Top 7 Silver Coins for Investment

Silver coins have always been a favored choice for investors like you, seeking a tangible asset that beautifully marries aesthetic appeal with intrinsic value. Whether you re a seasoned collector or a newcomer eager to diversify your portfolio, grasping the essentials of top silver coins is crucial.

This article delves into seven standout silver coins, including the iconic American Silver Eagle and the elegant Canadian Silver Maple Leaf. You ll also discover the benefits and risks associated with investing in silver coins, key factors to consider when selecting, and practical tips for storage and protection.

Embark on this journey with us as we unveil the potential of silver coins in today s investment landscape.

Contents

- Key Takeaways:

- 1. American Silver Eagle

- 2. Canadian Silver Maple Leaf

- 3. Australian Silver Kangaroo

- 4. Chinese Silver Panda

- 5. British Silver Britannia

- 6. Austrian Silver Philharmonic

- 7. Mexican Silver Libertad

- What Makes Silver Coins a Good Investment?

- What Factors Should Be Considered When Choosing Silver Coins for Investment?

- What Are the Benefits of Investing in Silver Coins?

- What Are the Potential Risks of Investing in Silver Coins?

- How Can One Start Investing in Silver Coins?

- What Are the Best Ways to Store and Protect Silver Coins?

- What Are the Tax Implications of Investing in Silver Coins?

- What Are the Predictions for the Future Value of Silver Coins?

- Frequently Asked Questions

- What are the top 7 silver coins for investment?

- What makes these silver coins a good investment?

- Which of these silver coins has the highest purity level?

- Do these silver coins have any collectible value?

- Are these silver coins a good hedge against inflation?

- How can I invest in these top 7 silver coins?

Key Takeaways:

- Diversify your investment portfolio with the top 7 silver coins, including the American Silver Eagle, Canadian Silver Maple Leaf, and Australian Silver Kangaroo.

- Consider factors such as purity, mintage, and popularity when choosing silver coins for investment.

- Investing in silver coins benefits you by hedging against inflation, diversifying your assets, and offering potential for long-term growth.

1. American Silver Eagle

Discover the allure of the American Silver Eagle, one of the most sought-after silver bullion coins in the precious metals market. Its high-quality bullion composition, pure silver content, and legal tender status make it an excellent choice for enhancing your investment portfolio.

This coin features a stunning portrayal of Lady Liberty, walking boldly against the backdrop of a rising sun a powerful symbol of freedom and hope. This iconic imagery, crafted by renowned artist Adolph A. Weinman, has captivated collectors and enthusiasts since its introduction in 1986.

Minted by the United States Mint, each coin is produced with meticulous attention to detail, ensuring both beauty and quality. The American Silver Eagle occupies a unique position in the market, serving not only as a desirable collector’s item steeped in rich history but also as a reliable hedge against economic uncertainty. This makes it a savvy addition to any investment strategy you may have in mind.

2. Canadian Silver Maple Leaf

Unleash the potential of the Canadian Silver Maple Leaf, minted by the Royal Canadian Mint. This coin is a true masterpiece in the world of silver coins, featuring the unmistakable maple leaf. It is a top choice for both investment and collection due to its outstanding quality and strong market recognition.

This stunning coin showcases intricate design elements, including a meticulously detailed maple leaf a proud national symbol of Canada set against a radiant patterned background that elevates its visual allure. The mint utilizes advanced minting technology to ensure that each coin meets the highest standards of purity, boasting an impressive 99.99% fine silver content, making it one of the purest silver coins available on the market.

As legal tender, it carries a face value of five Canadian dollars, though its intrinsic value typically far surpasses this nominal amount. Its exceptional credibility and quality have earned it a loyal following among investors and collectors, solidifying its esteemed status in the global precious metals market.

3. Australian Silver Kangaroo

Explore the beauty of the Australian Silver Kangaroo, crafted by the esteemed Perth Mint. This coin stands as a stunning example of investment-grade silver coins and prominently features the kangaroo, a quintessential symbol of Australia, captivating those with an eye for precious metals.

This coin not only embodies Australia’s rich cultural tapestry but also showcases the exceptional craftsmanship synonymous with the Perth Mint. The intricate details and advanced minting technology amplify its artistic charm, elevating it to the status of a true collector’s gem.

For anyone looking to diversify their portfolio, this silver coin is increasingly recognized as a solid investment, merging aesthetic appeal with financial security. As a result, collectors and investors alike value its harmonious blend of beauty and practicality, making it a critical addition to any serious collection or investment strategy.

Start your silver coin investment journey today!

4. Chinese Silver Panda

Chinese Silver Pandas are prized for their silver content, limited mintage, and artistic value. Every coin bursts with stunning designs that beautifully reflect China’s rich cultural heritage, making them highly desirable in the collectible coin market.

The historical significance of the Chinese Silver Panda dates back to its first issuance in 1983. This coin was created to celebrate wildlife and promote conservation efforts. Each year, a new design captures the essence of the beloved giant panda, incorporating elements steeped in traditional Chinese artistry and symbolism. This unique design makes it visually appealing and a true cultural treasure.

The demand for precious metals changes frequently, and the rarity and artistry of these coins significantly enhance their investment potential. They attract both collectors and savvy investors, ensuring they remain a smart choice for diversifying your portfolio.

5. British Silver Britannia

The stunning British Silver Britannia is renowned for its breathtaking design and strong government backing. It represents a dependable choice for safeguarding your wealth and serves as a hedge against the unpredictable nature of the precious metals market.

Launched in 1997 by the Royal Mint, this coin embodies British heritage and exceptional craftsmanship. Its design highlights the figure of Britannia, a powerful symbol of strength and courage that resonates with collectors and investors alike.

As legal tender in the UK, it carries a face value of two pounds, but its intrinsic silver value often eclipses this nominal amount. The Britannia is highly esteemed in investment portfolios, providing an appealing means of diversification and security, especially during turbulent economic times.

6. Austrian Silver Philharmonic

The stunning Austrian Silver Philharmonic, showcasing the world-famous Vienna Philharmonic Orchestra, captivates both investors and collectors through its exceptional craftsmanship and rich cultural significance.

This remarkable coin encapsulates the refined essence of orchestral music with its intricate design, highlighting instruments like the grand piano and strings that symbolize harmony and artistry. Its allure extends beyond mere aesthetics; it stands as a premium option within high-quality silver.

The Philharmonic has carved a niche among silver enthusiasts, merging the beauty of artistry with the solid value of precious metals. It emerges as a coveted asset that resonates across both artistic and financial spheres, making it a true treasure in any collection.

7. Mexican Silver Libertad

The Mexican Silver Libertad, graced by the iconic Angel of Independence, represents national pride and rich historical significance, making it a highly coveted collectible in the world of silver investment.

Since its debut in 1982, the coin’s design has evolved, beautifully reflecting Mexico’s vibrant heritage and the artistry of its creators. For enthusiasts, the Libertad is more than mere currency; it embodies cultural symbolism that resonates globally.

As an investment, it carries considerable weight in the precious metals market. Its limited mintage and striking aesthetics elevate its desirability. The Libertad serves as a hedge against inflation, while celebrating the artistry inherent in each piece, enhancing its appeal for both novice and seasoned collectors.

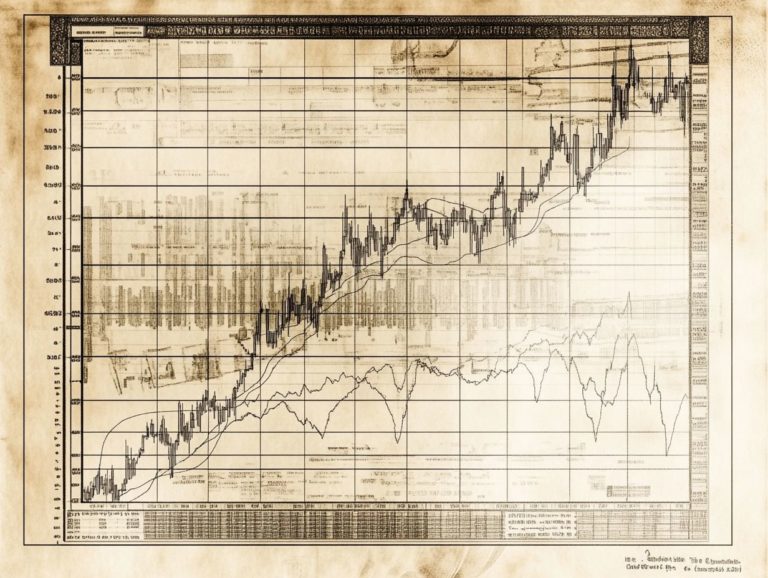

What Makes Silver Coins a Good Investment?

Silver coins are increasingly seen as a wise investment choice. They offer the potential to hedge against inflation, protect your wealth, and provide a tangible asset that holds value during economic turbulence. This makes them a truly versatile opportunity for any investor.

You re drawn to silver coins not just for their intrinsic beauty; their historical performance speaks volumes. Silver coins demonstrate resilience during market fluctuations. When global economies face uncertainty, the demand for physical assets like silver tends to rise, underscoring its growing investment appeal.

Incorporating silver coins into your investment portfolio introduces much-needed diversification. This effectively reduces overall risk. By holding these coins, you can safeguard your wealth against inflation, ensuring your investments retain purchasing power (the ability to buy goods and services) even in rocky times. This strategy enhances your security and long-term financial stability.

What Factors Should Be Considered When Choosing Silver Coins for Investment?

When selecting silver coins for investment, it s crucial to consider several key factors: high-quality silver that is suitable for investment, the current silver spot price, market recognition, unique design elements, and limited mintage. Each of these can significantly influence their long-term value.

Keep a vigilant eye on market trends to effectively gauge your purchase timing. Fluctuations in silver prices can open up lucrative opportunities, allowing you to maximize your investment.

Understanding the potential for appreciation over time is essential. Historical data reveals that coins with solid demand tend to increase in value. Coins with innovative designs or those that commemorate significant events can capture collectors’ interest, leading to heightened demand and potential price surges.

Rarity plays a pivotal role as well. Limited mintage creates a sense of exclusivity, igniting a fervent collector’s market that drives up demand and enhances your investment potential.

What Are the Benefits of Investing in Silver Coins?

Investing in silver coins offers incredible benefits you won’t want to miss! They serve as a reliable strategy for wealth protection, act as a hedge against inflation, and contribute valuable collectible coins to your investment portfolio.

Beyond fundamental financial advantages, these tangible assets significantly diversify your investment portfolio. Diversification is essential for minimizing risk, and silver coins provide a substantial alternative to traditional stock investments. During times of economic uncertainty or market fluctuations, silver often retains its intrinsic value, making it a prudent choice for those aiming to safeguard their wealth.

The historical and artistic significance of many coins appeals to collectors, who appreciate their aesthetic and cultural value. This dual appeal not only enriches your investment experience but also enhances the potential for appreciation in value over time.

What Are the Potential Risks of Investing in Silver Coins?

Investing in silver coins can be a rewarding endeavor, but it’s essential to recognize the potential risks involved. Fluctuations in the silver spot price and economic volatility can significantly impact the effectiveness of your investment strategy.

Market fluctuations can create uncertainty, leading to unexpected losses if you’re not well-informed. Liquidity issues (the ease of buying or selling assets) might arise, making it challenging to buy or sell specific coins at favorable prices especially those that are rare or not widely traded.

It’s crucial to conduct thorough due diligence when selecting pieces for your investment portfolio. Understand market demand, historical value, and authenticity to have a profound effect on your current and future returns. Keeping these factors in mind will better equip you to navigate the complexities of silver coin investments.

Start exploring silver coins for your investment portfolio today!

How Can One Start Investing in Silver Coins?

Investing in silver coins begins with a solid understanding of the market. Conduct thorough research into the various silver coins available and pinpoint tangible investment opportunities that resonate with your financial objectives.

Start by defining your budget to kick off your exciting investment journey! Once you’ve set that budget, identify reputable dealers known for their integrity and expertise in silver investments. This ensures that the coins you purchase are not only authentic but also fairly priced.

Grasping market trends is crucial. It allows you to discern the optimal moments to buy or sell. By committing to continuous education within the silver investment landscape, you’ll empower yourself to make informed decisions and navigate market fluctuations confidently.

What Are the Best Ways to Store and Protect Silver Coins?

Properly storing and protecting your silver coins is essential for maintaining their value. There are several effective methods you can employ to ensure maximum security and preservation within your investment portfolio.

Utilizing safes or bank safety deposit boxes is a highly secure option, offering robust protection against theft and environmental factors. When you choose a safe, look for features like fire and water resistance to further shield your coins from potential damage.

Handling techniques matter too! Using gloves and avoiding direct contact with the coins can help prevent tarnishing and scratches, ensuring they remain in mint condition. Also, be mindful of the environmental conditions in your storage area, as high humidity or extreme temperatures can negatively impact the longevity of these valuable assets.

What Are the Tax Implications of Investing in Silver Coins?

Understanding the tax implications of investing in silver coins is crucial for you as an investor. Different jurisdictions impose varying regulations, which can significantly affect your financial considerations.

Being aware of these nuances will help you navigate the complexities associated with potential taxes on profits when you sell. For instance, you might encounter different tax brackets depending on how long you hold your silver coins before selling.

Accurate reporting of these investments is essential to avoid any legal pitfalls. It s also important for you to explore strategies that maximize your tax efficiency, such as utilizing tax-deferred accounts (which allow you to delay paying taxes on your investments) or deducting associated costs. This way, you can minimize your tax burden while still enjoying profitable investments over the years.

What Are the Predictions for the Future Value of Silver Coins?

Predictions regarding the future value of silver coins hinge on numerous factors, especially economic trends and the dynamics of supply and demand. It s essential for you to analyze these elements meticulously.

Recent market analyses highlight the significance of historical data in shaping your investment strategies. With increasing uncertainty in the global economy, many investors see silver not merely as a collectible, but as a smart investment choice.

As inflation rates soar and economic volatility becomes the norm, silver emerges as a reliable hedge against currency devaluation. Analysts foresee that as uncertainty persists, demand for silver is likely to rise, making it an enticing option for diversifying your portfolio.

By leveraging past trends alongside current insights, you can make more informed decisions about when to enter or expand your positions in silver.

Frequently Asked Questions

What are the top 7 silver coins for investment?

Here are the top silver coins you should consider for your investment: the American Silver Eagle, Canadian Silver Maple Leaf, Australian Silver Kangaroo, Austrian Silver Philharmonic, Chinese Silver Panda, Mexican Silver Libertad, and British Silver Britannia.

Explore more about silver investments and consider seeking professional advice to enhance your investment strategy!

What makes these silver coins a good investment?

These silver coins are a great investment. They are well-known in the global market and have a purity level of .999 or higher.

There is also strong demand among investors and collectors.

Which of these silver coins has the highest purity level?

The Austrian Silver Philharmonic boasts the highest purity level at .9999. This makes it one of the purest options for investment.

Do these silver coins have any collectible value?

Yes, these coins have collectible value! Their unique designs, limited mintages, and historical significance can boost their worth over time.

Are these silver coins a good hedge against inflation?

Absolutely! Silver is often seen as a store of value and can help protect your purchasing power during economic downturns.

How can I invest in these top 7 silver coins?

You can invest by buying from a reputable dealer or through trusted online platforms. Always research and compare prices before making a purchase.