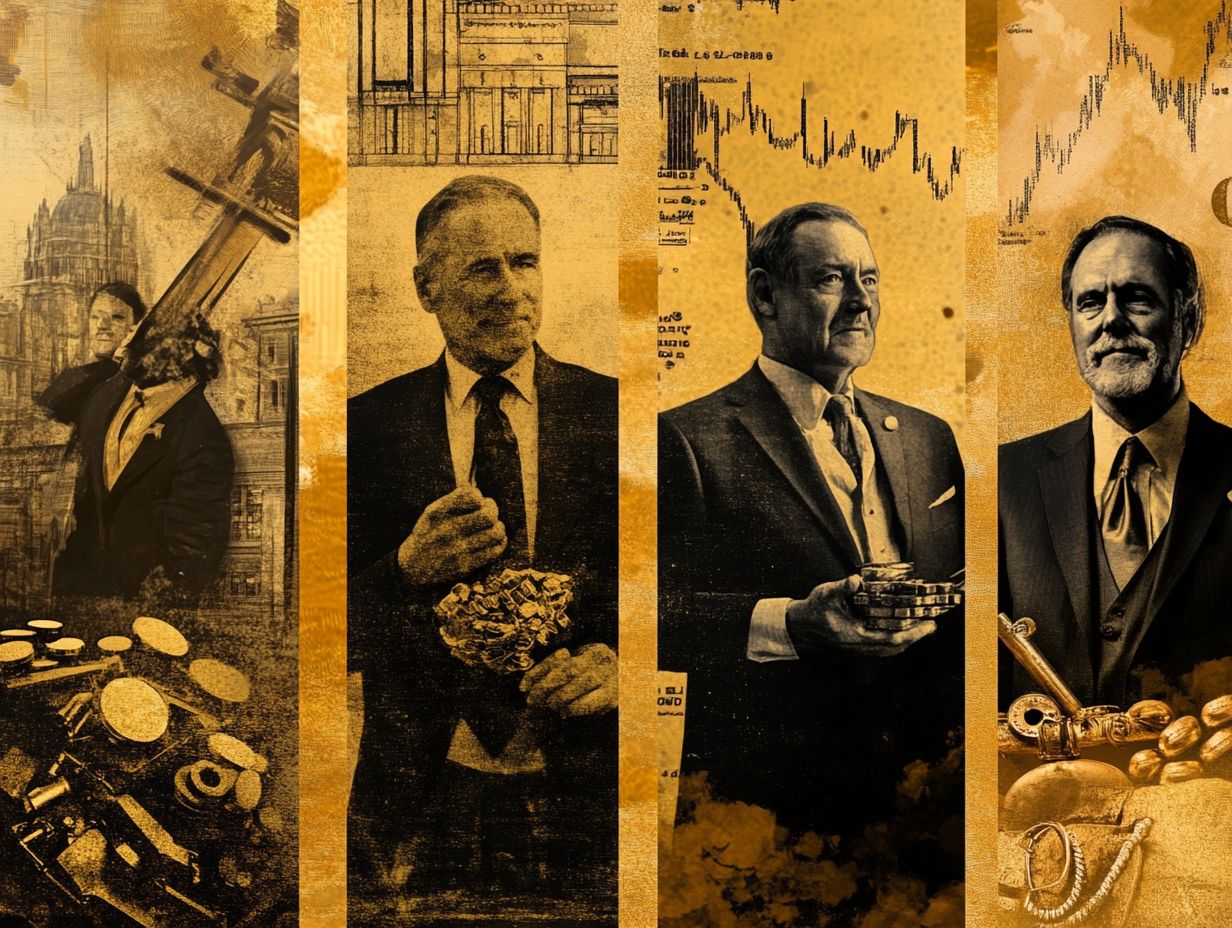

5 Key Players in the Gold Market

Gold has captivated humanity for centuries, embodying wealth, power, and stability.

Central banks and individual investors are the key players driving its demand, each contributing uniquely to the gold market.

This article delves into these influential figures, the factors that sway gold prices, and the various avenues for investing in this precious metal.

Whether you’re a seasoned investor or simply intrigued by gold’s allure, you’ll uncover valuable insights to enhance your understanding of this dynamic market.

Contents

- Key Takeaways:

- 1. Central Banks

- 2. Gold Mining Companies

- 3. Jewelry Industry

- 4. Investment Funds

- 5. Individual Investors

- What Drives the Demand for Gold?

- Frequently Asked Questions

- Who are the 5 key players in the gold market?

- What role do central banks play in the gold market?

- How do mining companies impact the gold market?

- What is the significance of jewelry makers in the gold market?

- Why are investors and traders important in the gold market?

- How do governments play a role in the gold market?

Key Takeaways:

- Central banks play a crucial role in the gold market, as they hold a significant portion of the world’s gold reserves and can influence its price through buying and selling.

- Gold mining companies are responsible for the production and supply of gold, which directly impacts its price and availability in the market.

- The jewelry industry is a major player in the gold market, as it accounts for a significant portion of the global demand for gold.

1. Central Banks

Central banks hold a crucial position in the global gold market. They shape gold trading through their policies and management of gold reserves.

In pivotal centers like the London Over-the-Counter (OTC) and Shanghai Gold Exchange, their actions carry significant implications for both investment banks and individual investors.

Institutions like the People’s Bank of China buy and sell gold to stabilize currencies and manage inflation. When purchases increase, it often indicates a move to diversify reserves away from the U.S. dollar, driving demand and prices up.

When central banks decide to sell large quantities of gold, the sudden increase in supply can lead to a price drop. This may prompt you to reassess your investment strategies in response to market changes.

2. Gold Mining Companies

Gold mining companies like Wheaton Precious Metals Corp and Gold Fields Limited play a pivotal role in the gold market. They significantly contribute to the supply chain and have a direct impact on the performance of gold stocks.

Navigating this complex landscape requires you to consider a multitude of factors, including rising operational costs, stringent regulations, and varying market conditions that can profoundly affect both output and gold pricing. Additionally, if you’re looking to diversify your portfolio, it’s wise to explore 5 questions to ask before investing in silver.

For instance, production costs fluctuate based on energy prices, labor availability, and technological advancements in extraction processes. Compliance with environmental regulations often pushes mining firms to adopt more sustainable practices, which can influence profit margins.

Geopolitical factors and global economic stability can cause rapid shifts in demand. Therefore, knowing how these companies operate can be key to making informed investment choices.

3. Jewelry Industry

The jewelry industry plays a pivotal role in shaping gold demand, with your preferences and economic conditions steering trends in the gold market. This impacts both individual investors and major financial institutions.

Take a look at India, for example here, gold isn’t just a metal; it s woven into the cultural fabric, fostering a unique demand landscape. In stark contrast, you have the Middle East, where the allure of luxury items is on the rise.

As consumer preferences increasingly lean toward sustainable and ethically sourced materials, it’s essential for you as an investor or manufacturer to recalibrate your strategies. Now is the perfect time to rethink your investment strategies to keep up with changing consumer values.

These regional variances in jewelry demand not only dictate pricing but also ripple through broader market dynamics. It s a call for you to rethink your investment approaches and harmonize with the evolving values of today s consumers.

4. Investment Funds

Investment funds play a vital role in the gold market. These funds, often managed by leading investment banks, offer various financial products like gold futures and ETFs. They significantly impact the total value of all investments in the market and influence how you, as an investor, approach gold trading.

These funds use different strategies. Some focus on actively managed portfolios, while others follow passive index-tracking methods designed to cater to your unique investment preferences.

For instance, some funds may emphasize direct investment in physical gold, while others prioritize shares in mining companies or exploration initiatives.

Investors have consistently turned to gold as a safety net, especially during times of economic uncertainty or inflation. This attracts those who prioritize stability, making gold a go-to option. Its unique position not only serves to buffer your portfolio against market volatility but also tends to drive up demand.

This dynamic influences broader market trends and enhances gold’s appeal among those who are risk-averse.

5. Individual Investors

Individual investors are increasingly recognizing gold as a vital addition to their investment portfolios. By employing various trading strategies, you can effectively balance your risk tolerance while securing long-term savings through assets like gold bullion.

This growing awareness comes from gold’s well-established reputation as a safe haven during times of economic uncertainty. Many are now leveraging its inherent stability for wealth preservation. With inflation concerns on the rise, the precious metal is often viewed as an effective protection against loss, helping to ensure your purchasing power remains intact.

You have several avenues to explore for investment, including:

- Acquiring physical gold

- Investing in gold mining stocks

- Opting for gold exchange-traded funds (ETFs)

Each method presents unique benefits, catering to diverse investment preferences and strategies. This further enhances the appeal of gold in today s financial landscape.

What Drives the Demand for Gold?

The demand for gold is shaped by a complex interplay of factors that you ll want to consider. These include supply and demand dynamics, jewelry demand, market trends, and the actions of central banks. All these elements are crucial in determining the gold price in both the US futures market and the London OTC market.

Broader economic conditions, such as inflation rates and interest rates, significantly influence how you might perceive gold as a safe haven asset. When economic uncertainty looms or when inflation rises, it s common for many to turn to gold, viewing it as a protection against currency devaluation.

Geopolitical tensions can also create spikes in demand; global instability often drives individuals and institutions to seek the security that gold provides.

Understanding these interconnected factors is vital for you if you aim to navigate the gold market adeptly. By doing so, you can develop informed investment strategies that align with current and anticipated trends.

What Are the Factors Affecting the Gold Market?

Several factors influence the gold market, including economic conditions, trading volumes, price volatility, and currency fluctuations. This creates a dynamic environment for you as a market player and investor.

Among these factors, interest rates are particularly significant. When rates rise, the opportunity cost of holding non-yielding assets like gold increases, often leading to diminished demand. On the flip side, persistent inflation can push you toward gold as a safe haven, serving as a shield against eroding purchasing power. For those looking to deepen their understanding of the market, exploring 5 must-read books about silver investing can provide valuable insights.

The stability of currencies also plays a crucial role in gold prices. A weaker dollar usually enhances gold’s appeal in global markets. Understanding these elements, along with the 5 key indicators for silver market analysis, helps you craft informed investment strategies. Adapt your approach to the ever-evolving gold market.

Understanding the Impact of Key Players on Gold Prices

Key players in the gold market central banks, investment banks, and individual investors hold significant influence over gold prices through their buying and selling plans, shaping market dynamics.

Central banks adjust their gold reserves as part of their monetary policy. They strategically buy or sell large quantities to stabilize national currencies or address inflationary pressures. Large investment banks use advanced trading methods that can quickly change gold prices. Their trading volumes and market analyses create trends that ripple through the market, much like the insights from 5 key figures in the silver investment market.

Individual investors react to economic news and market sentiment, modifying their behaviors and further influencing gold trends. This interplay of actions can lead to both volatility and periods of stability in gold prices. Understanding the 5 key indicators for silver investment success can also provide valuable insights into market dynamics.

Types of Gold Investments

When investing in gold, you have several options: purchasing physical gold, investing in gold stocks, trading gold futures, or utilizing specialized financial products. Each option comes with its advantages and risks.

Buying physical gold, like coins or bars, gives you a tangible asset to hold. However, it involves storage costs and secure handling. In contrast, investing in gold stocks allows you to benefit from the growth potential of mining companies, though this can be affected by market volatility.

If you’re comfortable with high-risk scenarios, trading gold futures could lead to substantial profits. Meanwhile, structured financial products like ETFs offer easier liquidity and diversification, appealing to various investment strategies.

Each approach caters to different investor profiles, whether you seek stability, high returns, or a hedge against inflation.

Risks of Investing in Gold

Gold is often seen as a safe investment, but it comes with risks, including price volatility and the need for well-crafted buying and selling plans that match your risk tolerance.

Market fluctuations can create unpredictable price swings. Risks from global events or political changes can also significantly impact gold prices, often causing them to react to worldwide happenings.

To navigate these uncertainties, consider diversifying your investment portfolio beyond just gold. Incorporate other asset classes like stocks or bonds. Staying informed about market trends and geopolitical developments is essential; timely adjustments to your strategy can help mitigate risks and enhance overall returns.

By adopting a cautious and informed approach, you can safeguard your investments while reaping the benefits of gold.

Monitoring the Gold Market

Effectively monitoring the gold market requires a solid understanding of market analysis, trading hours, and the intricate dynamics that influence how prices are set. This knowledge gives you the power to make informed investment decisions.

To monitor the market, leverage various tools and resources. Financial news outlets provide timely updates on geopolitical developments and economic indicators affecting gold prices, while market reports offer comprehensive analyses of recent trends and price movements. Additionally, consider checking out 5 must-watch documentaries about silver investing for deeper insights.

Analytics platforms provide valuable insights from trading volumes and historical data, helping you identify patterns and make forecasts. Staying attuned to these trends sharpens your competitive edge and enhances your decision-making capabilities. Given that fluctuations can occur swiftly, prompt action based on diverse information sources is critical for success.

Frequently Asked Questions

Who are the 5 key players in the gold market?

The gold market has five main players: central banks, mining companies, jewelry makers, investors, and governments.

What role do central banks play in the gold market?

Central banks hold large gold reserves. Their buying and selling can significantly influence gold prices.

How do mining companies impact the gold market?

Mining companies produce gold, impacting its supply. Their production levels directly affect gold’s availability.

What is the significance of jewelry makers in the gold market?

Jewelry makers are among the biggest consumers of gold. Changes in their demand can greatly shift market dynamics.

Why are investors and traders important in the gold market?

Investors and traders play a crucial role by buying and selling gold. Their actions influence gold prices and market trends.

How do governments play a role in the gold market?

Government policies can shape the gold market significantly. They often hold gold reserves, which impacts overall supply and demand.