How to Start a Silver Investment Fund

Investing in silver has become a sought-after alternative to traditional assets, presenting unique benefits and the potential for significant growth.

This article explains what a silver investment fund is. It highlights the benefits of investing in silver and provides a clear guide to starting your own fund.

From grasping market dynamics to implementing effective risk management strategies, this guide covers all you need to know to succeed in silver investing.

Ready to dive into the exciting world of silver investments? Discover the opportunities that await you in the silver market!

Contents

Key Takeaways:

- Start diversifying your portfolio today to unlock stability and growth!

- Conduct thorough research and plan strategically to ensure success in the silver market.

- Stay informed and adapt to market changes while implementing risk management strategies to maximize returns for your investors.

What is a Silver Investment Fund?

A Silver Investment Fund is a specialized investment vehicle designed to help you acquire silver assets, including physical bullion, silver-backed securities, and other silver-related investments, all aimed at achieving your financial goals. Such a fund can be an effective strategy for diversifying your portfolio, especially if you re looking to protect against rising prices and take advantage of the growing industrial demand for silver, as well as its reputation as a safe haven during times of economic uncertainty.

These funds may also include investments in silver mining stocks, which grant you exposure to the operational side of the silver market, alongside silver exchange-traded funds (ETFs) that offer both liquidity and ease of trading.

You might find these funds particularly relevant right now, as many market analysts predict a surge in demand for silver in electronics and renewable energy applications. The integration of silver into essential green technologies has sparked considerable interest, prompting savvy investors like yourself to contemplate the potential for long-term growth.

For those looking to enhance their financial portfolios while navigating today’s ever-changing economic landscape, silver investment funds can serve as a strategic choice. Consider following these silver investment tips for millennials to make informed decisions.

Benefits of Investing in Silver

Investing in silver presents a wealth of advantages that make it a compelling option for diversifying your portfolio. As a protection against rising prices, silver can offer a stabilizing force during economic downturns, while its reputation as a safe-haven asset draws investors when market conditions grow turbulent.

Additionally, the growing need for silver in industry, along with opportunities in silver mining stocks and ETFs, makes it an attractive long-term investment.

Advantages for Investors

Investors like you, who are keen on diversifying portfolios, often discover that silver presents unique advantages, particularly as a safe-haven asset. Its historical performance during inflationary periods makes it an appealing option for safeguarding wealth, while the versatility of silver coins creates avenues for both collection and investment.

Silver tends to align quite well with economic downturns, frequently outperforming traditional markets when they stumble. This characteristic further cements its status as a robust hedge against economic uncertainty.

Beyond silver coins, which possess intrinsic value and charm for collectors, bullion offers a clear-cut route for those focused solely on investment returns. By integrating silver into your broader investment strategies, you can boost your portfolio’s resilience.

It provides a tangible asset that retains value over time, especially during market volatility, effectively diversifying risk and potentially offering liquidity when you need it most.

Comparison to Other Types of Investments

Silver has unique advantages compared to other investments like gold and commodities. Its market dynamics are distinct and worth exploring.

While gold often takes center stage as the go-to safe-haven asset, silver presents additional opportunities, particularly through physical bullion and silver ETFs. For those looking to enhance their investment strategies, understanding how to use technical analysis in silver investing can be beneficial. These options can be less sensitive to market fluctuations and more versatile for diverse investment strategies.

Silver’s unique duality as both a precious metal and an industrial metal adds an intriguing layer to its appeal. A precious metal is valuable and often used for jewelry, while an industrial metal is used in manufacturing and technology. In contrast to gold, which typically shines during economic uncertainty, silver’s value can be significantly swayed by industrial demand. This makes it an attractive option for those looking to hedge against inflation.

For instance, during times of increased technology production, the demand for silver in electronics and solar panels can drive its value higher. Silver ETFs, such as the iShares Silver Trust, offer a seamless way for you to gain exposure to silver without the hassle of physical storage. Additionally, understanding how to evaluate gold investment companies opens doors for all types of investors, inviting them to seize thrilling opportunities in their portfolios!

Steps to Starting a Silver Investment Fund

Launching a Silver Investment Fund demands a thoroughly structured approach, encompassing thorough research and planning, careful legal considerations, and strategic marketing initiatives designed to attract discerning investors.

Each of these components is vital, ensuring the fund adheres to regulations while effectively articulating its unique value proposition to potential investors eager to diversify their portfolios with silver investments.

Research and Planning

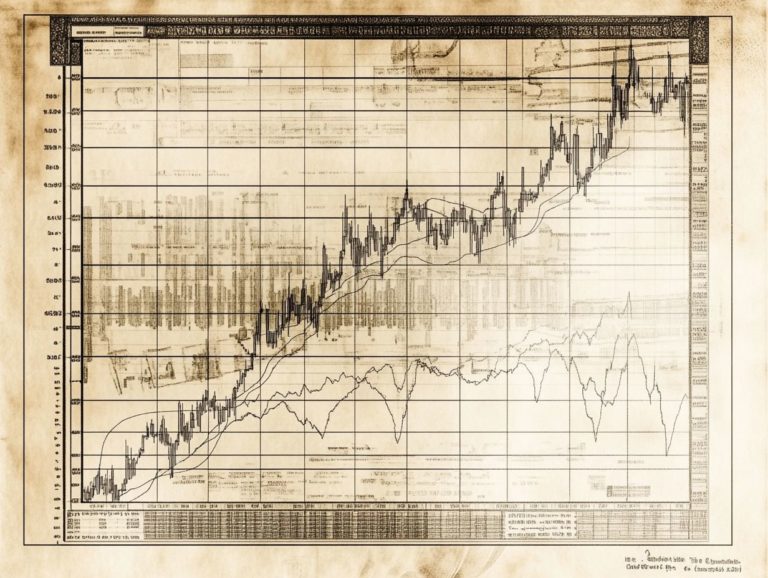

Effective research and planning are paramount when establishing a silver investment fund, as they form the bedrock for understanding market dynamics and aligning the fund s objectives with the investment aspirations of potential investors. A thorough market analysis that explores trends in silver prices, industrial demand, and the competitive landscape among various silver-backed securities will help you craft a robust strategy for fund management.

Understanding silver’s role in today’s economy is essential. Its status as a safe-haven asset during times of market volatility is crucial. As an investor, you need to articulate your investment goals clearly, whether you’re aiming for capital appreciation, income generation, or a hedge against inflation. To achieve these aims, consider how to create a solid investment plan that ensures your objectives harmonize seamlessly with the fund’s investment strategies.

By pinpointing key indicators that sway silver’s market behavior and acknowledging the broader economic factors at play, you can enable fund managers to make informed decisions that maximize returns while effectively mitigating risks. This approach not only elevates investor confidence but also nurtures long-term growth.

Legal Considerations

Navigating the legal considerations associated with a silver investment fund is essential for ensuring compliance with financial regulations and maintaining investor confidence. By engaging with experienced legal advisors and grasping the regulatory framework surrounding precious metals dealers and investment funds, you can avert potential legal issues that may arise and cultivate a transparent investment environment.

A thorough understanding of both local and federal laws is vital, as these regulations can significantly influence how your fund operates and is perceived in the market. The importance of adhering to licensing requirements, anti-money laundering (AML) laws, and securities regulations cannot be overstated; failure to comply could result in substantial fines or even a complete shutdown of operations.

By laying a solid foundation through legal due diligence, you not only enhance your organization’s credibility but also foster a trustworthy relationship with current and prospective investors. This proactive approach is key to ensuring long-term success in the competitive realm of silver investments.

Marketing and Attracting Investors

Effective marketing strategies are crucial for attracting investors to your silver investment fund. This is especially true in today s competitive financial landscape where choices abound.

By leveraging a combination of online platforms, engaging with brokerage accounts, and collaborating with both local and online dealers, you can significantly enhance your visibility and appeal to potential investors eager to diversify with silver investments.

Creating informative content that underscores the lasting advantages of silver investments can dramatically increase interest. Engaging social media campaigns tailored to resonate with your target demographics, complete with compelling visuals and infographics, allow you to communicate what makes your fund special effectively. For those interested in getting started, consider exploring how to invest in silver without breaking the bank.

Hosting webinars and local seminars fosters trust and offers educational insights, enabling potential investors to make informed decisions. Building partnerships with reputable financial advisors and industry influencers can amplify your reach.

These partnerships establish credibility and attract a broader audience keen to explore the advantages of incorporating silver into their investment portfolios.

Managing a Silver Investment Fund

Managing a Silver Investment Fund demands a meticulous strategy that integrates growth initiatives, risk management practices, and a deep understanding of market trends influencing silver investments.

By honing in on silver-backed securities and grasping the intricacies of silver price dynamics, you can adeptly respond to shifting market conditions. This approach helps you optimize returns while effectively mitigating the risks tied to investment volatility.

Strategies for Growth and Success

To achieve growth and success in your silver investment fund, you must implement a range of strategies designed to enhance performance and maximize returns. This might involve diversifying your portfolio with silver mining stocks, exploring investment opportunities in silver-backed securities, and continuously optimizing your asset allocation based on market conditions.

In addition to these foundational approaches, stay ahead of trends to seize timely opportunities! Regularly assessing the performance of silver mining stocks will help you identify which companies are driving value while keeping an eye on market dynamics that could influence silver prices, such as geopolitical events or shifts in industrial demand.

Leveraging silver-backed securities can provide your investors with exposure that carries less volatility, effectively balancing risk and return. By continuously monitoring performance, you can make timely adjustments to ensure that your fund aligns closely with both investor objectives and the ever-evolving market landscape. Additionally, understanding how to navigate gold investment regulations can further enhance your investment strategy.

Risk Management and Mitigation

Implementing effective risk management and mitigation strategies is essential for the long-term sustainability of your silver investment fund, particularly given the inherent market volatility associated with precious metals. By evaluating your fund’s exposure to different risks, aligning your investment strategies with your goals, and employing diversifying your portfolio, you can protect your assets effectively!

Understanding the complex dynamics of market fluctuations is crucial, as silver prices can be influenced by a multitude of factors, including economic indicators and geopolitical events. Therefore, using techniques like stress testing which helps you evaluate how your fund would perform under extreme market conditions and scenario analysis which assesses potential future events can allow you to identify potential risks before they arise, enabling you to make proactive adjustments to your investment strategy.

Aligning the risk profile of your fund with its overall investment objectives guarantees that your approach is not only defensively robust but also strategically sound. By incorporating a diverse range of assets within your portfolio, you enhance resilience against adverse market conditions, ultimately leading to more stable returns for you as an investor.

Summary of Key Points

A silver investment fund presents a distinct opportunity for you to diversify your portfolio while skillfully navigating the intricacies of silver investment.

This investment path offers potential for capital appreciation and acts as a safeguard against inflation and currency fluctuations. This makes it especially attractive in times of economic uncertainty. Explore this exciting option today by reflecting on whether silver is a good investment and its vital role in various industrial applications. Stay informed about market trends to enhance your strategy.

Implementing strong management practices like regularly reviewing your portfolio holdings and monitoring market conditions can significantly enhance your fund’s performance. By embracing a comprehensive approach that emphasizes continuous education and disciplined strategies, you can greatly increase your chances of reaping the rewards associated with investing in silver. Additionally, understanding how to plan for taxes when investing in precious metals is crucial for maximizing your investments.

Predictions for the Silver Market

What does the future hold for silver investments? Predictions for the silver market suggest a vibrant and dynamic landscape shaped by various factors, including global economic conditions, industrial demand for silver, and inflationary pressures.

The current trend points to a notable rise in industrial demand, especially from sectors like electronics and renewable energy, where silver s unique properties are increasingly recognized and valued. Ongoing concerns about inflation further fuel interest in silver as a hedge against currency devaluation, making it an attractive option for diversifying assets.

With these dynamics at play, it’s natural to reevaluate your investment strategies, leaning towards funds that promise not just potential growth but also stability in these volatile markets. As the landscape evolves, staying attuned to developments in both demand and investor sentiment will be essential in shaping your future investment opportunities.

Frequently Asked Questions

What is a silver investment fund?

A silver investment fund is an investment vehicle that allows individuals to pool their money and invest in various silver assets, such as stocks, exchange-traded funds (ETFs), and physical silver. This enables diversification and potentially higher returns than investing in silver individually.

How do I start a silver investment fund?

To start a silver investment fund, create a legal entity, such as a corporation or limited liability company (LLC), to act as the fund. You’ll also need to establish a management team, set investment goals and strategies, and raise capital from investors.

What are the benefits of starting a silver investment fund?

- Diversification of investments

- Potentially higher returns

- Ability to invest in various silver assets without managing them individually

- Pooling resources and expertise from other investors and management team members

How much money do I need to start?

The amount of money needed to start a silver investment fund depends on your specific goals and strategies. Some fund managers may start with a few thousand dollars, while others may require hundreds of thousands or even millions. It s important to have a solid business plan and budget in place before seeking investors.

How are investors in a silver investment fund compensated?

Investors in a silver investment fund are typically compensated through a share of the fund’s profits known as “carried interest,” which is a share of the profits based on the fund’s total gains. This can vary based on the individual’s investment amount and the fund’s performance.

What are the risks associated with starting a silver investment fund?

Like any investment, there are risks associated with starting a silver investment fund. These may include market fluctuations, economic downturns, and unforeseen expenses. It’s important to thoroughly research and plan for potential risks and have a backup plan to mitigate any losses.