The Effect of Geopolitical Events on Gold

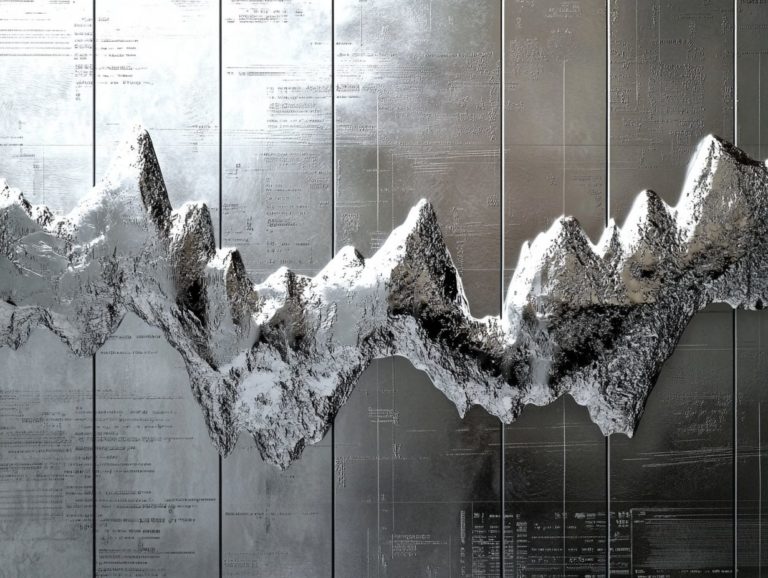

Gold has long stood as a source of stability during periods of uncertainty, with its value frequently mirroring the chaotic currents of geopolitical events.

Let s explore the fascinating link between global crises and gold prices, drawing on historical case studies that illuminate this vital connection. We will also examine the current geopolitical landscape and its potential effects on gold investments, offering strategies to navigate these uncertain waters effectively.

Act now to harness the power of gold and secure your financial future amid the turmoil.

Contents

- Key Takeaways:

- The Relationship Between Geopolitical Events and Gold

- Historical Examples of Geopolitical Events Affecting Gold

- Current Geopolitical Climate and Gold

- Strategies for Investing in Gold During Geopolitical Events

- Frequently Asked Questions

- What are some examples of geopolitical events that impact the price of gold?

- How does geopolitical uncertainty affect the demand for gold?

- What is the historical relationship between gold and geopolitical events?

- How does the US dollar’s role as a global reserve currency impact the relationship between gold and geopolitical events?

- What are some other factors besides geopolitical events that influence the price of gold?

- Is investing in gold a reliable strategy for protecting against geopolitical events?

Key Takeaways:

- Geopolitical events greatly impact gold prices, as investors seek safety during uncertain times.

- Historical examples, such as wars and political instability, show a significant correlation between geopolitical events and the value of gold.

- The current geopolitical climate, including trade tensions and political upheaval, can majorly influence the demand and price of gold.

The Relationship Between Geopolitical Events and Gold

The relationship between geopolitical events and gold captivates investors and financial analysts alike, especially in times of rising global tensions. Gold often acts as a safe-haven asset during crises, gaining traction amidst geopolitical risks such as the Israeli-Palestinian conflict, military confrontations, and escalating tensions in Ukraine and Taiwan.

These crises can significantly impact economic variables and investor flows. This makes gold an essential component in many sophisticated financial strategies.

Understanding the Connection

Understanding the connection between geopolitical tensions and gold volatility involves examining the macroeconomic landscape. Pay close attention to the roles of central banks and investor flows.

As global tensions escalate through military conflicts, trade disputes, or political turmoil you may find yourself among many investors gravitating toward gold, viewing it as a reliable option in uncertain times.

When global tensions rise, central banks often adjust their monetary policies. They may also increase their gold reserves to safeguard against market instability. This behavior affects their strategies and shifts market dynamics.

The anticipated changes in interest rates and inflation can sway your sentiment, drawing you toward the reliability that gold embodies. Thus, the intricate interplay between geopolitical factors and economic indicators can lead to notable price fluctuations, reaffirming gold’s reputation as a traditional safe haven during periods of turbulence. Understanding the impact of geopolitical events on metal prices is crucial in navigating these uncertainties.

Historical Examples of Geopolitical Events Affecting Gold

Historical examples of geopolitical events impacting gold reveal a consistent trend: during major crises like 9/11 and the Ukraine-Russia conflict, gold prices experienced notable surges. This pattern underscores gold’s enduring reputation as a safe-haven asset in times of uncertainty.

Case Studies and Analysis

Case studies and analyses of geopolitical events, such as the Iraq War and the escalating tensions between China and Taiwan, vividly illustrate how your behavior as an investor can shift, leading to fluctuations in gold prices.

These events serve as crucial reference points, showcasing how uncertainty in global politics compels you to gravitate toward gold as a safe haven. For instance, during the Iraq War, the surge of fears and instability prompted significant spikes in gold prices as you and other market participants sought to hedge against geopolitical risks. Additionally, understanding the effect of geopolitical events on silver prices can provide valuable insights into market dynamics during such times.

Similarly, the current tensions between China and Taiwan have ushered in increased market volatility, driving a rush toward gold as a dependable asset. Historical data trends reveal that your responses to these crises often follow a broader behavioral pattern, underscoring gold s role not just as a commodity, but as a strategic financial instrument during tumultuous times.

Current Geopolitical Climate and Gold

The current geopolitical climate, characterized by rising tensions among the BRICS nations and pressing climate change concerns, as well as conflicts like the Ukraine-Russia war, profoundly impacts gold prices and shapes investor sentiment.

These factors are not merely headlines; they play a critical role in guiding investment decisions and strategies.

Relevant Factors and Potential Impact

Several relevant factors, including inflation rates, interest rate policy, and geopolitical tensions, significantly influence gold prices and can capture your interest as an investor.

In the current landscape, stay alert to shifts in monetary policy as central banks balance economic growth and control inflation. When inflation rises, you might seek refuge in gold, viewing it as a stable store of value, especially during economic uncertainty.

Geopolitical risks, such as conflicts or trade tensions, further enhance the allure of gold and encourage you to diversify your portfolio.

As economic growth prospects fluctuate, the interplay of these elements creates a complex environment where your sentiment regarding gold as a safe asset continues to evolve.

Strategies for Investing in Gold During Geopolitical Events

Investing in gold during geopolitical events can offer you a distinct edge, especially when considering gold’s role as a crisis hedge in times of market turbulence.

By adopting effective strategies, you can maximize your potential for securing wealth and stability, ensuring that your portfolio remains resilient against uncertainty.

Expert Tips and Best Practices

Expert tips emphasize the importance of understanding market dynamics and ensuring your portfolio remains diversified.

Navigating the complexities of gold investment amid geopolitical tensions demands careful planning and a keen awareness of the broader economic landscape. Stay vigilant about global events, as fluctuations in political stability can significantly impact gold prices.

By analyzing economic indicators like inflation rates, currency strength, and interest rates, you position yourself to make well-informed decisions.

Regularly follow expert analyses and forecasts to gain insights into potential market shifts. Act now to diversify your investments with a variety of gold assets, such as bullion and ETFs (Exchange-Traded Funds), to mitigate risks while capitalizing on gold’s reputation as a safe haven during uncertain times.

Frequently Asked Questions

What are some examples of geopolitical events that impact the price of gold?

Examples include political tensions, economic sanctions, trade wars, and geopolitical crises such as wars or natural disasters.

How does geopolitical uncertainty affect the demand for gold?

Geopolitical uncertainty often leads to a decrease in confidence in traditional currencies and financial markets, causing investors to turn to gold as a safe-haven asset, which increases its demand and drives up its price.

What is the historical relationship between gold and geopolitical events?

Gold has been regarded as a store of value and a hedge against political and economic turmoil for centuries, making it a popular choice during times of geopolitical uncertainty.

How does the US dollar’s role as a global reserve currency impact the relationship between gold and geopolitical events?

The US dollar’s status as a global reserve currency means that its value is closely tied to geopolitical events, and any changes in its value can ripple through to affect the price of gold.

What are some other factors besides geopolitical events that influence the price of gold?

Factors such as interest rates, inflation, and overall economic conditions can also impact the price of gold, in addition to geopolitical events.

Is investing in gold a reliable strategy for protecting against geopolitical events?

Gold can protect against geopolitical events. However, it’s essential to have a mix of different investments to manage risks and seize opportunities.

Explore your investment options today!