations

When crafting your investment strategy for gold, it’s essential to consider a range of approaches and market conditions that align with your long-term financial goals.

This involves a thoughtful evaluation of diversification methods, allowing you to balance your portfolio with other asset classes and mitigate risk.

Timing plays a pivotal role; aim to seize opportunities during market dips to take advantage of lower prices. For those looking to invest, knowing how to understand precious metal trends over time is crucial. Keep a vigilant eye on geopolitical events that could sway gold prices.

Conducting thorough market research is crucial as it keeps you informed about trends and economic indicators. As market conditions fluctuate, your ability to adapt your strategies can significantly impact your success, ensuring your commitment to gold remains effective and in harmony with your investment objectives.

Frequently Asked Questions

What is the significance of analyzing historical gold price movements?

Analyzing historical gold price movements can provide valuable insights into the trends and patterns of the market, helping investors make informed decisions about buying and selling gold.

How can I access historical gold price data?

There are several websites and platforms that offer access to historical gold price data, such as Yahoo Finance, Bloomberg, and Investing.com. You can also find data from government and financial institutions.

What are the key factors that influence gold prices?

Several factors can impact gold prices, including economic conditions, inflation, interest rates, geopolitical events, and the demand and supply of gold.

What are some common trends in historical gold price movements?

One common trend in historical gold price movements is its inverse relationship with the stock market. When stock prices decline, investors often turn to gold as a safe-haven investment, causing its price to rise. Another trend is that gold prices tend to rise during times of economic uncertainty.

How can I use historical gold price data to make investment decisions?

Dive into historical gold price data! It reveals trends that can guide your investment moves. For example, if gold prices have been steadily rising over a period of time, it may indicate a good time to invest in gold.

Can historical gold price movements predict future prices?

While historical gold price data can provide insights into market trends, it cannot predict future prices with certainty. Many factors can impact gold prices, making it difficult to accurately predict its future movements.