Palladium Supply and Demand: Key Trends

Exciting changes are sweeping through the palladium market, influenced by a blend of industrial requirements and economic dynamics.

As demand rises, especially in the automotive sector, grasping the current market landscape and its future outlook becomes essential for you.

This article delves into the various factors affecting supply and demand, analyzes price trends supported by historical data, and emphasizes the wider economic implications.

By providing insights into the challenges and opportunities on the horizon, you will obtain a thorough understanding of palladium’s role in today s economy.

Contents

- What You Need to Know!

- Overview of Palladium Market

- Factors Affecting Palladium Supply and Demand

- Mining and Production Challenges

- Trends in Palladium Prices

- Historical Data and Predictions

- Impact of Palladium on the Global Economy

- Key Industries and Countries Affected

- Future Outlook for the Palladium Market

- Frequently Asked Questions

- What is palladium and why is it in demand?

- What are the key trends in palladium supply and demand?

- How does the current global economy affect palladium supply and demand?

- What impact does the use of electric vehicles have on palladium supply and demand?

- What factors can influence the future of palladium supply and demand?

- How can investors take advantage of the current trends in palladium supply and demand?

What You Need to Know!

- Palladium market is currently in high demand and projected to continue growing in the future.

- Industrial and consumer demand, along with mining and production challenges, are key factors affecting the supply and demand of palladium.

- Palladium prices have shown a steady increase over time and are predicted to continue rising due to its impact on key industries and economies globally.

Overview of Palladium Market

The palladium market stands as a crucial component of the global precious metals landscape, marked by its dynamic characteristics shaped by investment opportunities, price fluctuations, and shifting supply dynamics.

With an increasing focus on sustainable technologies, particularly within the automotive sector, the demand for palladium has experienced significant transformations. Its unique properties render it critical in catalytic converters devices that reduce harmful emissions from vehicles, especially as environmental regulations become stricter and electric vehicles rise in popularity. However, it’s essential to be aware of the risks of palladium investment in this evolving market.

Understanding the interplay between historical pricing and contemporary demand trends provides a clear insight into the market’s promising potential for future growth.

Current State and Future Projections

The current palladium market presents a nuanced landscape shaped by intricate supply constraints and rising demand, prompting you to consider future forecasts that may illuminate potential price trends.

As geopolitical tensions political conflicts between countries that impact trade escalate, particularly in key mining regions, the supply of this precious metal encounters significant challenges, leading to tighter inventories. Concurrently, robust economic growth in sectors like automotive production, where palladium plays a crucial role in catalytic converters, fuels a demand that outstrips current output levels. This situation has led to a rise in interest in understanding the growing demand for palladium.

These dynamics create a volatile marketplace, with price fluctuations that are likely to continue into the foreseeable future. Investment trends and regulatory shifts will also influence market dynamics, revealing a landscape that requires your careful monitoring if you aim to capitalize on these unfolding changes.

Factors Affecting Palladium Supply and Demand

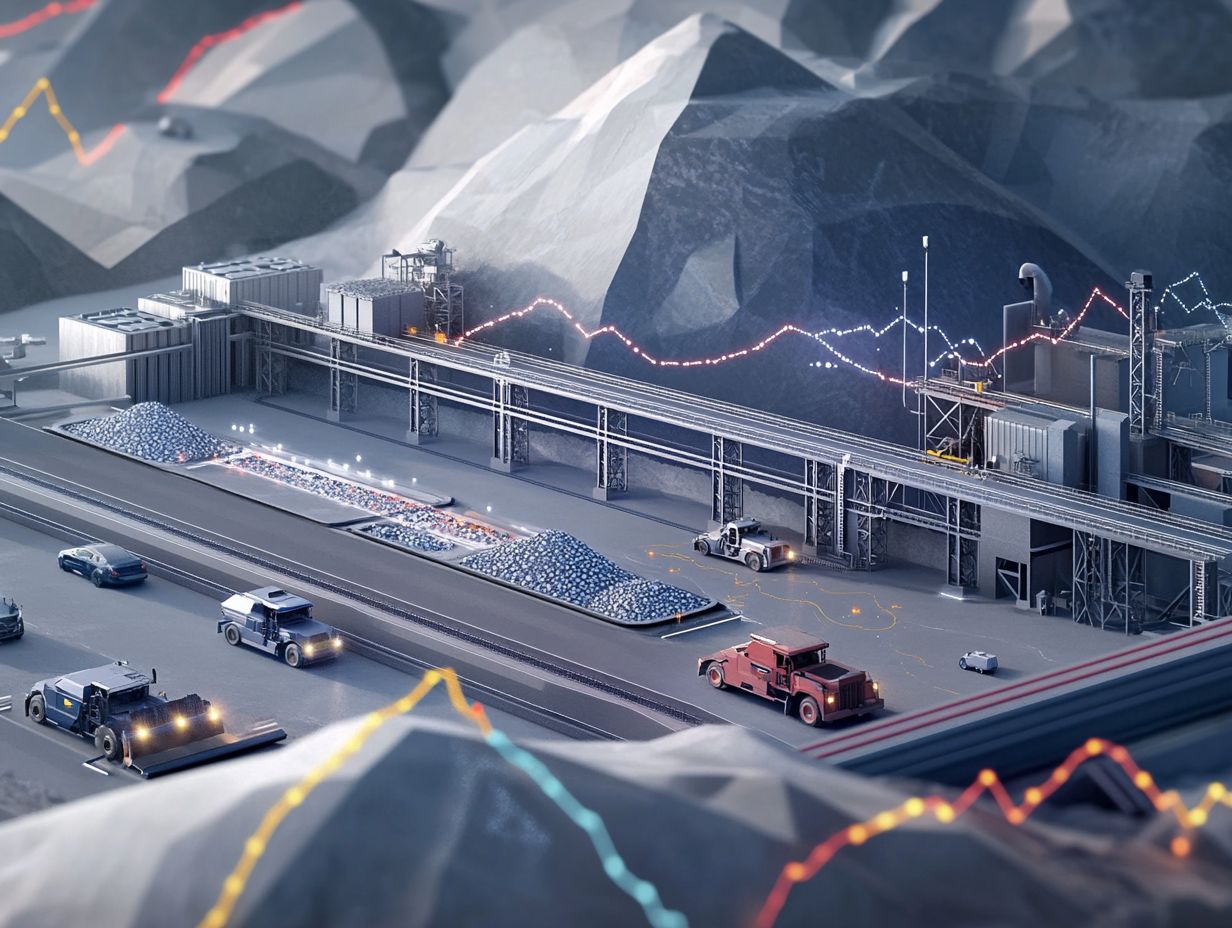

Several key factors profoundly influence the supply and demand dynamics of palladium. From mining operations and production challenges to breakthroughs in recycling technology, these elements collectively shape the market trends you need to be aware of.

Industrial and Consumer Demand

The demand for palladium is expansive, bridging both industrial and consumer sectors, with the automotive industry standing out as the largest consumer. You ll find it primarily used in catalytic converters, where it plays a crucial role in reducing harmful emissions. This aligns perfectly with the increasingly stringent environmental regulations designed to promote cleaner air.

But palladium isn t just confined to cars. In the jewelry industry, its remarkable luster and hypoallergenic properties make it a favored choice among modern designers and consumers. Furthermore, electronic manufacturers rely on palladium for components that demand reliability and durability, further fueling the growth of the technology sector.

As consumer demand ramps up partly due to the shift toward electric vehicles these interconnections reveal how palladium s role may evolve, emphasizing its significance across diverse industries.

Mining and Production Challenges

Mining and production challenges significantly influence palladium supply. These challenges stem from rising costs, production hurdles, and the establishment of new mining operations in various regions.

Areas like Russia and South Africa present unique hurdles that complicate extraction processes. These include geopolitical tensions, fluctuating labor costs, and strict environmental regulations. As these nations work to balance economic growth and sustainability, miners navigate an increasingly volatile landscape.

The rising costs linked to these challenges can reduce output, raising concerns about future demand in the automotive sector and beyond.

While new mining operations may promise some relief for the supply chain, they often face similar obstacles. This indicates that the delicate balance of palladium availability is likely to remain precarious in the years ahead.

Trends in Palladium Prices

Observing trends in palladium prices reveals a landscape of notable volatility, shaped by historical pricing patterns and current market dynamics. This interaction creates an intriguing yet unpredictable environment for those interested in precious metals.

Historical Data and Predictions

Historical data on palladium pricing offers invaluable insights into market trends, helping you craft informed forecasts.

By examining price fluctuations over the years, you can identify patterns that often correlate with global economic changes and industrial demands. Major events, like the 2008 financial crisis and recent supply shortages due to geopolitical tensions, have had a profound impact on the market.

During periods of increased automotive production, which drives up demand for catalytic converters, prices tend to surge. Looking ahead, the shift towards electric vehicles could reshape the traditional dynamics of palladium pricing as you explore the global palladium market: key developments.

Impact of Palladium on the Global Economy

The influence of palladium on the global economy is substantial, driven by its important role in reducing vehicle pollution and addressing climate change challenges.

Key Industries and Countries Affected

Industries such as automotive, electronics, and jewelry are closely linked to palladium demand, impacting economies in countries like Russia, South Africa, Canada, and China.

The automotive sector, in particular, has transformed as manufacturers comply with stricter emissions regulations by using more palladium in catalytic converters. This increase in demand not only sparks innovation but also strains supply chains, affecting production timelines.

In South Africa, where a large portion of the global palladium supply is sourced, fluctuations in demand can lead to significant economic ripple effects, influencing mining jobs and local investments.

Conversely, countries heavily reliant on palladium imports may experience shifts in trade dynamics, altering their economic outlook based on market trends and geopolitical tensions.

Future Outlook for the Palladium Market

The palladium market is bursting with exciting investment opportunities, but it also presents formidable challenges. These prospects are shaped by complex market dynamics and the emergence of new technologies, especially the developing hydrogen economy.

Being aware of these factors can significantly enhance your strategic decision-making in this evolving landscape.

Stay informed about palladium market trends to make smarter investment choices. With ongoing geopolitical tensions, now is the time to understand how these factors impact palladium prices.

Opportunities and Challenges Ahead

Opportunities for investment in the palladium market come with a set of challenges that could influence price appreciation and the overall dynamics of the market.

As you contemplate the potential for substantial returns, navigating these challenges is crucial for your success! The competition from alternative materials like platinum and rhodium adds another layer of uncertainty that might sway market stability.

The evolving landscape of renewable energy initiatives adds another factor to consider. As the demand for cleaner technologies rises, questions about how these shifts will affect palladium’s investment opportunities in 2024 and its role in automotive catalysts and other industrial applications become increasingly pertinent.

While the appeal of investing in palladium is compelling, a thorough understanding of the impact of geopolitical factors on palladium is vital for making informed decisions.

Frequently Asked Questions

What is palladium and why is it in demand?

Palladium is a rare and lustrous silvery-white metal that is primarily used in the production of catalytic converters, which are devices that reduce harmful emissions from cars, for automobiles. Its unique properties make it a vital component in reducing emissions, leading to its high demand in the automotive industry.

What are the key trends in palladium supply and demand?

Key trends in palladium supply and demand include a growing need for catalytic converters in emerging markets and a shift toward cleaner and more fuel-efficient vehicles. Additionally, limited supply due to its rarity and challenging mining conditions plays a significant role.

How does the current global economy affect palladium supply and demand?

The global economy significantly influences the supply and demand of palladium. Economic growth in countries like China and India increases vehicle demand, consequently driving up the demand for palladium. Conversely, economic downturns can lead to reduced mining activity and a decrease in supply.

What impact does the use of electric vehicles have on palladium supply and demand?

The rising popularity of electric vehicles poses a potential threat to palladium demand, as they do not require catalytic converters. However, the production of electric vehicles still requires a significant amount of palladium for their batteries, somewhat offsetting the potential decrease in demand.

What factors can influence the future of palladium supply and demand?

The future of palladium supply and demand can be influenced by various factors, including technological advancements, changes in government regulations, and fluctuations in the global economy. Furthermore, the discovery of new palladium sources and the development of alternative materials for catalytic converters can also impact supply and demand.

How can investors take advantage of the current trends in palladium supply and demand?

Investors can capitalize on current trends by investing in palladium stocks or exchange-traded funds (ETFs) that track the price of the metal. They can also diversify their portfolio by investing in other precious metals, like gold or silver, that may have an inverse relationship with palladium.

Ready to dive into the palladium market? Start exploring your options today!