Are Paper Assets Safer Than Physical Assets?

Are you ready to unlock the secrets of smart investing? Understanding the distinctions between paper assets and physical assets is essential.

This article delves into their definitions, benefits, and potential drawbacks, guiding you through the intricacies of each type. You ll explore the safety of paper assets in contrast to their physical counterparts, consider important factors based on your risk tolerance and personal objectives, and recognize the significance of diversifying your portfolio.

By the conclusion, you ll be well-prepared to make informed investment decisions that align perfectly with your financial journey.

Contents

Key Takeaways:

- Paper assets offer a higher level of liquidity and are easier to diversify. However, they can also be affected by market fluctuations and inflation.

- Physical assets provide a sense of security and can hold their value over time, though they require more maintenance and can be impacted by external factors like natural disasters.

- When deciding between paper and physical assets, consider your risk tolerance and long-term goals. A well-diversified portfolio with a mix of both types of assets can provide stability and protection against market volatility.

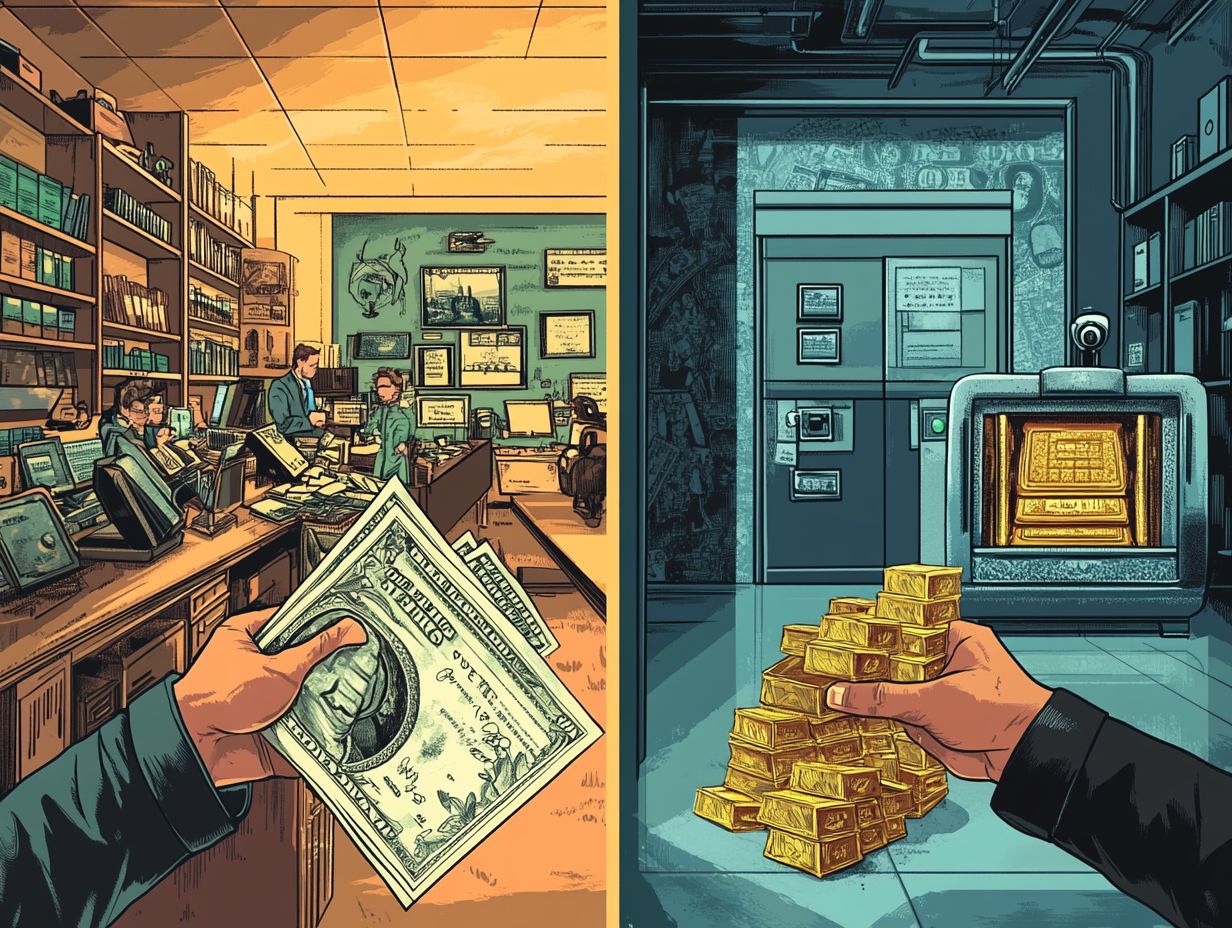

Understanding Paper Assets and Physical Assets

Grasping the difference between paper assets and physical assets is vital for anyone navigating the financial markets. These two asset classes cater to distinct investment objectives and come with varying risk/reward profiles.

Paper assets think stocks, bonds, and derivatives are intangible and may carry the risk that the other party might not fulfill their financial obligations. In contrast, physical assets, such as real estate and hard commodities like gold and silver, provide tangible forms of value retention, especially during economic downturns and market turbulence.

Definition and Examples

Paper assets encompass intangible investments like stocks, savings accounts, and derivatives, while physical assets include tangible items such as real estate and commodities, including precious metals.

These paper assets shine with high liquidity, allowing you to easily buy or sell them in the market, often with minimal impact on their value. For instance, stocks can be traded almost instantaneously, offering you a flexible avenue to capitalize on market fluctuations. On the other hand, physical assets, while often possessing intrinsic value, tend to provide greater stability during economic downturns.

Take gold, for example; this tangible commodity has historically served as a safe haven for investors aiming to preserve wealth, maintaining its value even when other investments may struggle.

The Safety of Paper Assets

The safety of paper assets such as savings accounts, U.S. Treasury bills, and various bonds has long served as a sanctuary for conservative investors, aiming to reduce risk while keeping liquidity in check.

With a variety of options available, from corporate bonds to municipal bonds, these investments typically offer relatively stable returns. Seize the opportunity for stable returns with these investment options!

Advantages and Disadvantages

Evaluating the advantages and disadvantages of paper assets is essential for investors looking to optimize their financial strategies amid market volatility.

By understanding these assets, you can make informed decisions that enhance the robustness of your portfolio. One standout benefit is their liquidity; paper assets can often be swiftly converted into cash, particularly appealing if you value flexibility in your investments. These instruments can also offer regular income through dividends or interest payments, contributing to your financial stability.

However, it s crucial to remain aware of inherent risks, such as the risk that the other party might not fulfill their financial obligations, as well as susceptibility to market fluctuations that can unpredictably affect value. Balancing these factors is key to your success in investing.

Take charge of your financial future today by understanding these vital asset types!

The Safety of Physical Assets

Physical assets such as real estate, tangible commodities like gold and silver, and other solid investments are often seen as a dependable shield against inflation and economic turmoil. Unlike paper assets, these tangible treasures possess intrinsic value, allowing them to hold their worth even when the market takes a nosedive.

This characteristic makes them particularly alluring for investors looking to diversify their portfolios and safeguard their financial future.

Pros and Cons

Exploring the pros and cons of physical assets is crucial for you as an investor. It is especially important to consider their roles in your investment portfolio and their potential as protection against inflation.

Tangible investments like real estate, gold, and collectibles not only possess intrinsic value but also promise significant appreciation over time. Real estate, for example, can generate rental income while appreciating due to demand in desirable locations.

However, it is essential to weigh the drawbacks as well. Higher transaction costs tied to buying and selling can nibble away at your profits.

Physical assets can also be hard to convert into cash quickly, creating hurdles when seeking flexibility within your portfolio.

Choosing Your Assets: Paper vs. Physical

When deciding between paper assets and physical ones, carefully consider essential factors such as your risk tolerance, investment goals, and current liquidity conditions in the financial markets.

Each asset type has unique advantages and disadvantages, making it vital for you to understand your personal financial situation and long-term objectives.

This understanding is key to crafting an effective portfolio strategy.

Risk Tolerance and Personal Goals

Understanding your risk tolerance and personal goals is crucial as you navigate the choice between paper assets and physical assets in your investment portfolio.

Each individual has a unique comfort level regarding market fluctuations, shaping their investment strategies. If you have a higher risk tolerance, you might lean towards aggressive stock investments for growth and long-term gains. Conversely, if you identify as a conservative investor, you may prefer bonds and stable assets for security.

Your personal goals also hold significant weight. A young professional saving for retirement might gravitate towards equities to harness the power of compounding returns. If you’re nearing retirement, you may prioritize wealth preservation through safer, more liquid investments.

Aligning your asset choices with both your risk tolerance and personal aspirations is essential for achieving your financial objectives.

Diversifying Your Portfolio with a Mix of Paper and Physical Assets

Diversifying your investment portfolio by incorporating both paper assets and physical assets can elevate your risk/reward profile. This enables you to navigate market volatility with confidence.

By strategically blending traditional investments like equities and bonds with alternative assets such as commodities and precious metals, you can create a robust hedge against economic instability and inflation.

This balanced approach not only enhances your financial strategy but also positions you to seize opportunities in a fluctuating market.

Start diversifying today! Evaluate your investment strategies with both physical and paper assets to secure your financial future!

Benefits and Strategies

A diversified portfolio is a game-changer for your finances! It combines both paper and physical assets, offering excellent ways for managing risk, enhanced return opportunities, and protection against market fluctuations.

By distributing your investments across various asset classes different categories of investments like stocks or real estate you can effectively reduce risks while maximizing potential returns. A common strategy involves allocating 60% to paper assets, such as stocks and bonds, while dedicating the remaining 40% to physical assets like gold and real estate.

Research shows that during economic downturns, having a portion in gold can stabilize your portfolio by countering the volatility of paper assets. Historical data reveals that portfolios with diversified assets consistently outperform those concentrated in a single type, highlighting the long-term benefits of a balanced investment strategy.

Frequently Asked Questions

Are Paper Assets Safer Than Physical Assets?

The answer to this question is not simple. It ultimately depends on several factors, including your risk tolerance and the specific types of paper and physical assets involved.

What are paper assets?

Paper assets are financial instruments that represent ownership or debt, including stocks, bonds, mutual funds, and options. They are typically traded on exchanges and can be easily bought and sold.

What are physical assets?

Physical assets are tangible items that have value and can be touched, such as real estate, precious metals, artwork, and collectibles. They are generally more illiquid than paper assets.

Why do some people believe paper assets are safer?

Some believe that paper assets are safer because they are easier to diversify and have the potential for higher returns. Additionally, they do not require physical storage or maintenance, which minimizes the risk of damage or loss.

Why do others prefer physical assets?

Others prefer physical assets because they represent tangible ownership and can serve as a hedge against inflation. They also tend to have less exposure to market volatility and potential fraud compared to paper assets.

Which type of asset is considered safer in times of economic downturn?

In general, physical assets tend to hold their value better during economic downturns compared to paper assets. This is because they have intrinsic value and are not subject to the fluctuation of financial markets.

Explore your investment options today and secure your financial future!