Investing in Silver for Retirement: A Guide

Thinking about retirement can feel like navigating a maze, especially when it comes to securing your financial future.

One intriguing option that s gaining traction is silver a precious metal boasting intrinsic value and the potential to serve as a robust hedge against inflation.

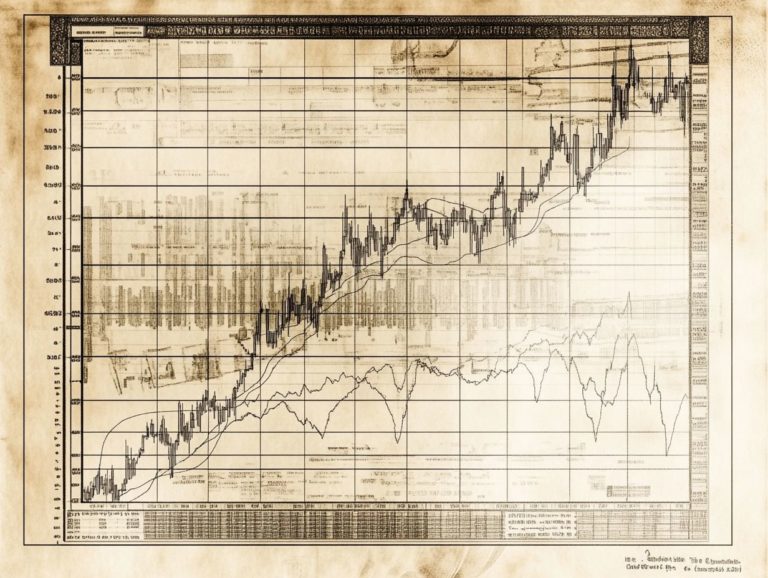

This article delves into various types of silver investments, weighing the risks and rewards while providing insights on market trends.

You ll also find guidance on getting started, selecting reliable brokers, and strategies to maximize returns while minimizing risks.

Thinking about adding silver to your retirement portfolio? Keep reading to discover its exciting potential!

Contents

- Key Takeaways:

- Explore the Exciting World of Silver Investments!

- Factors to Consider Before Investing in Silver

- How to Start Investing in Silver for Retirement

- Maximizing Returns and Mitigating Risks

- Frequently Asked Questions

- What is silver investing for retirement?

- Is investing in silver a good option for retirement?

- What are the advantages of investing in silver for retirement?

- What are the risks of investing in silver for retirement?

- How can I start investing in silver for retirement?

- When should I start investing in silver for retirement?

Key Takeaways:

- Consider silver as a retirement investment due to its potential for long-term growth and diversification benefits.

- When investing in silver, understand the differences between physical and paper investments and weigh the risks and rewards carefully.

- To start investing in silver for retirement, find a reputable broker or dealer and diversify your portfolio to maximize returns and minimize risks.

Why Consider Silver as a Retirement Investment?

Investing in silver as part of your retirement strategy can serve as a reliable hedge against inflation, making it an enticing option for those who seek to preserve wealth and achieve financial stability.

In a market marked by volatility and rising inflation rates, silver stands out as a safe-haven asset that diversifies investment portfolios, ensuring your financial decisions align with your long-term retirement goals.

Historically, silver has proven its worth by maintaining value when fiat currencies falter, particularly during times of economic uncertainty influenced by the actions of the Federal Reserve.

As inflation diminishes purchasing power, incorporating tangible assets like silver can provide stability to your investment strategy.

While you navigate market trends, it s essential to grasp the potential risks associated with silver investments. A financial plan that includes silver not only acts as a buffer against market fluctuations but also underscores the importance of adapting your investment approaches to maintain resilience in an unpredictable economic environment.

Explore the Exciting World of Silver Investments!

Understanding the different types of silver investments is essential for anyone looking to diversify their portfolio and implement effective wealth preservation strategies.

You can invest in physical silver, like bullion coins or collectible coins, or paper silver through products such as silver ETFs, which are funds that track silver prices. To understand the context of your investment choices, exploring the history of silver as an investment can provide valuable insights. Each option presents its own unique set of benefits and risks, allowing you to tailor your investment approach to your specific financial goals.

Physical Silver vs. Paper Silver

When you re weighing the merits of physical silver against paper silver, consider factors like liquidity and potential silver prices, both of which can significantly impact your investment performance.

Physical silver encompasses options such as bullion coins, rounds, and bars, while paper silver typically refers to silver ETFs or futures contracts.

On one hand, physical silver offers the tangible satisfaction of holding a valuable asset, but it also comes with extra costs like storage and insurance that could nibble away at your profits over time.

On the other hand, paper silver provides the ease of trading and liquidity, enabling you to respond swiftly to market fluctuations without the hassle of managing physical assets.

However, don t overlook the risks associated with paper silver, particularly concerning counterparty risks and market volatility. For those crafting long-term financial strategies, grasping these distinct characteristics is crucial, as each form of silver investment can bring different implications for portfolio diversification and potential returns over time.

Factors to Consider Before Investing in Silver

Before you plunge into silver investment, it’s crucial to evaluate a variety of factors, such as your investment strategy, market trends, and potential risks.

By grasping the current demand for silver and its pricing dynamics, you can make financial decisions that empower you to pursue choices aligned with your investment goals. This thoughtful approach will guide you on your journey to successful investing.

Risk vs. Reward Analysis

Conducting a risk vs. reward analysis is essential for you as an investor navigating the silver market, especially considering the market fluctuations that can influence silver futures and your overall investment returns.

By understanding the inherent risks associated with silver investments, you can make informed financial decisions. Dive into historical data and recent market trends to uncover the cyclical nature of silver prices, which are influenced by various factors such as international conflicts, industrial demand, and inflationary pressures.

While there s promising potential for significant returns thanks to silver’s status as a safe haven asset and its growing applications in technology you must remain aware of the volatility that can trigger sudden price swings. Balancing these elements will provide you with valuable insights, empowering you to either seize opportunities or mitigate the risks that accompany silver investing.

Market Trends and Predictions

Analyzing current market trends and predictions for silver demand and prices is essential for you as an investor seeking optimal opportunities in the precious metals sector. Understanding the impact of inflation on silver prices will provide you with valuable insights into future market behavior.

Be mindful of various economic indicators, such as employment rates and GDP growth, as they offer a solid backdrop for assessing silver’s potential. Additionally, monitor geopolitical factors, including tensions in major mining regions and trade relations among key players, which play a critical role in shaping market sentiment.

It’s also wise to monitor decisions made by the Federal Reserve; changes in interest rates can significantly influence the broader market, thus affecting the demand for silver as a safe-haven asset. By synthesizing these elements, you can better navigate the complexities of the silver market and make informed investment decisions.

How to Start Investing in Silver for Retirement

Embarking on your journey into silver investment for retirement is exhilarating! It requires you to make informed choices about trustworthy brokers or dealers, all while grasping the significance of Individual Retirement Accounts (IRAs) within your investment strategy.

By establishing a solid foundation in silver investing, you not only enhance your long-term financial stability but also bolster your wealth preservation efforts.

Choosing a Reliable Broker or Dealer

Choosing a reliable broker can make or break your investment experience! Their expertise can significantly shape your investing journey and influence your financial decisions.

By selecting a reputable partner, you ensure that you receive accurate information and gain access to high-quality investment products. When evaluating potential brokers, it s essential to scrutinize their credentials, including licensing and professional affiliations these elements reinforce their legitimacy.

Effective customer service can greatly enhance your investment journey, offering you timely assistance and personalized guidance tailored specifically to your silver investment needs.

Seek out brokers who provide competitive fees, a user-friendly trading platform, and a diverse range of silver investment options, from bullion to ETFs. If you’re wondering about the potential of silver, you might want to explore whether silver is a good investment. These considerations contribute to a secure and informed investing environment, ultimately boosting your chances of achieving your financial goals.

Diversifying Your Portfolio

Portfolio diversification is an essential investment strategy. Incorporating silver can significantly enhance your financial stability while reducing overall risk exposure. By adding silver to your investment portfolio, you benefit from its unique properties as a precious metal, effectively acting as a hedge against inflation.

In a world full of economic uncertainties, a diversified approach is vital. There are various ways to include silver in your portfolio, whether through coins, bars, or exchange-traded funds (ETFs). For those new to this precious metal, referring to investing in silver: a beginner’s guide can help tailor your strategy to different risk appetites and liquidity needs.

Putting some of your money into silver allows you to tap into its historical role as a safe haven during market volatility. This strategy not only helps balance potential losses in other investments but also opens the door to substantial upside as the demand for silver continues to rise in sectors like electronics and renewable energy. It’s also important to understand the silver investment taxes associated with this asset.

Maximizing Returns and Mitigating Risks

Maximizing your returns while minimizing risks is essential for a successful silver investment strategy, especially in the ever-changing silver market. By adopting well-informed investment strategies and seeking guidance from financial advisors, you can greatly enhance your investment performance and overall financial well-being.

Strategies for Success

Successful investing in silver demands clear plans tailored to the unique dynamics of the silver market. By leveraging insightful financial planning and market analysis, you can pinpoint the investment products that align seamlessly with your goals.

One effective approach is dollar-cost averaging. This strategy lets you invest the same amount of money regularly, regardless of the price. It minimizes the impact of market swings on your investment, allowing you to accumulate silver over time and capitalize on both high and low price points.

Exploring silver exchange-traded funds (ETFs) is a smart option. These funds track silver prices and offer an easy-to-handle investment without the hassle of physical storage. However, it’s important to consider the risks and rewards of silver investing before diving in.

For those with a bit more experience, looking into futures contracts can present lucrative opportunities in fluctuating markets, though it comes with increased risk. By mastering these strategies, you can confidently navigate the complexities of silver investment, making informed decisions that lead to success.

Frequently Asked Questions

What is silver investing for retirement?

Silver investing for retirement is the act of purchasing physical silver as a means of saving and growing wealth for retirement. It is considered a type of investment that can diversify a retirement portfolio and provide a hedge against inflation and economic uncertainty.

Is investing in silver a good option for retirement?

Yes, investing in silver can be a smart choice for retirement. Silver has historically held its value and can act as a hedge against inflation. It also has a high industrial demand and is used in various technologies, making it a valuable asset to hold for the long term.

What are the advantages of investing in silver for retirement?

There are several advantages to investing in silver for retirement. These include protection against inflation and potential for long-term growth. Silver is also a tangible asset that can be easily bought and sold, providing liquidity for retirement planning.

What are the risks of investing in silver for retirement?

Investing in silver for retirement does come with risks. The price of silver can fluctuate, so there is always a risk of loss. Additionally, storage and insurance costs for physical silver can add up over time. It is important to research and understand these risks before making any investment decisions.

How can I start investing in silver for retirement?

Ready to dive into silver investing for your retirement? The first step is to educate yourself on the market and risks involved. You can then choose to invest in physical silver such as coins or bars, or invest in silver through an ETF or mutual fund. It is important to consult with a financial advisor and do thorough research before making any investment decisions.

When should I start investing in silver for retirement?

The earlier you start investing in silver, the better! This gives you the best chance to watch your savings grow over time.

It’s never too late to invest, even if retirement is just around the corner.

Be sure to think about your money goals and talk to a financial advisor who can help you make the best decisions.